It’s common knowledge that about 50% of start-ups fail within the first five years and 70% fail within the first ten years. This is according to figures from the Bureau of Labor Statistics.

We’ve all heard these numbers before, but what’s the reason behind them? There are many common business blunders that, when overlooked, could be the demise of your business. In this post, we’re talking about how to become a Working Capital Super Hero so your business can survive and thrive well beyond the first few years.

Business Blunders

One common business blunder is the failure to plan. As Benjamin Franklin put it, “If you fail to plan, then plan to fail.” A business plan should be designed to increase your chances of success while mitigating your risk of failure.

The plan should adopt “what if” scenarios, indicate a response to the challenge and efficient and reasonable solutions to said challenge. Integrating the planning principle and looking at these “what if” scenarios will essentially give you a completive advantage over your competitors. Have a plan for every challenge your business may encounter.

Aside from your business plan (or lack thereof), one of the most significant business blunders that could make or break your business is the lack of timely and accurate financial information.

It’s virtually impossible to make informed business decisions based on perception alone. Without the benefit of accurate financial information, business owners make decisions on their gut without a full understanding of the financial impact to the business. Who wants that? Relying on your perception and gut feeling may lead you into a false sense of security and, unfortunately, failure.

Accurate, timely financial information is critical to sustain a profitable business. Understanding your revenue streams (a.k.a. your sales) and how they align with accounts receivable is an important relationship to have a handle on at all times.

The crux of the question is, how long are you carrying your receivable balances? In the finance world, this is also called DSO (days sales outstanding). It monitors the amount of time it takes for your business to collect revenue (a.k.a. cold, hard cash) after the sale has been made.

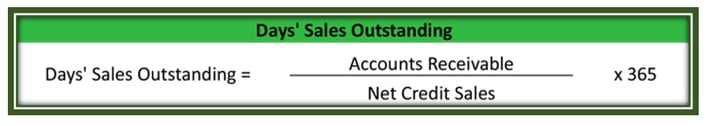

The formula for calculating your DSO looks like this:

We can all agree it’s profitable to convert sales into cash quickly, right? So, the lower the days outstanding, the more profitable it is to your business.

Conversely, if the number of days are higher, this means it’s taking you longer to get paid for all the work you’re putting in. This could tie up your liquid assets and have a detrimental impact on your business.

Getting Paid Faster

So, if you find it’s consistently taking a long time to collect on your sales, what can you do?

First, take a look at how your contracts and invoices are worded. What terms are you providing to your customer, and are you offering early payment incentives or discount terms?

By offering your customer a small incentive such as 1%/10 Net 30, it will lower your days outstanding which will convert your sales into cash faster. Here’s a quick example to show you what that would look like: if you invoice your customer for $100 and they pay within 10 days, then they get a 1% discount and pay $99. If they do not pay within 10 days, then they will pay the full $100 within the 30 day timeframe.

You can bet your clients and distributors are just as concerned about their bottom lines as you are, so this added incentive to pay early can make a difference.

Here are some things to consider when offering an early-payment discount to your customer:

- What’s standard in the industry?

- Are your competitors offering early payment discounts? If so, how much?

- Has the client paid on time in the past?

Early payment discounts are usually a win-win for vendors and their customers. Next time you issue an invoice, consider proposing an early payment discount. The result will be a stronger customer relationship and faster cash on hand for you.

As a business owner, understanding and monitoring your DSO can significantly impact your financial success. If your business doesn’t have sufficient liquid assets to cover operating costs, it could decrease the odds of long-term survival.

One customer caveat is to do your due diligence on new prospects, especially if you’re extending terms to them. So many times, business owners are so excited with the sale they fail to properly check the customer’s creditworthiness. This can pose a significant risk to the business if you are not able to collect on your receivables. Doing your due diligence now will save you a lot of time and money in the long run.

One of the key measurements of extending credit is reviewing the customer’s FICO score. FICO score is the most commonly used credit scoring system as of 2016, and it plays a key role in a lender's decision to A) offer credit and B) how much credit to extend. An example would be if a borrower has a FICO score of less then 600, he would be subject to higher interest rates then a buyer with a score of 700.

Accounts Payable

Accounts Payable is the term to describe the payment obligations you owe to your suppliers that will need to be paid in the future. A few examples of accounts payable balances include monies owed for inventory purchases, legal services, marketing services, utilities, rent and employee expenses. When entering a relationship with a supplier, a business owner should leverage the terms that are best suited for the business.

For example, if your business has sufficient cash balances and a readily available line of credit, you should take advantage of early payment discounts by paying ahead of time each month. However, if your business is operating with very little cash and you’re unable to borrow additional money, then you may opt to forgo the early payment discount to avoid the risk of overdraft.

How is this relevant to your business model, you may ask? Accounts Receivable and Accounts Payable are key indicators in calculating your net working capital.

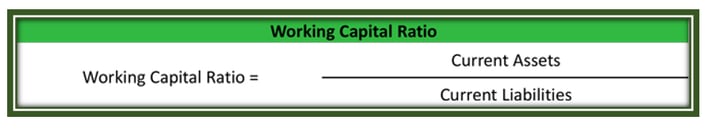

Many times, lenders will evaluate your working capital ratio. You can measure the health of your company by calculating a quick ratio:

Working capital ratio measures your current assets as a percentage of your current liabilities. So, it would only make sense that a higher ratio is more favorable.

A working capital ratio of 1 indicates the current assets equal the current liabilities. A ratio of 1 is usually considered the middle ground. It's not risky, but it is also not very safe. It means that if your business wanted to suddenly pay off all its liabilities, it would have to liquidate its current assets. So, you want to keep that ratio a little higher, if possible.

One caveat here—though most businesses strive to maintain consistently positive working capital, an extremely high figure is not always necessary. In some cases, very high working capital may indicate the company is not investing its excess cash optimally, or it is neglecting growth opportunities in favor of maximum liquidity.

Though a positive figure is generally preferable, a company that doesn’t put its capital to good use isn’t in a much better position than a business without a lot of cash to begin with.

In some industries, such as retail, high working capital is necessary to maintain smooth operations throughout the year. In others, businesses can run on relatively low working capital without incurring issues if they have consistent revenues and expenses, as well as a stable business model.

Though these may not be the most exciting concepts for a business owner, understanding them (and staying on top of them from month to month) will turn you into a working capital hero and contribute to the overall health of your business.

.png)