Smaller businesses can take cues from the last economic recession on how to prepare for a crisis.

How resilient companies thrive during downturns

According to a Mckinsey study of 1,000 publicly traded companies, the top performers who came out ahead during the 2007 recession all had the following in common:

• Resilient companies make quicker decisions. Early in the crisis, management didn’t wait to dump assets that might be less profitable, giving them the operational and financial flexibility to endure the recession. They also took balance-sheet actions.

• Ability to grow EBITDA consistently. Despite external factors, resilient companies grew their earnings before interest, taxes, depreciation, and amortization. To drive margin growth, resilient companies cut their operating costs by half a dollar for every dollar of revenue change, while their competitors increased their operating costs during the 2007 downturn. During the recovery, resilient businesses were able to move faster, cut costs, and increase earnings.

• Understanding potential threats to their business model. The COVID-19 pandemic caused disruptions in businesses’ sales channels. Early adopters of tech-enabled operations now have a competitive advantage over businesses that relied on in-person transactions. Knowing the potential impact of outside factors can help you plan for a crisis.

7 ways to build a safety net for your business

1. Get a line of credit

A line of credit is a flexible loan consisting of a fixed amount from a financial institution. During a downturn, accelerating debt payments can hurt your cash flow if you’re trying to survive until the economy bounces back. With the stimulus bill, banks are now able to lend the money that they were required to keep on hand after the housing market crash of 2007. That means there is more money available, making it a great time to get a loan or a line of credit. Ryan Steck, Director of CFO Services, recommends debt-financing with a line of credit over other loan options because it is a revolving door that works similarly to a credit card. You use the money as an emergency fund only when you need it and pay the interest when you use it.

2. Build a six-month cash reserve

Saving six months of operating cash can be a daunting goal for most entrepreneurs. Steck explains the best way to determine the amount for your savings. Ask yourself, if you made 0 sales this month, what expenses would go away? Consider both your fixed expenses such as rent and your variable expenses and multiply those costs by 6. When you factor your staffing costs, decide which employees are essential, revenue drivers. This should give a rough estimate of how much you would need if things get tight during a crisis. If saving for six months seems impossible, start small. CEO, Eddy Hood, advises, “Start with a week of savings and celebrate when you hit your goal!”

3. Get key man insurance

Keyman insurance is essentially a life insurance policy that recoups the financial loss in case of the sudden death of a valuable employee. Every business has employees that are vital to the structure of the company. If something unfortunate were to happen to the CEO, founder, owner of a business, then the gap in leadership could negatively impact the entire organization.

Keyman insurance buys you time to find a replacement person. You can also use the proceeds to pay off debts, distribute money to investors, or pay severance to employees. The provisions of every policy are different and some even cover long-term disabilities. To calculate how much insurance you need, consider your short-term cash needs and the time or costs to replace your key person in case of an emergency.

4. Invest in pull marketing

During the COVID-19 pandemic, many business leaders are reallocating their marketing spend from paid ads to inbound marketing channels such as content. Some industries such as retailers have paused ads simply because they are unable to sell as many products with limited store hours or temporary closings. Other businesses view content marketing as an evergreen tactic that draws prospects by providing valuable information. A paid ad will last for the length of a campaign, while a published post lasts on your site or social media platform forever, gaining traction over time.

5. Have a worst-case & best-case cash flow projections for 12-months

Cash-flow forecasts help you understand where the money goes into your business. This is especially important during a crisis because it replaces your anxiety with a plan that equips you to make better decisions. Look at your business and ask yourself, "What will my sales and expenses be, and what other items from my balance sheet are going to affect my cash going forward?" Consider your debt payments and account receivable cycles.

Your projection will show you how much cash you’ll have a year for now if your business continues on its current path. You can also predict what your cash will look like in 12 months if sales tank. Steck emphasizes the importance of understanding your cash position stating, “Looking at your bottom line of your P&L is only part of the equation.” If you are worried about having enough money by the end of the month, run a 30-day forecast. If you are confident that business is good then a monthly forecast is sufficient.

Learn more about how to forecast cash flow using Excel.

6. Expand your offering across industries and customer bases

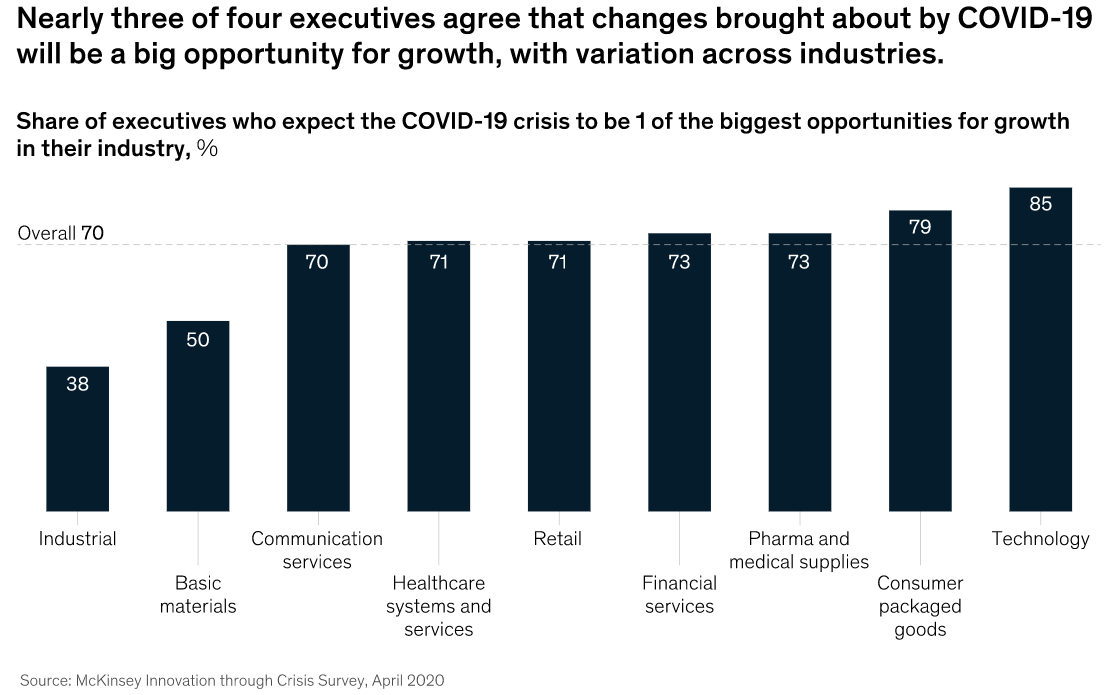

A recent survey shows that more than 90 percent of executives expect COVID-19 to fundamentally change the way they do business over the next five years and that the crisis will have a lasting impact on their customers’ needs. Business leaders need to identify and quickly address new opportunities that are being created by the changing landscape.

How companies have pivoted since the COVID-19 pandemic

• Changing the sales model. Smaller firms can leverage video conferencing technology to compete with large companies for leads and customer engagement. Since the spread of the coronavirus, sales teams can no longer rely on in-person interactions to meet prospects or close a deal. According to a McKinsey’s B2B Decision-Maker Pulse survey, 96 percent of businesses are turning to multiple forms of digital engagement with customers. Nurture your leads through educational webinars and virtual events followed up by targeted email campaigns to increase your conversions.

• Creating new offerings. Home appliance manufacturer, Dyson, and automaker, GM, entered the medical-device industry by manufacturing ventilators. Expanding into new offerings or industries may seem contrary to the belief of “staying in your lane”, but a crisis has a way of shattering norms and birthing innovation out of necessity. For example, the 2002 SARS epidemic in Asia caused citizens to shelter at home, leading to e-commerce to explode in China.

Discovering potential markets requires an understanding of client needs today. Utilize every customer touchpoint to gain insights on your client’s behaviors and challenges. This is the fuel to innovate solutions based on your customers’ needs.

7. Know your 50% plan

What would your business look like If your revenue got cut in half? Asking yourself this tough question forces you to determine what is essential to your business. Steck calls this your minimum viable product. Having a playbook allows you to preemptively decide how your business would operate in a dire situation so you don’t have to make the call in the middle of a crisis when emotions are running high. Some of the plays may include cutting operating costs, letting employees go, or renegotiating with vendors.

It’s better to proactively cut costs before a downturn to keep your operating margin as low as possible. Also, look for ways to improve productivity. This allows you to get the same results or products with less effort, saving you time and money.

Take control of your business during times of uncertainty. Ignite Spot provides your business with a safety net by helping you build up your cash reserves. Consult with a CFO today.

.png)