Here are some of the common frustrations reported by businesses that applied to the PPP loan and ways to navigate the challenges.

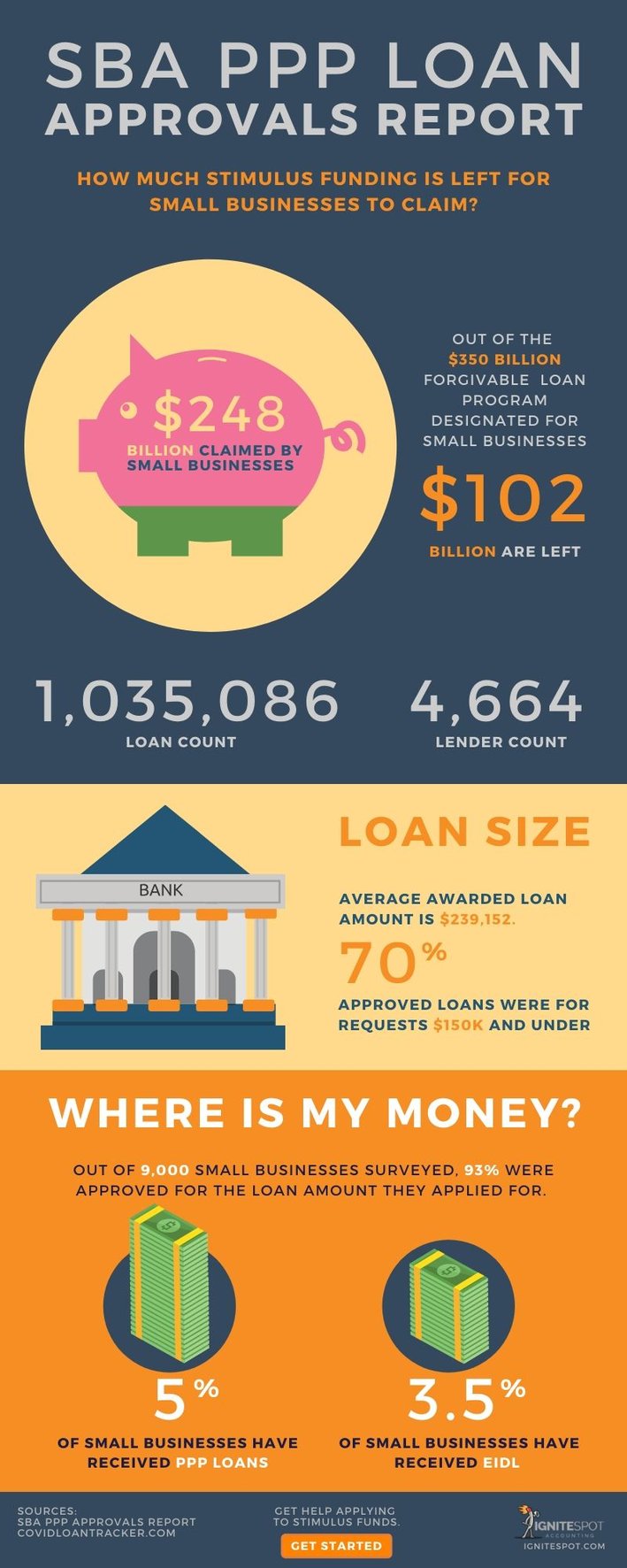

The first round of $350 billion Paycheck Protection Program (PPP) was claimed within 2 weeks after its launch on April 3rd. With another $335 billion of small businesses funding coming down the pipeline, we recommend applying for a PPP forgivable loan as soon as possible. Our business clients have been successfully funded by fintechs Lendio and Kabbage.

On April 13, the SBA reported 1,035,086 PPP loan approvals through 4,664 lenders totaling to over $245 billion. Funding for the federal stimulus loan will run out as quickly as the launch of the CAREs Act.

Source: SBA PPP Approvals Report By: Ignite Spot

The unprecedented jobless rate rallied the congress to pass the $2 trillion stimulus bill at record speed. However, the swift execution of the CAREs Act was fraught with setbacks. Small businesses reported technical glitches on the SBA’s site processing EIDL applications. Last-minute changes for calculating average monthly payroll for the PPP loan caused banks to delay the release of applications to their business clients. Some companies scrambled to find a bank to accept their loan application since many lenders prioritized applicants who were current customers with an existing loan, credit line, or checking/savings account with the financial institution. Here are some of the common frustrations reported by businesses that applied to the PPP loan and ways to navigate the challenges.

What are your options if your bank will not accept your PPP loan application?

Businesses may have their application denied because many banks are prioritizing applicants who have an existing loan, credit line, or checking/savings account with the financial institution. Some clients at Ignite Spot have expressed applying for the PPP loan with larger banks such as Wells Fargo as a nightmare scenario of waiting over an hour to see a banker or having their banks drag their feet to release applications. Other clients are describing an easy online application process working with smaller community banks.

The funding is in high demand so research other lenders who are participating in the PPP. View Fortune’s list of banks and lenders currently accepting SBA loan applications. Some banks were initially unable to process loan applications when the stimulus program launched because they were overwhelmed with pre-application requests.

CEO of Jersy Mike’s Sub, Peter Cancro, stated the application process is smoother when business owners work with lenders that they have a relationship with or when businesses apply to local banks.

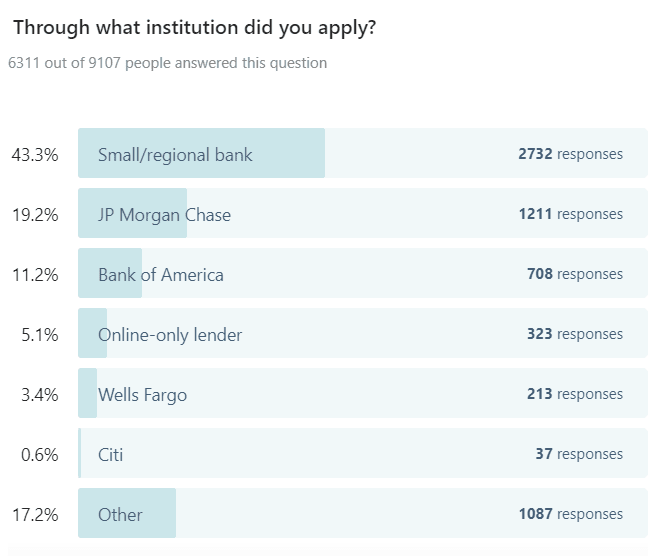

Source: Covid Loan Tracker Published April 15, 2020

Where can you apply for a PPP loan?

Lenders participating in the PPP range from large banks, small regional banks, credit unions, and fintechs. You can use the SBA’s finder tool to find an eligible lender near you. According to a Nasdaq report on April 13, 84% of PPP Loans disbursed came through small/regional banks. 10% of PPP Loans paid came through JP Morgan Chase. If your current bank is Wells Fargo or leaving you in the dark about the PPP Loan application, check out fintech Divvy, who provides a secure online application.

What documents do you need to apply for the PPP loan?

The SBA system is asking for payroll documentation that lenders didn’t think they’d have to provide. We covered what documents that you need to apply in a previous post. View our checklist of required documents for your PPP loan application.

How do I get my PPP loan forgiven?

Banks and borrowers are apprehensive about participating in the PPP because of the lack of details about how borrowers can get their loans forgiven and how banks get the guarantee fulfilled by the SBA. Lenders are relying on the Treasury’s FAQ, which has changed several times.

President of the National Association of Guaranteed Government Lenders, Tony Wilkinson, said, “Most bankers would rather not hang their hat on an FAQ.”

Business owner and founder of Virtue + Vice, Melanie DiSalvo, said, “The grant idea is really loose terminology. In the back of my mind, I keep thinking there is no such thing as a free lunch.”

Borrowers will have to diligently track the spending of their PPP funds to prove the awarded amount is being used for payroll costs, mortgage interest, rent, and utility payments over the eight weeks after getting the loan. The Treasury’s PPP Fact Sheet also states, “Your loan forgiveness will be reduced if you decrease your full-time employee headcount or if you decrease salaries and wages by more than 25% for any employee that made less than $100,000 annualized in 2019.”

We’ll keep you posted on how to track your awarded PPP funding to get your loan forgiven. View Ignite Spot CEO, Eddy Hood's simple tip that doesn't require you to have perfect accounting records.

How long does it take to receive funding after your PPP loan is approved?

The Covid Loan Tracker, which surveyed 9,000 small businesses and collected data from the SBA, found the average business owner received funding 1 week after their loan approval. The same study reports that EIDL funds are paid in 15-30 days on average. Some of our business clients at Ignite Spot have already been approved for the PPP loan and received funding this week.

If you haven’t already applied to the stimulus loan, our accounting experts are ready to help. Click the link to view our stimulus loan application services and get the funding your business needs.

.png)