Profits, losses, revenues, oh my! As a business, you really want one thing: to bring money into your company. But business success takes both hard work and time to build, and you’re already chomping at the bit. So aim for a short-term goal as you continue to grow: your break-even point. How do you calculate your break-even point? Let’s take a closer look at what a break-even point is, how to calculate the figure, and why it’s such a major benchmark for growing businesses like yours.

What is a break-even point (BEP)?

From an accounting perspective, a break-even point is the sweet spot where your total revenues are equal to your total expenses during a specific period. That is to say, break-even sits just outside the red and is the threshold where your company hasn’t quite made money yet on sales compared to its expenses but is just on the cusp of doing so.

Why is BEP important for businesses?

Your break-even point is a scalable analysis that informs your business plan. Your investors want to know two things when they support you: the potential ROI and the time frame to expect it. New businesses take months—and often years—to become profitable, so it’s helpful to be able to forecast for investors when yours will turn a corner.

But it’s not just a gauge for emerging businesses; a break-even point helps existing businesses plan and pivot to reach their goals and:

- Adjust prices.

- Highlight overlooked expenses.

- Set revenue goals.

- And more!

Determine your break-even point to get a broad view of your cash flow and create goals to set your business up for financial success.

What do you need to calculate BEP?

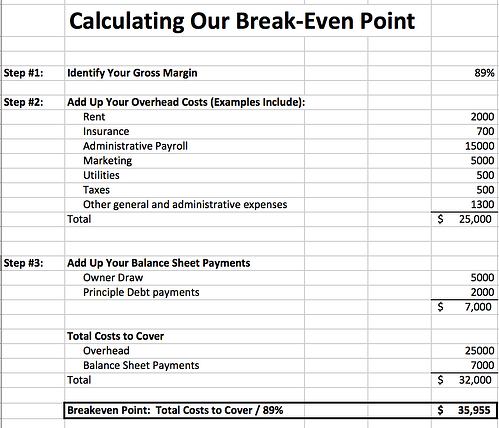

“OK, Ignite Spot, I’m ready to dive in. How do you calculate a break-even point already?!” Just a few more details to remember—we promise. With all of the expenses that come along with running your business, it can be intimidating, but you only need three things to calculate your break-even point: gross margin, overhead costs, and balance sheet payments.

1. Gross Margin

Your gross margin—or gross profit margin—is your company's net sales minus the costs of producing your goods and services. It includes how much profit you make before you subtract selling, general, and administrative costs.

Example: Pretend your gross margin is 89 percent. This means that for every dollar you sell in products or services, you get to keep 89 cents to go toward your company’s overhead costs.

2. Overhead Costs

Overhead costs are the operational costs that you incur within your business regardless of how successful you are. Rent, insurance, administrative payroll, and marketing all fall under overhead. Add up every dollar that you spend each month to see your total overhead costs.

Pro tip: Most people cut out marketing, which is a big no-no. They do this because if things get bad, marketing is often one of the first things to go in order to save money. That’s a big mistake! Calculate your break-even point with the marketing budget built in so your company can grow.

Example: Let's pretend that you have $25,000 in overhead costs.

3. Balance Sheet Payments

Balance sheet payments are monthly expenses that are not classified as an expense in typical accounting terms. The principal portion of loan payments, payments to investors and shareholders, and owner draws are all examples of balance sheet payments.

Example: Let's pretend you take a $5,000 owner's draw from your company each month and an additional $2,000 you need to pay in principal payments on debt. As a result, your balance sheet payments are $7,000.

What’s the break-even formula?

In accounting, the break-even point formula is determined by adding your overhead expenses to your balance sheet payments and dividing by gross margin percentage. Break-even point is a tricky concept for many entrepreneurs, with blunders resulting from:

- Selling many products or services, all with different cost structures

- Confusing the cost of goods sold with overhead costs

- Inaccurate financial data

But calculating the break-even point for your business is simple once you have the right data. Use the following equation to calculate your break-even point:

(Overhead Expenses + Balance Sheet Payments) / Gross Margin = Break-Even Point

Figuring out how much you have to sell to keep the doors open seems like a no-brainer, but it takes a little bit of everyone’s favorite four-letter word (No, not that one): Math. Get that groan out of your system, take a breath, and watch our quick video on how to calculate the break-even point for your business:

Remember all the little examples we sprinkled throughout this post? All those figures link back to what we’ve illustrated in the video. So your calculation looks like this:

(25,000 + 7,000) / .89 = $35,955

To break even, your business needs to sell $35,955 in products and services.

Get a handle on your break-even point to find financial success.

To get (and keep!) your business in the black, remember the answer to this question, “How do you calculate break even point?” Your break-even point reflects when your total revenues are equal to your total expenses, helping you plan for your future, whether that means forecasting how many units to sell or adjusting your prices.

While it’s a valuable tool, your break-even point shouldn’t be the only way you determine your budget. You should also take a close look at your static versus actual numbers all year round to plan for the long term. Need a little help along the way? Get in touch with us with any questions or to sign up for expert accounting services.

.png)