Take control of your business during times of uncertainty with these 8 tactics revealed by CEOs in the tech and financial industry. These tangible steps are inspired by the recent shift in consumer behavior in response to Covid-19. We looked at what founders of SaaS companies are doing to protect their business from economic disruptions and how popular brands are shifting their business model to tap growth opportunities.

💸Defensive Tactics

Your best defense is to monitor and limit cash flowing out of the business. These tips will help you save money and cut costs. The first step is having solid financial reporting via your income statement, balance sheet, and cash flow analysis so you can make informed decisions on how to cut costs. Focus on activities that are essential to your business, such as sales.

1. Cut Costs

This is the most obvious tactic but can be the most difficult to implement when it comes to deciding which expenses to cut. CEO, Eddy Hood, recommends looking at your expenses by the vendor during a period between 3-12 months. Export a list from QuickBooks into Excel. Then create 3 categories: Necessary, Negotiate, and Unnecessary. View the full video explanation here.

If you need to brush up on your Excel skills, register for our free webinar on June 17 to learn how to build a cash flow forecast with Excel.

CEO of AppSumo, Noah Kagan, recommends canceling subscriptions and keeping necessary expenses such as web hosting fees, sales, and any marketing costs related to driving customers.

2. Negotiate lower monthly payments, including rent and subscriptions

Shutdowns from Covid-19 are leaving office buildings deserted and forcing teams to work from home. A reduction of rent for office space can help when finances are tight. Here’s a sample rent reduction letter shared by Kagan:

Dear {property managers}

Due to the recent COVID-19 outbreak, I’m sure you are aware businesses are struggling - especially companies like ours. And many of your tenants in your properties.

I wanted to contact you today to ask if we could discuss temporarily lowering our rent. We love working out of this space here, but now with our teammates required to work from home and the reduction in revenue from our customers, finances are difficult, and a reduction in rent would go a long way.

It’s important to me to be a good and responsible tenant. We have always paid our rent on time and in full. I have maintained the building in good condition, and I have been kind and respectful to both you and our fellow building mates. I don’t believe you could ask for a more conscientious tenant.

I would like to request a $10,000 reduction of my monthly rent for a period of 6 months. I believe this is a fair rate and would help me retain occupation here, which is very important to me.

There are also many benefits to you if I stay, including avoiding the expense and hassle of listing the vacancy, readying the space for a new tenant, going through the application process and avoiding the loss of rental income while you search for a new tenant.

I don’t want to have to hand in the keys and close down permanently, the preferred option is a temporary rent reduction to allow me to continue to occupy and pay your rent for the years to come.

In exchange for your understanding, I would like to know if there is something I could do for you as well. If you wish, I could pay the rent reduction back in 24 months assuming the economy recovers and I am open to other ideas.

We do enjoy being here, but we are strapped for options. I am hoping it doesn’t come to us closing down and we can agree on new terms. Please let me know your thoughts at your convenience. If you wish to discuss this further, do not hesitate to reach out.

Thank you,

{Your signature}

Kagan also suggests contacting all the subscriptions you have and ask for 50% off. Here’s the email template he uses:

Hey {first name}

Can you please cancel our subscription? Confirm when it happens.

If you can do $X / month then we can keep it, otherwise, we can't afford it. I can evaluate in 12 months going back to $X.

Hope you understand,

{Your signature}

🤑 Offensive Tactics

In addition to keeping a close eye on your expenses, you also need to find ways to grow your business proactively. This could include offering new products or services, changing your value proposition to align with current concerns of customers, or pivoting to a different business model. You must continue to move cash in your business by collecting money owed to you and doubling down your marketing and communication efforts.

3. Offer a new product or service

Help solve your customers’ problems around their new stuck-at-home lifestyle. Gyms can stream classes online at a discounted rate of their customers’ normal monthly membership. Shake Shack partnered with food delivery service Postmates and Coachella to deliver complimentary burgers to would-be festival-goers streaming music performances at home. The pandemic is creating a shift in consumer behavior that brings many challenges, but also opportunities for companies to address. Ignite Spot created a service to help businesses apply to PPP loans in the first round of stimulus funding and are available to help clients access the additional $335 billion in PPP funding the senate approved on April 21, 2020.

4. Collect all payments and debts owed to you

It can be awkward to ask clients for payments during an economic downturn. You don’t want to seem tone-deaf to the recession caused by Covid-19, but you can help by offering discounts to accounts who pay quickly.

Check out these tips for collecting Accounts Receivable.

5. Give something away for free

For a service-based business, you can offer a high-value service free of charge for a limited time. This is a great way to give people a sample of your service so they can see the value of your offering and are left wanting more. Patrick Campbell, Founder & CEO of Profitwell, stated he is giving discounts to get cash now. Similar SaaS subscription companies are offering deals on a bundle of service with the third month free if you pay for the first two months upfront. At Ignite Spot, we offer our first CFO financial advisory session for free. Clients receive a cash flow report that incorporates all of their expenses, sales projections, and debt. Even if they decide to work with another fractional CFO, they leave with a great tool to help them determine their break-even point.

6. Learn new technical skills and optimize your business to operate online

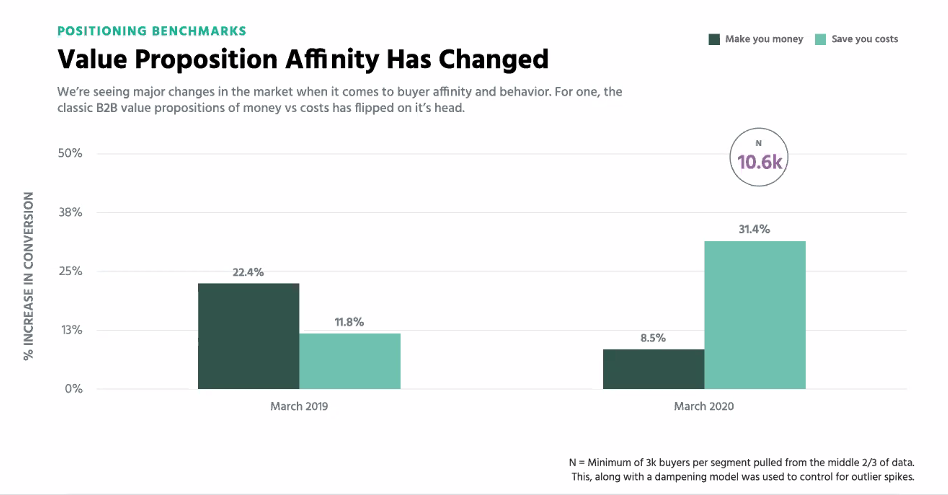

With coronavirus shutdowns across the world, there are more people stuck at home. This is changing customer behavior and buying habits in 2 major ways. First, more people are online. Find ways to connect with your customers using technology, email, and social media. Second, according to a survey of buyers from Profitwell, business customers are more attracted to the value proposition of saving money than making money.

March 2020 Buyer Survey Source: Profitwell

If you’re a B2B, help clients work efficiently at home with online software. Here’s a list of our favorite cloud tools at Ignite Spot. If you’re a B2C, help your customers to access your product and services from home. Coffee shops can sell their coffee online and ship directly to their customers’ homes. Campbell recommends that if you sell anything that physically touches consumers (or if you are a B2C), you should pivot to an online model for your customers. This brings us to the next tip: pivot.

7. Pivot

To access growth opportunities, you might need to pivot your business model or change how you distribute your service. Airbnb changed their Experiences offering from unique travel excursions to virtual bike tours and online sangria parties. The delivery is different, but the product is the same: fun, memorable escapes.

8. Raise capital through stimulus package loans

The CARES Act allocates low-interest loan options including the Paycheck Protection Program(PPP) loan and the Economic Injury Disaster Loan(EIDL). The first round of $350 billion PPP was claimed within 2 weeks. If you have not already applied, we recommend applying for the second round that was approved on April 21, 2020. Get help with your stimulus loan application here.

.png)