A meeting with an accountant can easily end in disaster. That’s because the accountant is focused on debits and credits while you're left to wonder why none of the numbers look right.

A meeting with an accountant can easily end in disaster. That’s because the accountant is focused on debits and credits while you're left to wonder why none of the numbers look right.

These kind of failed accounting meetings happen daily in small business America and were here to set them straight. Below you’ll find a quick and easy checklist of 7 things you should cover with your accountant each time you meet.

We’re assuming that you've scheduled a consistent meeting with an accountant at least once a week. If not, set that up first. You need to have calendared time to check in with your finances. If your meetings are sporadic, then the information you get will be sporadic as well. Giving your accountant a weekly meeting to prepare for will make all the difference in the world.

The 7 Talking Points to Master when Meeting with an Accountant

#1: What is your cash position?

Your accountant will need to book all of the current bank transactions and reconcile them to your accounting software before you can talk about this. Doing so will allow you to consider your cash position in light of all the uncleared items that haven’t hit your bank account yet. Knowing your true cash will help you to sleep at night. In any meeting with an accountant, getting a clear picture of cash is step #1.

#2: Where do you stand on receivables?

Go over your accounts receivable aging tables and look at any customer that is over 60 days old. Have a discuss to determine which customers need a followup call, finance charges or a trip to the collections agency. You should also talk about deposits that are coming in for week.

#3: What bills need to be paid this week?

Have your accountant prepare a list of all bills that are due within the next 7 days and review them together for payment. Have your accountant cut the checks so that you can sign them. You'll also want to review your accounts payable aging table to see what bills are still open and coming down the road.

#4: What is your new cash position?

Once you've approved the bills to be paid, have your accountant give you your new cash position so that you know what you have left.

#5: How are you doing compared to your budgets?

Most importantly, have your accountant compare your actual revenue and expenses to the budgeted amounts for the month. How are you doing so far? Do you need to make adjustments to your sales strategy, labor costs or operations in order to reach your goals for the month? Every meeting with an accountant should compare your goals to your actual performance.

#6: How profitable will you be this month?

Determine how much profit will be left after you have incurred your expenses for the month. You want this figure to be at least 10% of your revenues. For more on this, see our post titled How to Make a 15% Profit in Your Business Every Month.

#7: What is your tax and investment strategy this month?

During your meeting with an accountant, make sure that you're setting aside the necessary taxes for the month. We suggest transferring the funds to your savings account so that they don’t accidentally get spent. Also, determine what you will do with the remaining profits you earned for the month. Once you've set aside cash for taxes, you should then consider saving towards a working capital goal that will cover at least 2 months of your operating expenses.

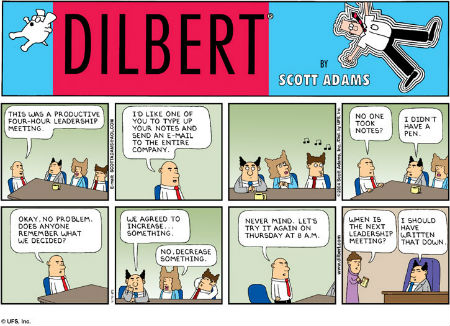

Meeting with an accountant each week shouldn't take longer than 30 minutes. The goal is to make sure you're completely connected to your finances after your weekly meetings. As a business owner, you must have this connection if you are going to be successful.

If your accountant isn't cutting it for your business, visit our accounting services page at Ignite Spot Accounting to see how we can help your business.

For additional tips on how to transform your meetings in general, check out these 4 tips from Fast Company.

.png)