January is the month for new resolutions. I've been coaching a lot of entrepreneurs over the past few weeks on how to double the size of their companies over the next 12 months. The conversation has been happening so much, that I thought I would write a blog post about it today.

January is the month for new resolutions. I've been coaching a lot of entrepreneurs over the past few weeks on how to double the size of their companies over the next 12 months. The conversation has been happening so much, that I thought I would write a blog post about it today.

This plan isn't hard to implement and will actually work, but you have to stick with it.

First of all, what does it mean to double the size of your company? Are we talking about having twice as many employees? Double the office space? Twice the revenue? This blog post is focused on two things: doubling your annual revenues and having a cost structure that allows you to at least double your profit. Let's get started.

Step 1: Fix the Financial Statements

You'll never double the size of your company in a sustainable way if your financial statements are a mess. The accounting system needs to be strong enough that you can pull reports for key metrics and trust that your cash cycle is protected. That means that your books need to be tight enough that customers are being invoiced on time with little to no collection problems and bills are being paid with the right cash injections.

The reports are vital; they will show you the heartbeat of your company. You need to be able to see profitability and margins at a glance as well as cash balances, and more. If you can't, you may still be able to double the size of your company, but you'll get an ulcer doing it.

Step 2: Commit to 10%

Before we go any further, we need to understand that doubling the size of the company is a bad idea if you don't actually make more money in the end. Sure, you may end up with more sales and employees, but your profit and bank balance need to reflect the growth. If you don't actually make more money after all is said and done, why go through the pain of getting bigger?

Before we go any further, we need to understand that doubling the size of the company is a bad idea if you don't actually make more money in the end. Sure, you may end up with more sales and employees, but your profit and bank balance need to reflect the growth. If you don't actually make more money after all is said and done, why go through the pain of getting bigger?

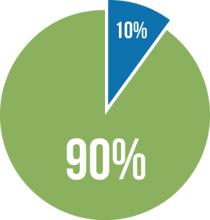

This means that you need to learn how to operate your business on 90% of your cash. The remaining 10% needs to be stashed for wealth building, taxes and a rainy day. To learn more, check out one of our most popular articles titled #1 Profit Coaching Tip: The 90/10 Rule.

Step 3: Build a Real Marketing Budget

Now that your financials are in order and you're running at 90% cash, it's time to look at your marketing budget. You would be surprised at how few companies actually do marketing. The reasons are many including:

- I don't understand how to do marketing.

- I tried marketing once and lost money.

- Marketing doesn't work for my business.

- I don't know how to market online.

The list goes on and on. If you're not marketing, you're not going to grow. Sure, you'll get some word-of-mouth growth and some walk-ins, but you're not going to double your business in 12 months on that kind of traffic. You need to add some gasoline to the fire.

Here's the good part. You don't have to know how to do it. There are plenty of marketing firms that will do it for you. Your job is to hire them. I tell all of my clients that if you want to actively get bigger each year, plan on spending between 6% - 8% of revenue on good marketing. That means that if you bring in $100,000 a month, you should be spending between $6,000 and $8,000 a month. Are you doing that? Chances are that your competitors are and they'll leave you in the dust if you don't get stated.

But that's a lot of money, you say. I know it is. So what. Almost all companies have waste in their system and when they let go of the dead weight employee or cut unnecessary spending on "meals and entertainment", they can always find marketing money.

Once you have found your marketing capital, it's time to get a professional. Don't do it yourself. You don't have time to learn how to run a Google AdWords campaign or build a website.

Step 4: Write of the First Three Months

Here's the rub: I want you to be completely comfortable knowing that your first three months of marketing won't bring in a single dollar of revenue. Stinks I know. Why is that? It's because your marketing firm needs data in order to actually convert visitors into paying customers. That takes time to understand and optimize.

The good news is that because you cut out waste in your company by firing the dead weight employee and cutting unnecessary spending, it was money you were already spending anyways.

After a few months of trial and error, your marketing firm should have a grasp on how to get you a good ROI for your spend.

One final clarification. Don't hire a branding firm. You don't need fancier stationary or a good PR campaign right now. What you need is a company that will put your marketing money towards something that will convert leads in a measurable way.

Step 5: Control Your Labor Budget

Once you start growing, you're going to want to hire staff to deal with that growth. Fine, just don't over do it. Work with your accountant to determine what your labor budget should be and stick with it. If you have $500,000 a year to spend on staff, don't go over that. If you feel you need to, then get serious about making your current staff more efficient instead of hiring more. This is crucial, otherwise you'll end up doubling your business and actually making less or even loosing money because your payroll is too bloated.I tend to make things sound easier than they really are. I know that these five steps represent a lot of work for you in the coming year, but it is possible to get them done. I speak with far too many business owners who say they want to double in size, but they aren't taking any of the above measures. With these steps, you have a real chance at making it happen. Without them, you're living a pipe dream.

.png)