If the events of 2020 inflicted mayhem on your cash flow — specifically your accounts receivables — you’re not alone.

The most recent Payment Practices Barometer, published by leading trade credit insurer Atradius, showed that the total value of uncollectable B2B receivables quadrupled in the last year. Every outstanding payment contributed to that fourfold increase of bad debt write-offs.

Don’t wait for the next economic crisis: automate your accounts receivable (A/R) process today, so your cash flow can survive future upsets.

Specifically, we recommend automating your accounts receivable and future-proofing your business with A/R automation tool Biller Genie. One of our customers used Biller Genie, and their success story was so compelling that we decided to try it ourselves. We couldn’t be happier, so we want to pass the recommendation on to you. Here’s why.

The most recent Payment Practices Barometer, published by leading trade credit insurer Atradius, showed that the total value of uncollectable B2B receivables quadrupled in the last year. Every outstanding payment contributed to that fourfold increase of bad debt write-offs.

Don’t wait for the next economic crisis: automate your accounts receivable (A/R) process today, so your cash flow can survive future upsets.

Specifically, we recommend automating your accounts receivable and future-proofing your business with A/R automation tool Biller Genie. One of our customers used Biller Genie, and their success story was so compelling that we decided to try it ourselves. We couldn’t be happier, so we want to pass the recommendation on to you. Here’s why.

1. Because it streamlines your employees’ work

Biller Genie’s features save office teams time by automating repetitive tasks. “This tool can automate many of your A/R and reconciliation processes,” says Dan Luthi, COO of Ignite Spot. “It's easily going to save our own team 15 to 20 hours based on how it's tracking in our own business so far.”

A global study recently revealed that workers waste an average of three hours a day on automatable tasks, a labor cost that adds up quickly. Biller Genie helps your people automate a number of time-consuming tasks, like...

-

• Sending new business clients a “payment information” PDF to fill out and return. Usually, office workers are then tasked with inputting this data for ACH setup.

-

• Fielding neutral or even unpleasant questions. Customers often contact your team to change payment methods or terms or which forms of payment you accept.

-

• Sending outgoing emails or calls to remind clients of unpaid invoices. No one wants to hound customers for every outstanding payment. The unpleasant task isn’t just time-consuming; it’s also stressful. Finance teams already carry undue stress. This factor can (and should!) be lifted from our finance teams.

-

• Briefing customers who need to remember historical transactions. When folks need to recall when (and how much) they’ve paid in the past, often, employees have to bring them up to speed.

Instead of these tasks, your employees can spend time on more positive, personal, relationship-building conversations with your customers. Transferring time and energy away from automatable tasks also mitigates mistakes (which often then take even more time to resolve).

2. Because it improves your customers’ accounts payable (A/P) experience

Your employees aren’t the only ones who want to avoid extra conversations. Biller Genie lets customers skip the redundant discussions and simplify their relationship with you. How? By giving them the nudge to remember to pay you on time.

For companies not using Biller Genie, 59% of overdue receivables need three or more follow-ups to resolve the outstanding payment. “Most customers don't actively avoid paying you,” smiles Dan. “They sometimes just forget, and it's just not in their thought process.” Then, Dan explains that once an invoice is overdue, customers may see your name and number on caller ID and feel a pang of guilt, or worse, aversion.

Billie Genie sends automated (yet personalized and friendly) messages to replace those icky interactions. Plus, the tool provides customer web portals that are available 24/7, so your clients don’t need to wait until business hours to manage their accounts.

3. Because it helps your clients visualize the partnership

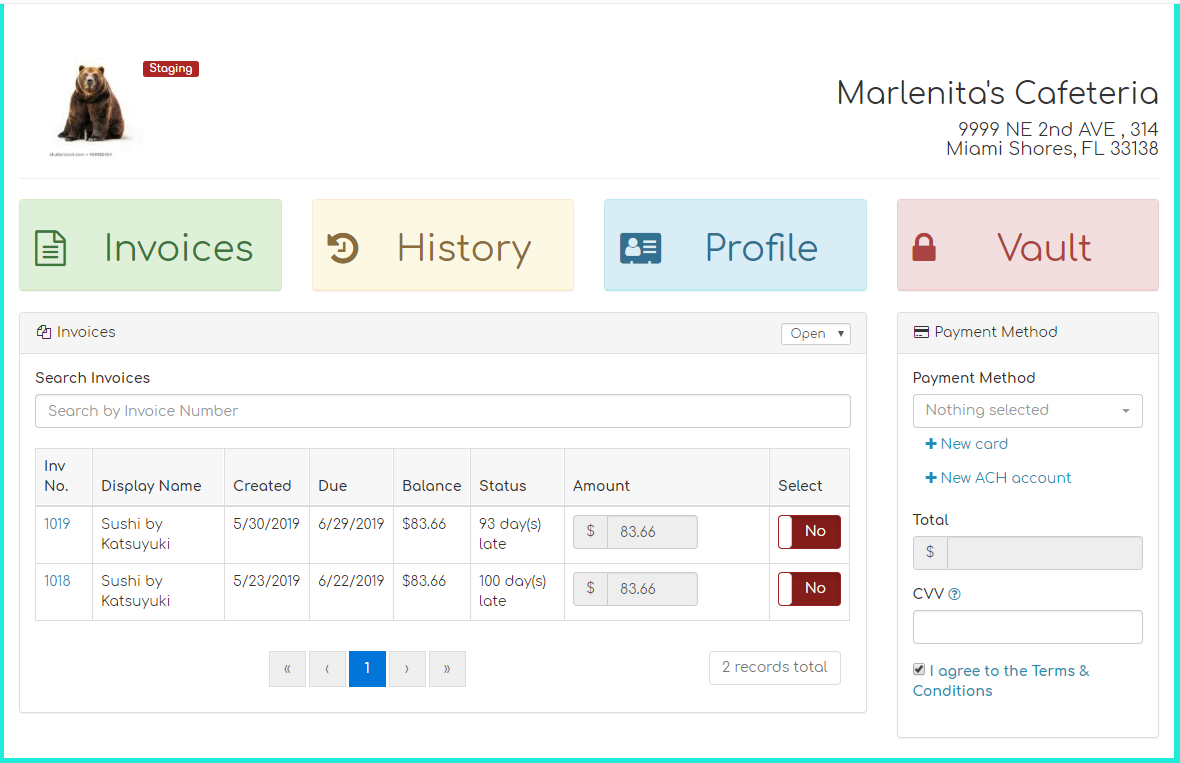

When you use Biller Genie, your customers get a user-friendly dashboard that shows them all the information they need about their partnership with you.

Many leaders struggle to wrap their heads around their accounting partnerships. Spencer Sheinin, author of Entreprenumbers, says that business owners often confide in him, saying, “I’m not actually sure what financial info I need — I just know I’m not getting it.”

Biller Genie’s customer dashboard displays data that can answer customers’ questions — both the ones they came to resolve and the ones they didn’t even realize they had. For example, they can track deliverables and map those to specific invoices — including each outstanding payment yet to be made. Source: Biller Genie

Source: Biller Genie

They can also view their personal information, payment methods, and options for future upgrades.

4. Because it lets clients make important choices — on their own

Your clients’ new visibility lets them customize their experience to get the most out of working with you.

Granted, people still prefer interacting with other humans when it comes to big decisions. But for small tweaks to their account? Most folks these days don’t want — or need — a human involved. Harvard Business Review reports that 81% of customers across industries try to find answers or solutions on their own before reaching out to a representative.

With their Biller Genie customer portal, your clients have many self-customization options:

-

• They can opt to pay now instead of waiting until they’re auto-billed.

-

• They can input and securely store other payment methods.

-

• They can update their profile with new personal information (except for address changes — those sync from your current accounting software).

-

• They can view all of their historical payments and transaction history to make important decisions, like when to pay their late fee or 3% credit card processing fees.

Some of your clients won’t use this feature much. But others will take the reins and steer their relationship with you, deepening their investment in the partnership.

5. Because it untangles the complexities that come with growth

Biller Genie irons out workflows and communication channels that otherwise get snarled when businesses grow.

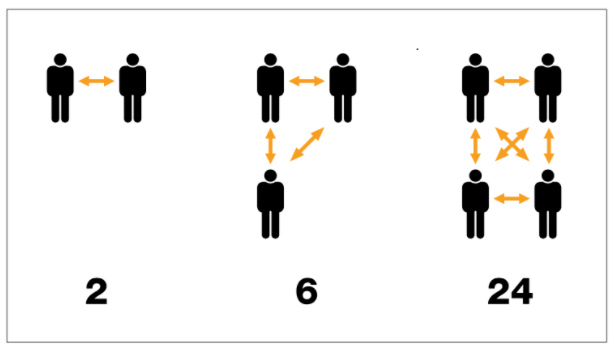

Verne Harnish, a founder of the Growth Institute, depicts this complexity with a helpful visual. When two people are involved in an organization, you have two possibilities for communication and collaboration (both productive and destructive). Three people working together produce six avenues. Four team members introduce 24 possibilities, and so on. The more collaborative possibilities your organization has, the exponentially higher the chances of both successful and unsuccessful outcomes.

Source: GrowthInstitute.com

When businesses scale up, one of the most common casualties is processes in the A/R department. And companies that adopt new technological solutions willy-nilly suffer tangled, insecure redundancies that threaten workflows and morale.

“I’ve always been leery of introducing new tools,” Dan says, recalling a time when Ignite Spot was growing quickly. The team’s A/R was suffering under the new complexities. “The moment we started talking with Biller Genie, it just started clicking. I saw how it would take away all of those potential problems. Here we had a chance to replace all those internal complications and barriers we had been creating for ourselves.”

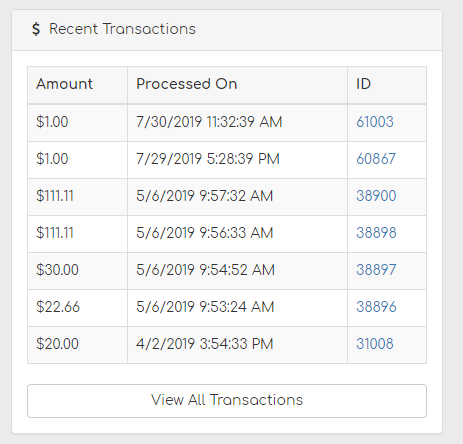

One way the tool does this is by giving leaders new visibility into their accounts receivables. The dashboard provides an overview with a drill-down capability for when you need detailed answers. For example, you’ll easily see recent (clickable) transactions. To get more information about any of those events, users simply click the transaction ID.

Source: Biller Genie

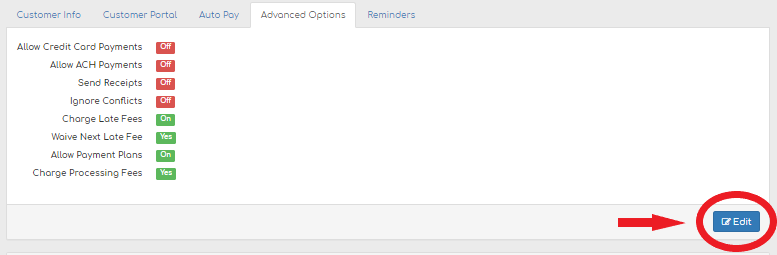

Another growth hazard Biller Genie helps you sidestep is the loss of personalization. Let’s say you just talked with a customer who has fallen behind. One outstanding payment turned into many, and now they want to start a payment plan to pay down their balance. Allow this bespoke leeway (and if you’re feeling generous, waive their next late fee) with the click of a button:

Source: Biller Genie

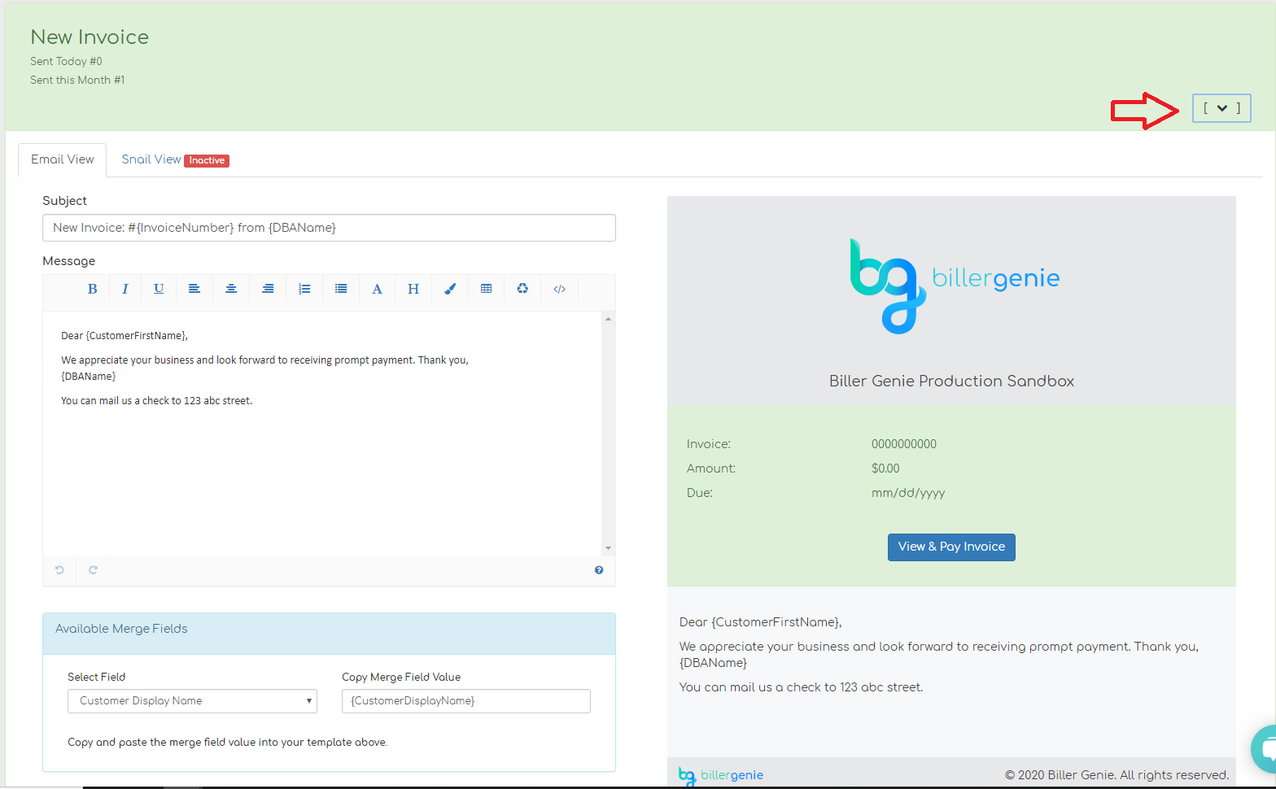

You can also adjust the tone and voice of each customer’s reminders. You see, when businesses grow, their messaging traditionally becomes less human and more corporate. Often, growing companies can’t accommodate the varied histories and needs of each customer, so they stick with safe yet flavorless phrasing. Again, Biller Genie solves for this, allowing a specially customized “tone of voice” for every situation (like addressing an outstanding payment), all without taking up all your team’s time. Source: Biller Genie

Source: Biller Genie

6. Because it’s a cinch to adopt and use

Don’t settle for tools that add stress, friction, or new bottlenecks to your A/R processes. With Biller Genie, there’s no need to change your current invoice generation process.

A recent survey revealed that three-quarters of small business owners struggle to implement new technology.

Dan says that for his team, implementing Biller Genie was a breeze. “To be honest with you, the only real hurdle was our own internal mindset,” he recalls. “Mentally getting past that roadblock of having these money conversations early on in the customer relationship — and then setting clients up with their web portals — was our only challenge. It never occurred to us to go back to the old way because the old way was more complicated for our clients. It was more cumbersome to them.”

7. Because it enhances your accountants’ advice, too

Automating your A/R processes puts you on the same page as your financial advisors.

Before cloud-based Biller Genie, many small businesses downloaded and used do-it-yourself “bookkeeping software” tools. Since most small business leaders don’t have accounting knowledge, these point solutions were just good enough to enable more mistakes and problems that accountants were then hired to sort out.

But that was before. Now, the collaborative nature of cloud-based accounting automation lets your accountant handle your books quickly, easily, remotely, and more accurately.

Biller Genie’s reports allow your accountant to view your whole A/R picture and tailor advice to your changing situation in real time. At a glance, for instance, they can view how many of your customers are using auto-pay or the customer portal.

Source: Biller Genie

And that’s just the beginning. “Your accountant could look, and say, ‘Hey, right now you're at a 90-day term on how you're collecting and that's affecting your cash flow,'” Dan suggests. “Together, you could consider a 30-day term, or even a 45-day term, any change that will help you to improve the movement of cash within your business.”

Another example? Your accountant could check your Biller Genie reports and identify lax limits on customers’ current consumption. “Imagine your accountant saying, ‘I see that this client has a 90k open receivable balance, and it’s been that way for over 90 days,’” says Dan. “With that second set of eyes, you could get them down to a $45,000 balance and a 45-day limit.” Once you’ve gotten that balance to a manageable level, then you can manage expectations to prevent one outstanding payment from slowly morphing into many.

The result is a healthier, more proactive handle on your business’s cash flow.

Don’t let go of another outstanding payment: Partner with Ignite Spot to partner with Biller Genie

Your outsourced accounting team here at Ignite Spot has partnered with Biller Genie. What does that mean for you? “Each of our clients will be able to provide their clients the landing portal for their customers to see all of their outstanding invoices and information for free,” says Dan with a smile. “That is a free gift, from us to you, so that you can provide your own customers free web portals and their many benefits.”

And Biller Genie is just one of our technology partners. We’ve automated the tedium so that our accountants are freed up to give you strategic advice that can supercharge your decision-making. Call us today for a free 30-minute conversation to learn exactly what that means for you and your unique business.

.png)