A big part of accounting revolves around the wonderful world of taxes and regulatory bodies that work in conjunction with the bookkeeping aspect of tabulating business performance and tracking the flow of money throughout a company. Inventory accounting deals with the valuation of a company’s inventory, which can vary due to not only how many products are held in inventory but also how much those products or materials cost.

This distinction is important due to the fact that over time, most raw materials (and therefore products) rise in cost due to inflation. This means the value of an item in inventory can change over time even though the amount paid for that item by the company is a fixed price. This fluctuating nature of inventory gave rise to two primary methods for inventory accounting: FIFO and LIFO.

What is FIFO?

First in, first out (FIFO) is the method of inventory accounting which assumes that the first items you add into your inventory, whether by purchasing or production, are also the first items that you sell when a sale is made. A good analogy is to think of cartons of milk at the grocery store. Milk expires relatively quickly which means they need to place the oldest milk they have at the front to ensure it doesn’t go bad. So, the first shipments of milk they receive are also the first ones that are sold.

What this means in terms of material cost increasing over time, as we mentioned above, is that the items which were purchased at the lowest rate are sold through first. This means the value of the ending inventory at the end of the fiscal year would be higher and closer to the current cost of those items at the time of reporting.

FIFO is the standard accounting method across most of the globe, but the United States allows businesses to choose between FIFO and the alternative method of LIFO.

What is LIFO?

Last in, first out (LIFO) is the opposite of FIFO accounting. With the LIFO accounting method, the most recently purchased products or materials are considered to be the first items to sell when a sale is made. One way to think of this is if you stacked slabs of granite on top of each other in your warehouse whenever you made a purchase. When a sale is made, the slab on top would be taken off to sell to the customer and older slabs would remain in inventory.

This results in an increased reported cost of goods sold, which can help reduce the amount paid in taxes come the end of the year. LIFO tracking can result in more complex inventory layers due to the possibility for pieces of reported inventory staying on your business records for years. The LIFO system is also not permitted under the International Financial Reporting Standards (IFRS) and can be prone to dramatic changes to reported costs of goods sold if older items within the inventory are sold.

Which One Should I Use?

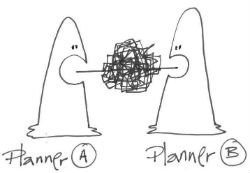

Picking one may be simple depending on the sector of business within which you operate. Adhering to the IFRS framework may be reason enough for you to go with FIFO reporting. However, if you have the choice between the two, there are cases in which it would be more beneficial to report using LIFO tracking. Consulting a financial advisor and providing them with details on your business would allow them to help you decide which is best for you.

The experts at Ignite Spot are available to provide financial advising and to help with your tax preparation. Contact us today to learn more.

Photo by Samuel Zeller on Unsplash

.png)