Are you frustrated by the lack of clarity on how to determine your profitability or how to scale your business? Then refine your financial reporting process to make it efficient and reliable. Learn from the mistakes of these entrepreneurs who share their horror stories of inflated revenues and understated operating costs that left their company in the red.

How To Read Financial Statements

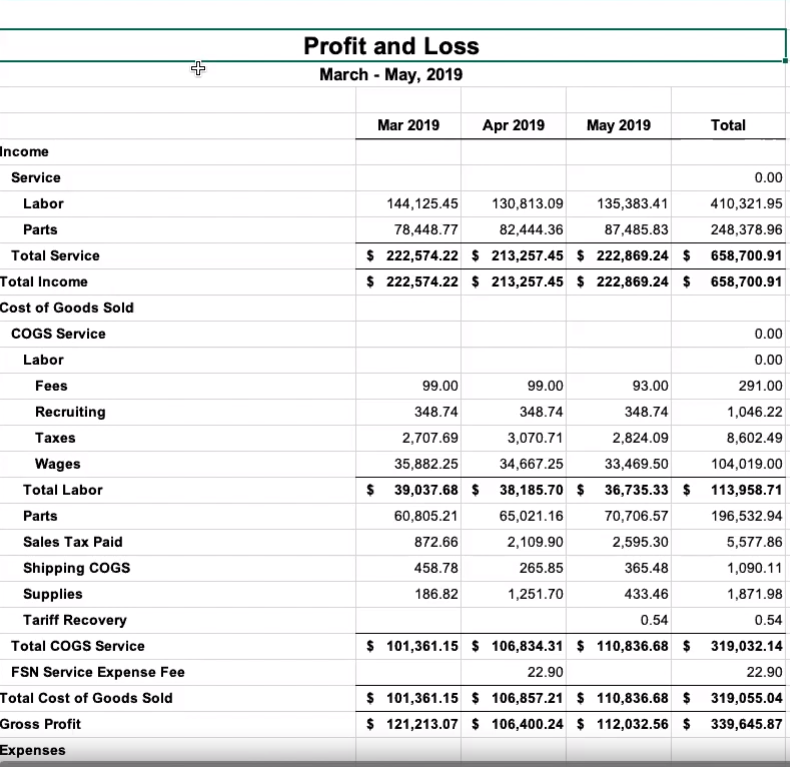

Watch the webinar, How to Read Financial Statements, for details about common QuickBooks reports, including your Profit and Loss Statement, Balance Sheet, and Statement of Cash Flows, that can be exported into Excel. Director of CFO Services, Ryan Steck covers the purpose of each financial report.

Timestamps

10:00 Profit and Loss

24:00 Gross Profit

27:00 Operating Expenses

42:10 Balance Sheet

1:00:30 Statement of Cash Flows

The Dangers of Inaccurate Financial Reporting

You use your financial reports to make key business decisions so when the data is incomplete or inaccurate it can cause disruptions in cash flow and hurt the profitability of your company.

Michael Eckstein, Owner of Eckstein Advisory, warns that bad reporting always leads to bad decisions.

“You can't make investment decisions based on just your bank account balance. You need to know what your cash flow looks like. How much profit do you have to reinvest? If you can afford additional debt and if your investments will make you money.”

Kenneth Crowell, Goal Academy Executive Director, describes having incomplete financial reporting like driving while looking in the rearview mirror. “Nothing is more frustrating than growing by leaps and bounds financially, but then you can’t make the tough decisions.”

“We didn’t have accurate balance sheets and P&L statements that we could rely on. So many times our internal accounting department would get bogged down. We would expect a report to get to the board level, but something would happen where they couldn’t reconcile quickly enough or forget the credit card reconciles. We’ve since reorganized our internal team to assist our outsourced accountant.”

Horror Stories of Bad Financial Reporting

Incomplete Operating Costs

During his first year of business, WikiLawn President, Dan Bailey, made a major accounting error that left out about 35% of operating costs.

“The resulting report showed us having a far more profitable quarter than we actually had. It looked like there was a massive surge, and so we started to plan based off of that. I even hired more employees at the time, thinking we could sustain them.

I learned the hard way that wasn't the case. We made it work -- barely -- but that problem in accounting still haunts me to this day, and it taught me very quickly that while a small business owner wears many hats, he shouldn't deal with financials unless he's well-versed in it and knows the procedure to triple check all sources of income and spending. I have contracted an accountant since then and haven't regretted it for a second. ”

Underestimating Labor Costs

Job costing reports are customized reports used in cost accounting. Production managers can create job costing reports, but inaccurate estimates for material and labor cost directly impact the COGS on your P&L statement and therefore the profitability of your project.

Jeff Neal, Capital Coating Project Manager, explains how he lost thousands of dollars from a bad project estimate.

“We were installing floor lines in a facility. Part of the job was to remove existing floor lines. Unfortunately, I didn't estimate enough time to remove these existing lines. The cost was days of additional man-hours, which cost thousands of dollars. The project ended up being in the red upon completion.”

Hiring the Wrong Accountant

President of Activate Your Vision, Lucinda Cross, warns that lacking a bookkeeper and relying on a tax accountant results in overpaying for services and underpaying your independent contractors.

“My profitability for my e-commerce side of the business was failing, more loss than profit. The break down started to happen when I started making more money in my business and not having an adequate tracking system. Using multiple merchant sites and payment outlets from Paypal to Square, to Strip to Shopify, I did not have a financial funnel in place. I hired a full marketing team when I should have hired a bookkeeper, sales agent, and accountant.”

Common Mistakes that Lead to Bad Financial Reporting

Common Mistakes that Lead to Bad Financial Reporting

Not Reconciling Your Bank Accounts

Prax Accounting Executive Director, Jenn Viridis, says that reconciling is the most overlooked step in accounting, yet it is the most important step in closing a period.

“Reconciling is the process by which you confirm the numbers in your system match what truly happened and that you haven't overlooked anything. It's incredibly common to find unreconciled activity sitting on the books for years - which means all accrual financial statements for those periods will be incorrect.

I've personally found hundreds of thousands of dollars of overstated revenues (the company paid too much in taxes as a result) and similar volume in overstated expenses (the IRS makes bank auditing these companies). In most instances, I've found these situations exist despite the company having in-house accounting - full balance sheet reconciliations are one of the most frequent misses we come across.”

According to CPA, Tim Adams, a common problem with small businesses is the belief that software like Quickbooks "automatically" takes care of your accounting. Adams says this misconception is especially strong if you have a bank feed connection in place.

“You still have to know how to use the accounting package, reconcile their bank accounts, and have checkpoints in place to verify accuracy. If a business doesn't have a reconciled bank account, chances are overwhelming they do not have accurate financials. The owner needs to learn basic bookkeeping procedures or better yet, hire a professional so the owner can spend time on more profit-producing activities. Small businesses can get access to fractional accountants and CFO's on a virtual basis without having to hire a full-time (or even part-time) employee.”

Lack of Oversight on Company Spending

Multiple employees spending money on unnecessary subscriptions, marketing, supplies, and travel kept Airbase Founder, Thejo Kote, from scaling quickly. Kote had to wait till after the month-end close to view his actual spending against his budget.

“I had an impossible time getting real-time information on company spending and while I wanted my teams to be empowered, that meant giving up oversight. I felt that we couldn’t fully control the budget since we would only see the charges after they had already happened. The expense reporting process was tough on everyone and corporate cards can get compromised without a company even knowing.”

Habits to Keep Your Financial Statements Flawless

We asked CPA's and CEO's what habits business owners should adopt to prevent bad financial reporting. Here are some pro tips.

Start with COGS

Steck advises, “If you are going to focus on your financials or have areas you want to clean up, start with the COGS.”

“Cost of goods sold is where you can lose information that is critical. Spend time on your COGS so you can understand what your true gross margin is. That will help you make better decisions.”

Have a Bookkeeping System

Loanry CEO, Ethan Taub says, “The first thing you need to do is have a bookkeeping system that works best for you and your team.”

“There are many out there, so you need to do the research, but fast. If you are already starting your business, this needs to be done before anything else. Having a schedule as for when this is done is also important. If you know you get new clients every week, 2 weeks or a month, that should be when you are bookkeeping all your finances, to have solid records, but also keep track of all work.”

Use Technology to Track Spending

Kote recommends having processes in place to track expenses. He created Airbase to solve the problem of executing payments and accounting for non-payroll spending.

“I now use it to lock in a pre-approval process, make payments safely and easily and sync everything automatically to the general ledger. We’ve got control, a faster close, and better visibility so that we can fully manage the business.”

To keep tabs on operating expenses, Crowell uses Divvy, expense tracking software and corporate card. “We switched all of our expenditures to a Divvy card so we can control the budgeting right up-front instead of spending then reworking the budget around that.”

Reconcile Bank Accounts

Viridis’s quick tip is to pull the most recent reconciliation report from your accounting software for each bank and credit card account.

“The only items that should be listed under 'unreconciled' or 'uncleared' are transactions that happened recently but haven't cleared yet, such as a check you issued that hasn't been cashed. 99% of activity outside these parameters are potentially a serious red flag.”

Cross suggests that every business owner prepare for future success by having what she calls "The Fab 5."

1. Accountant

2. Lawyer

3. Business Coach

4. Admin Assistant

5. Business Mentor

Bonus: get a Therapist

Are you frustrated by the lack of clear financial reports to help you make decisions on how to scale your business or increase your profitability? A CFO can help you. Schedule a free 30-minute consultation with CFO Services Director, Ryan, today.

.png)