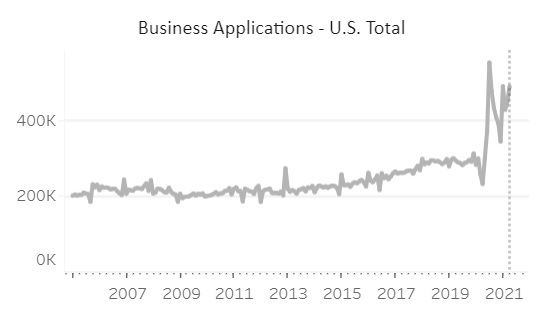

About half of all startups don’t survive past year five. And in the last year, more businesses have been formed than ever before. So if you’re the founder of one of them, you’ll want to know exactly how to beat the odds. Source: U.S. Census Bureau

Source: U.S. Census Bureau

Strong startup accounting practices are key to a sustainable launch.

Plenty of startups make it way past that five-year milestone. Our team of accountants, guided by Ignite Spot CEO Eddy Hood, has seen hundreds of such success stories. A common theme? Solid, smart startup accounting practices that support both growth and profit.

1. Choose the best business entity

Want to launch a business that’ll be around in five, ten, or twenty years? The most foundational move you can make is to set your entity up to achieve both growth and healthy profits.

The wrong business structure can hinder growth or profit. On the flip side, though, the right one enables both.

Here’s an example. Imagine a C-corp startup that’s founded on the power of equity crowdfunding. The investments of over 100 people who believe in the idea often supercharge short-term growth, something an S-corp or LLC cannot access. But one drawback is that the crowdfunded C-corp must wait to deduct losses from their corporate tax returns.

That drawback is a biggie. It can even strangle profitability. You see, the C-corp will be paying steep taxes for a few years after that initial crowdfunded boom.

Short-term growth is good, but not if it comes at the cost of long-term viability. Again, you must choose an entity that balances both initial growth and sustainable profits.

Corporate tax returns aren’t the only factor at play. Here are some things you should consider when choosing one structure over another:

- •risk of personal legal liability

- •varied funding options

- •ease of profitability

- •the number of founder(s) and their values

- •your tax strategy

- •whether you’ll operate across states

- •your social security and Medicare plan

- •how much equity you’d like to put in and/or keep

- •how much audit risk you can or want to handle

- •your working rhythms — whether they align with tax years, filing deadlines, etc.

- •your exit strategy

With so many factors, it’s clearly a complex decision. But doing your due diligence at this stage helps you avoid legal conundrums and long-term financial liability. For further reading on this topic, check out our resource on entity types.

2. Write a business plan

An entrepreneur who tries to launch a startup without a business plan is like a homebuilder who begins construction without blueprints. A business plan should be forward-thinking. It won't just describe how you'll get your first 10 customers but will also show how you'll stay afloat when you have your first 1,000.

This step may feel like more of a vision-casting move than an accounting one. But it has huge financial impact on startups: an entrepreneur who writes a business plan is 2.5x more likely to actually launch than one who doesn’t.

In the short term, a business plan supports your startup’s finances by helping you get funding. Investors will see the viability — as well as the flaws — of both your strategy and tactics. Want real insights about your idea? Listen to the feedback from the lenders and investors who choose not to invest in your company just as much as you heed those who do. If you listen carefully, those investors will usually have suggestions on how to grow without sacrificing profitability. The insights can be the difference-maker for businesses that want to start up, stay up, and scale up.

In the long term, your business plan serves as a core guiding resource. The plan isn’t carved in stone, however. As your business encounters unforeseen challenges and opportunities, your business plan may become less relevant. As always, in business, adaptability is key.

The experts at Startups.com have published a full guide to help you write an investor-ready business plan that will put your startup accounting on the right path from day one.

3. Organize your transactions

Financial analysts at Investopedia say that all successful companies are good at record-keeping.

Not “most” successful companies. Not “some.” All.

If you want to be successful long term, you must keep good records from day one. Why? Because with tidy books, you’ll be more productive, and productivity leads to profitability.

A recent survey revealed that three out of four struggling business owners acknowledge that a disorganized company is less productive. Another study shows that for every $50k salaried role, $11k is lost due to disorganized systems and processes.

Good news, though: startups are in a better position to tackle this than enterprises. That’s because you can get ahead of your accounting books before they get so tangled that it’s an effort to undo.

To get organized, start by creating a plan for every transaction before any begin rolling in.

Then, develop a payroll system. Having it in place readies you for growth, even before you have any employees. If you do it reactively as your first few employees arrive, you'll have a harder time coming up with a standard, organized system retroactively.

As you plan your talent management, calculate your own compensation and how you’ll administer it.

Finally, learn your tax obligations, plan for ideal taxation, and work these decisions into your daily processes.

4. Use the best tools to stay organized

Sorry, but all of your hard work getting organized will dissolve if you don’t constantly maintain structure. Tech tools are your way of keeping those good bookkeeping habits on track.

Tidy books can quickly become messy when you assume that they'll stay organized just because they were created with organization in mind. When this happens, the team becomes stressed and less productive. And, by then, whipping the books back into shape seems like a large, even overwhelming task.

A handful of new accounting tools like Bench, Gusto, Divvy, and Neat can help you keep your accounting organized.

“I subscribed to QuickBooks accounting software,” recalls Rick Hoskins, founder of Filter King. “Honestly, having an easy-to-use interface with simple directions helped me reduce the amount of time I was spending on accounting and reduced the probability of errors. It also saved me from having to hire an expert, which at the launch of any startup is a great cost.”

The move allowed Rick to balance growth and profitably. Where is Filter King today? “My DTC company is now the largest HVAC filter brand online,” he says with a smile.

5. Choose startup financing

All wise founders want to know where their first few shots of capital will come from.

Celebrated repeat-founder Hiten Shah may have said it best:

Source: Hiten Shah via Twitter

Don’t trust any funding source that encourages you to prioritize either growth or profit at the expense of the other. For sustainable profit-growth balance, consider your funding options:

- •Begin with your own savings if possible.

- •Borrow from your 401(k) or take out a HELOC.

- •Ask your personal circles to invest.

- •Get a conventional business loan.

- •Explore peer-to-peer borrowing.

- •Investigate and approach angel investors.

- •Pitch VCs (venture capitalists).

- •Launch a crowdfunding campaign.

Remember that each entity has its own rules and allowances for funding vehicles, so talk to an expert before deciding which is the best for you. And for more funding ideas, join a startup incubator/accelerator.

As you assess each option, remember to ask whether the method supports growth, profit, or both. Remember that growth will equal exciting times, but neglecting profitable funding options can lead to an early end to the party.

6. Wrangle cash flow

The way money moves in and out of your business greatly influences both your growth and profit. Focus on establishing a healthy cash flow early on, and you’ll position the business for both sustainable growth AND healthier profits.

First, know the most common cash-flow pitfalls:

- •Thinking of cash flow and EBITDA (earnings before interest, taxes, depreciation, and amortization) as synonymous. Watching this metric is good, but it’s not the full picture of your cash flow.

- •Doing it yourself. Don’t try to analyze your cash flow if you’ve never dabbled in startup accounting before.

- •Ignoring profit. As we talk about the importance of balance, remember that the overwhelming tendency is for startups to focus on growth alone.

Thankfully, preventing these issues at the startup phase is much easier than trying to get a handle on them when you’re in a mid-market-sized mess. Before you launch, make a commitment to:

- •Spend regularly — but slowly.

- •Establish systems and processes that make collecting payments easier.

- •Reward timely (preferably cash) payments from clients.

- •Avoid hoarding cash out of fear

7. Hire the right financial helper(s)

You may start your accounting solo, but you must slowly increase your service providers until you have the need — and ability — to pay a full-timer. This way, you’re not paying too much and sacrificing profitability, and you’re not sacrificing your financial visibility to grow blindly.

Dr. Steve Shwartz recalls the first few years of his experience as the co-founder of an automatic and agentless discovery and asset management product called Device42. “My personal accountant did our taxes and made sure we did all the necessary filings,” he says. “After two years, we had 80 customers and $600k in recurring revenue and raised our Series A which turned out to be our only round of financing. The financial records were in good shape for the Series A due diligence.”

At that point, the team hired a fractional CFO to help them analyze their financials. They also engaged a bookkeeping firm to manage the entries in QuickBooks. “I spent little time on finances and spent much more time writing code and growing the rest of the staff,” Steve says. “Over the next few years, as the company grew, our fractional CFO and our outsourced bookkeeper worked more and more hours until they reached a point where it was getting to be nearly a full time job for both.” At that point, Device42 had over 500 customers and over $15 million in revenue. It was the perfect time to hire a full-time CFO and controller.

Of all these actions, this one — hiring an outsourced accounting firm — is the number one way to help you balance profit and growth, so your startup becomes a scale-up. Remember, all founders believe in their business ideas. None of them envision failure. What makes that hope a reality is solid startup accounting.

Like Steve, your business can hire as you grow: start with an accountant at first, then graduate to also outsourcing your bookkeeping work, engage a CFO for strategic advice, and once your fledgling startup is a humming commercial enterprise, then consider bringing those folks in-house.

Growth and profit: Startup accounting’s tightrope

By now, you’ve picked up on a pretty strong message from us: as accountants, we urge you to use all of these tips to counterweight growth with profit. When asked how this wisdom served her as CEO and founder of the Glassperts, Dominique Kemps says, “I can safely attribute 85% of my success to good and sustainable accounting practices."

For help with any of these steps, call Ignite Spot. We have helped hundreds of startups launch sustainably so that they’re on the favorable side of those “startup success rate” statistics. Your first session is free, so call us today.

.png)