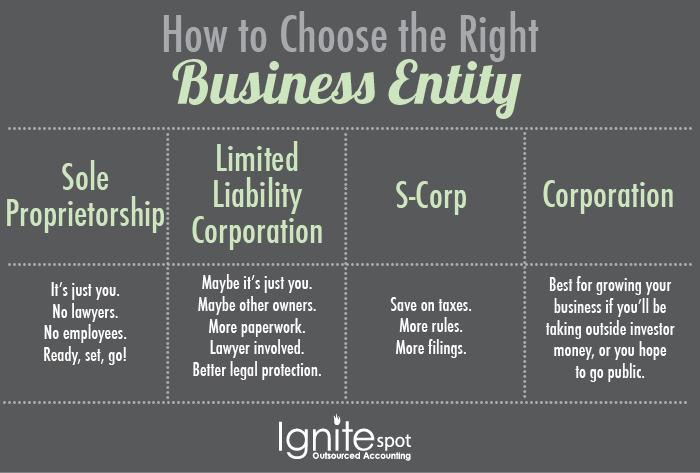

Tax season will look much different for each small business--depending on what kind of entity they are. Why did you choose your entity? Were you more concerned about business strategy or tax stragegy? Or both? Today, our CFO, Ryan Steck, will walk you through the pros and cons of the standard business entities to help you get ready for tax season. Enjoy this short 10-minute video, and find out what tax surprises might be waiting for you and your business.

The Pros & Cons of Business Entities

Sole Proprietorship Defined

A sole proprietor is someone who owns an unincorporated business by himself or herself.

Sole Proprietorship PROS

- Easiest, simplest and most flexible entity.

- You just have to get a business license from the city and state.

- You don't have to meet with lawyers.

- You don't need any extra documents.

- It's the cheapest way to get started.

- You don't have to file any extra tax returns--just add one Schedule to your tax return.

Sole Proprietorship CONS

- There are extra taxes involved (like Self-Employment)

- The IRS will keep an extra close eye on you--they're worried you don't know what you're doing.

Limited Liability Corporation (LLC) Defined

A Limited Liability Company (LLC) is a business structure allowed by state statute.

Owners of an LLC are called members. Most states do not restrict ownership, and so members may include individuals, corporations, other LLCs and foreign entities. There is no maximum number of members. Most states also permit “single-member” LLCs, those having only one owner.

LLC PROS

- Fairly simplistic.

- You get extra legal protection.

- Allows for more financial flexibility.

- Ability to add partners.

LLC CONS

- Requires more filings than a Sole Proprietorship (legal documents, articles, etc).

- You need an attorney's assistance.

- You'll spend more money getting the business set up.

- There are extra taxes involved.

- You'll most likely have to file a separate business tax return.

S-Corp Defined

S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates. This allows S corporations to avoid double taxation on the corporate income. S corporations are responsible for tax on certain built-in gains and passive income at the entity level.

S-Corp PROS

- Not subject to extra taxes.

- Great tax savings.

S-Corp CONS

- More complicated.

- Subject to more financial and tax rules.

- More filing requirements.

- Quarterly reports and returns.

- You have to file an individual tax return and a business tax return at the end of the year as well.

Corporation Defined

In forming a corporation, prospective shareholders exchange money, property, or both, for the corporation's capital stock. A corporation generally takes the same deductions as a sole proprietorship to figure its taxable income. A corporation can also take special deductions. For federal income tax purposes, a C corporation is recognized as a separate taxpaying entity. A corporation conducts business, realizes net income or loss, pays taxes and distributes profits to shareholders.

The profit of a corporation is taxed to the corporation when earned, and then is taxed to the shareholders when distributed as dividends. This creates a double tax. The corporation does not get a tax deduction when it distributes dividends to shareholders. Shareholders cannot deduct any loss of the corporation.

Corporation PROS

- Treated completely separated from the individual.

- Most secure entity concerning legal protection.

- Good for businesses that want to grow with outside investments from VC's, angel investors, or if you want to be a publicly traded company.

Corporation CONS

- You have to use an attorney to file set-up documents.

- File a separate business tax return.

- Double Taxation (watch the video for more info on this).

Still have questions about your 2014 Business Tax Preparations?

What To Read Next:

How To Calculate Your Gross Margin

How To Cacluate Your Break-Even Point

15 Stupid Small Business Tax Preparation Mistakes

Video Transcript:

Ryan: Hi I’m Ryan Steck. I’m excited to be here. I’m the lead CPA here at Ignite Spot.

Ann: And I’m Ann Whittaker. I’m in the marketing department, and I know nothing about taxes. I’m here to make sure that this guy makes sense.

Ryan: We’re excited to be here, and excited to talk to you today a little bit about entities. Entities are when you start a business: what do you want to do? What do you want to be? What do you want it to look like? And so what we’re going to talk about today is how do you actually decide what is the right entity when you start your business?

So, Ann, let’s start today by talking about what types of entities there are out there. We’ve got S-corporations; we’ve got partnerships that can be partnerships or LLCs; we’ve got sole proprietorships; and we’ve got corporations.

Ann: Ok, can we say those one more time?

Ryan: I would love to. I’ll even do them in a different order. We’ve got LLCs; we’ve got sole proprietorships; we’ve got partnerships that can be LLCs as well; we’ve got S-corporations; and we’ve got regular corporations.

Ann: Alright, help me out here. Let’s start with one of those, and tell me the pros and cons.

Ryan: Sure. And before we go into one by one what each of them look like and what the pros and cons are, understand that each of them do come with pros and cons. There’s no perfect fit. When you’re deciding what type of business you want to be, there’s some advantages and there’s some disadvantages--depending on what your business strategy is; depending on what your tax strategy is; you really have to be careful and make sure you get the right business entity. So I just wanted to make sure we’re not getting the ‘solve-all’ solution. We never will. So we just want to get the best fit for you that we possibly can.

Ryan: Ok. So let’s start with the sole proprietor. Why do we want to start there? It’s the easiest. We’ll work through some of the more complicated entities in just a minute, but let’s start with the easy one: the sole proprietor. Sole proprietors are great because all you have to do is go out to the city, get a business license, and you’re off and running. Most people don’t have to get with their lawyers; they don’t have to sit down and create all these plans and spend a lot of money to get the business started. They can just go and start doing business. It’s great. It’s easy. You don’t have to file any extra tax returns. You add one schedule to your own tax return, and that’s it. It’s simple. So we like sole proprietors because they’re just easy.

Ann: Ok, so let’s get that straight. So: one tax form; it’s just you; no lawyers needed; you’re ready to go.

Ryan: Exactly. So it’s simple; it’s easy; and if you’re just getting going, you’re just moving and just trying to get the business off the ground, why not?

Ann: Alright. Great.

Ryan: So what’s the cons? Because like we said, there’s always negatives to any of these. There’s extra taxes involved. Some of the other entities can save you on some taxes. There are extra taxes. One of them is called self-employment taxes. Also, there’s just some rules out there where the IRS may want to look at you a little bit more if you’re a sole proprietor.

Ann: Ok. So be aware of those extras.

Ryan: Mmm hmm. The IRS can get concerned sometimes that a sole proprietor hasn’t done their job.

Ryan: Alright, next let’s look at the LLC. We’ve looked at the sole proprietorship: it’s easy; it’s flexible; it has some cons to it. An LLC is going to work a lot like a sole proprietorship. There are a few other advantages, and there are a few other things to consider. But it works a lot like a sole proprietorship. The one nice thing about an LLC over a sole proprietorship is you have the opportunity to bring on partners. With a sole proprietor, you can’t do that. So, a lot of times if you have a partnership, an LLC is the way you go if you like simplicity. Because much like a sole proprietorship, an LLC is fairly simplistic. The one thing is an LCC requires more filings. You have to get some legal documentation; you have to get some articles; you have to go through an attorney and get some things done. Which is kind of a con that you have to spend extra money, but it’s kind of a bonus in the fact that you get some extra legal protection with your business. We live in a litigious world--sometimes having that LLC can be really helpful.

Ann: Cool. Ok, so with the LLC tell me about the tax pros and cons when it comes to tax time.

Ryan: Sure. So the tax pros and cons: much like a sole proprietorship, there are some extra taxes involved. On top of a sole proprietorship you actually have to file a separate business tax return, potentially. And so there are some extra filings you potentially have to look at. The one thing I do like about the LLC is it does allow a lot more flexibility in what you can do with your financials over some other entities we’re going to talk about later. Your ability to take money out, what you do with that money, how you’re taxed on it, is very flexible. And so LLCs are great because they have flexibility. They still have some extra taxes though so that’s the negative.

Ann: Got it.

Ryan: Next let’s talk about the S-corporation. We’re getting a little more complicated here--a little more complicated in the entity and what it looks like. There’s some things we can look at and some strategies we can implore with an S-corporation, but like anything that gets more complicated, you have to be careful and make sure you’re making the right decisions anytime you’re looking at an S-corporation. An S-corporation, much like a sole proprietorship, much like an LLC or regular partnership, is what’s called a pass-through. What in the world is a pass-through you ask?

Ann: Yeah! I don’t know. Help!

Ryan: A pass-through means that, at the end of the day, all taxes are paid on your personal tax return. So even if you filed a separate business tax return like you would with an S-corporation, or an LLC, you’d still pay all the taxes on your individual tax return. So they all work a lot the same up to this point. All of the entities we’ve talked about, they do the same thing in that they all come through to the individual. So what’s the difference between an S-corporation and an LLC and a sole proprietorship? The big difference is the S-corporation is not subject to these extra taxes we’ve talked about. So great! Why don’t we want to do that?

Ann: Yeah that sounds like too good to be true.

Ryan: So like everything we’ve talked about, everything comes with pros and cons. So, what are the cons with an S-corporation? The cons are that you’re subject to more rules. There’s more filing requirements: you have to file quarterly reports and quarterly returns, and you have to file an individual tax return and a business tax return at the end of the year.

Ann: So, lots more work for you. Lots more time. You’re going to need some help, maybe.

Ryan: Exactly.

Ann: Ok.

Ryan: So, on top of having to do extra filings, on top of having to do extra work with the S-corporation, unfortunately you also have to live by more stringent rules than what you get with an LLC.

Ann: Got it.

Ryan: So there’s certain times you have to be aware of when you’re taking money out of the business, how that looks, if you’re lending money or putting money into the business. All of that falls under some different rules and regulations; all of that has different guidance.

Ann: So it sounds like you have to be really organized and really stay on top of things with the S-corp.

Ryan: It is. If you are not someone who is organized and stays on top of things, you get yourself into trouble in a hurry with an S-corporation. But the tax savings can be fantastic.

Ann: Cool. Ok, so get organized! Ok.

Ryan: A C-corporation is very different from the other entities that we’ve talked about to this point. A lot of times it’s my least favorite. But there are some instances where it does make sense. Like some of the other more complicated entities we’ve talked about, you do have to meet with a lawyer, you have to get documents, and you have to get things filed. So, not much difference to that point. You have to file a separate business tax return, just like some of the other entities, but here’s the difference: it’s treated completely separate from the individual.

Ann: So this is good when it comes to liability?

Ryan: This is very good when it comes to liability. This is the most secure entity that you’ve got out there. So if you want legal protection, a C-corporation can be a very good vehicle for you for legal purposes.

Ann: Got it. So taxes: pros and cons?

Ryan: Well, the taxes pros and cons is fairly simple. Everyone’s probably heard the term “double taxation.” I don’t know if you know what the means or not.

Ann: No idea. Please tell.

Ryan: So what that means is that the corporation taxes all your income, and expenses, at the corporate level. So you’re going to fill out a tax return for your corporation and you’re going to pay taxes on your profits. Just like any individual would.

Ann: Right.

Ryan: But here’s the problem: when you go to pull money out of your business, as the owner, you pay taxes on the income again that you pull out.

Ann: Oh gosh. Double dip. Got it.

Ryan: Double dip. There’s no other entity that works like that.

Ann: Ok.

Ryan: So, why in the world would anyone want to be a C-corporation?

Ann: Yeah, that doesn’t sound good to me.

Ryan: Well, there are some benefits. One of the benefits is is that if you’re going to go out and try to grow your business through investors, which is angels, VCs or outside investments, a lot of times these groups want to see a separate entity. They want to see something where they can come in and invest in the corporation, but not necessarily invest in you. They want to invest in the business.

Ann: It’s safer for them that way.

Ryan: It’s safer for them so a lot of times they will demand that you be a corporation, so that there’s that separation between you and the business. So, if you’re going to go that route, or if think you are going to be on the stock market someday, and you want to be publicly traded, that’s another reason to be a C-corporation.

Ann: Ok. Great.

Ryan: But other than that, there’s not a lot of tax advantage of doing it. It’s really dependent on your growth strategy.

Ann: Got it. That’s great.

.png)