Research from QuickBooks reveals that small-business owners who hired an accountant were glad they did.

In fact, 85% said doing so saved their businesses money. Almost all business owners (90%) said the move saved them time, and nearly all (89%) said they were less stressed, thanks to the help. A vast majority (85%) said they’d become more legally compliant, and most (84%) said their accounting expert helped the business plan ahead.

Need help planning for your business? Learn 8 key factors that give your business a competitive advantage.

The only catch? To get these results, business leaders must be involved in their finances, too.

Here’s 3 tips on working with your outsourced accounting team so they can do even more for your business than you imagine.

1) Set mutual goals with your outsourced accounting expert

When you win, your accountant also wins, so establish milestones together that ensure both of you can thrive. For this kind of reciprocal growth, clarify what you want. Some CEOs want to stabilize cash flow. Others just want to be more organized financially. Some want visibility for better decision-making. And still, others might have a goal to acquire a competitor within a year.

Once you’ve settled on your goals, ask your accountant in what areas you can improve your business.

Also, ask what financial moves your business can make today to change course (defensively or offensively). A seasoned accountant will give you a plan of action to get started, so you’ll have concrete steps to follow.

In exchange, expect your outsourced accounting expert to share their plans for continual improvement as well. Review both of these plans each time you meet.

2) Be proactive and expect proactivity in return

Once you’ve handed off your financials to an expert and clarified your mutual goals, stay engaged and effective — that is, proactive — in the accounting process. Here’s how.

Ask every question you have

Curiosity is natural. It’s a powerful character trait for a leader, especially regarding a business’s inner workings.

One of the common reasons business owners don’t ask questions is that they wrongly anticipate friction in getting the response, or they fear hearing an intimidating answer. Expect this mental block and push through it. Know that it lessens over time with continued inquiries. A good accountant will appreciate your interest. They don’t expect you to be a corporate finance whiz — that’s their job. So ask questions; when you do, you’ll find your partnership grows in capacity.

To build the habit of asking ongoing questions, plan to speak with your accountant monthly. Keep a running list of ad hoc questions. Ask about everything from technical aspects of finance (like, “What is deferred revenue, anyway?”) to general guidance (such as, “How much should I be paying myself at this stage?”). You can even ask about broader trends (for example, “Does real-time payment mean we reconcile transactions constantly?” or “Should we accept Bitcoin?”) and more.

Then, use a standing list of strategic questions to ask in every monthly meeting. Here are some examples:

• What have you done for our business this month? (The answer may seem obvious, but some nuances may surprise you).

• How healthy is my current cash flow, and what can I do immediately to improve it?

• Do you have any recommendations for avoiding financial trouble or capitalizing on an opportunity?

• Can I do anything now to maximize my tax savings later?

• How can I help you answer these questions even more thoroughly next month?

In exchange, an accountant will likely ask questions about your industry and your operations, too. Be ready to answer your accountant’s questions as diligently as you expect them to answer your questions about financials.

You’ll cover basics, such as your business structure, payroll needs, and sales-tax filing requirements early on in the relationship. Questions that indicate a proactive accountant run more along these lines:

• How (if at all) have your goals changed since we last spoke?

• Do you have plans to grow? If so, how (geographically, by diversification, etc.)?

• What’s your greatest financial challenge right now?

• How happy are you with your team’s performance and output?

• Have you encountered any regulatory hurdles lately?

Reciprocal interest shows a mutual desire for success. Ask good questions often, and expect your financial advisor to do the same.

Lean in to the concepts that feel intimidating

Best-selling author Garrett Gunderson claims that the number one reason business owners dislike accounting is that they feel powerless. At Ignite Spot, we agree — business owners often avoid their financials. But neglecting them doesn’t prevent them from vexing you. In fact, when you dodge the difficult issues, you miss out on crucial intelligence.

So lean into challenging concepts (and their accompanying tasks). The more you do, the more you’ll learn, and the more benefits you’ll see. Need some examples? How about exploring new technology, engaging in exercises like cash flow analyses, learning about unusual gains and losses, and dabbling in some scenario mapping?

In their book Proactivity at Work, management scholars J. Michael Crant and Kaifeng Jiang reveal that personal initiative leads to a better attitude, enhanced leadership and task performance, and even lower reported levels of exhaustion. Plus, your accountant will enjoy talking with you about the more nuanced concepts of corporate finance.

In exchange, an exemplary accountant will also press into challenges, working through the complexities and tangles of your unique operations. Expect this proactive inclination; the accounting practitioner who demonstrates it is a keeper.

Find a proactive accountant today. Download the pricing guide.

Look for both trouble and opportunities

Another way to get the most out of your outsourced accounting team is to review your financial statements with interest. Search out trends and curiosities within the numbers there.

That means you must learn to read your financial statements. Your accountant can recommend resources to get you up to speed if you’ve never analyzed a balance sheet or an income statement before.

Once you know your way around these reports, compare the figures to those of the previous period, and highlight notable positive changes in green and negative changes in pink. Then, review your long-term goals, and determine whether (and what) changes you should make to align the business with the trajectory toward those goals.

In return, expect the same diligence from your accountant. In fact, if your expert hasn’t already come to you with suggestions to sidestep snags, it may be time to reevaluate your partnership. You’d be in good company: a lack of proactive attitude and output drives 72% of business owners to leave their accountants and switch to a better option.

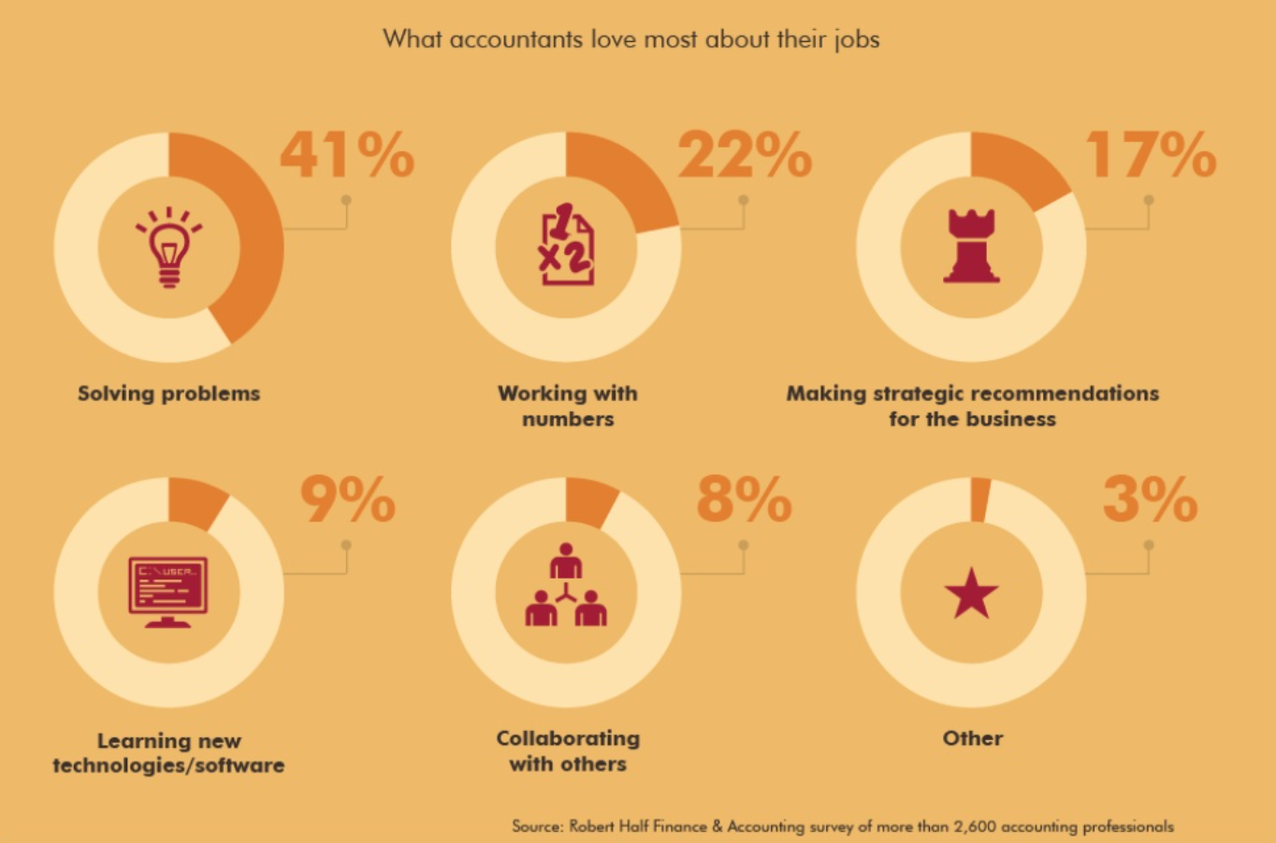

If that’s you, take heart: there are plenty of experts out there who love to investigate and puzzle together fixes and wins for their customers. A recent survey of over 2,600 accounting pros reveals that the thing they love most about their role is solving problems for their business clients.

Source: Robert Half, 5 Surprising Facts About Accounting as a Profession

But when both sides look for trouble and opportunities on behalf of the other, the partnership thrives every time.

3) Provide guidance and expect guidance in return

Neither you nor your outsourced accounting expert can communicate telepathically, so you’ll need to offer ongoing feedback.

Clarify expectations with specificity

Crystallize the scope of work involved and the expectations of deliverables. How will these offerings be handed over or presented? At what time, on what day, and through which communication channels?

Expectations can also involve your hopes for future expansion of services, any disappointments to date, and even theories you’d like to test through experimentation.

In exchange, your accountant will clarify what your participation will do for them and for the partnership. For example, when you follow the specific steps in your advisor’s action plan mentioned above, your accountant is freed up to offer insights based on mutual goals and the organized data.

Trust your outsourced accounting expert

Once you’ve clarified expectations, and your accounting expert has begun delivering on those objectives, it’s time to let them do their job. Collaborating never means hovering.

One way to respect the balance between involvement and autonomy is to resist the temptation to pick up the phone every time you encounter a new accounting term, for example. Another tangible way to trust your expert is to give the relationship time. Allow for at least three months of working with your outsourced accounting expert before deciding to continue or switch providers. And finally, trust them to have your best interest at heart.

Indra Nooyi, chairman and CEO of PepsiCo, once said,

“Whatever anybody says or does, assume positive intent. You will be amazed at how your whole approach to a person or problem becomes very different. When you assume negative intent, you're angry. If you take away that anger and assume positive intent, you will be amazed.”

The assumption of success guides your accountant toward that very end just as effectively as technical feedback, so acknowledge their commitment early and often. You'll be glad you did.

In exchange, an accounting team should build your trust over time by

• Offering you continual accounting tips;

• Responding to questions quickly, correctly, and confidently; and

• Tailoring financial information and advice to your particular industry and business

“Account me in!“ — mutual involvement matters

A healthy relationship with your outsourced accounting team can provide more value than you expect. It can save you money, time, and stress while providing you peace of mind and visibility into your financials. But, as you can see, it won’t happen without your input. Give your accounting expert the engagement they need to work for you, and your business will be better for it.

To get started, you’ll want to meet an outsourced accounting team and see this kind of proactive partnership in action. Download our pricing guide now to learn exactly what next steps are best for your unique business.

.jpg?width=960&length=960&name=IS_Biller%20Genie_SM%20(1).jpg)

.png)