As part of our profit coaching efforts, we try to go beyond number crunching and help clients really grow their business. We weed through a lot of crap on the Internet, but we save the good stuff to share with you. Here's the 6 most insightful and inspiring bits we found on the world wide web this week:

For Entrepreneurs

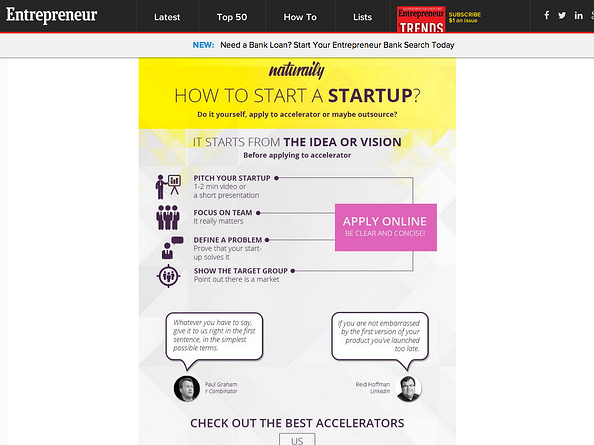

01. Entrepreneur.com's Infographic: "The Many Pathways to Starting a Startup"

There's probably as many different ways to start a startup as there are startups, but Entrepreneur.com did a great job of mapping out the most common ways people get a business going. Click here to see the full infographic.

02. Mashable Features Wisdom from 5 Founders

Here's some of our favorite bits of advice sampled from the full article:

Three business commandments … I've learned three things that I believe matter a lot: You catch more flies with honey, a.k.a. there are no diminishing returns to specific positive feedback (I learned this from our founding angel Joel Peterson); adequate performance gets generous severance, which is Netflix's policy for being dignified but decisive with employees who are not a fit (which I learned from our former CTO and now founder/CEO of Attune, Mike Hart); and if you aim to please everyone, you will please no one--that's what I'm learning right now. - Andy Dunn, CEO of Bonobos

Emphasis on teamwork … Empowering my employees to work better together was a bit of a struggle — especially during the transition from 30 to 100 employees. To combat this struggle, I placed a heavy emphasis on the importance of teamwork. We developed core company values, of which teamwork is a main tenet, and work to show employees that teamwork is really important. These values play a major factor in our quarterly review process. - Lisa Falzone, CEO & co-founder of Revel Systems

Subscribe to our blog to receive more articles about profit coaching, profitabilty and strategy.

For Leaders

01. Forbes: Why Tough Love Leadership Works

Josh Linkner argues that the best way to achieve good leadership status is to find a yin/yang balance in the way you work with your employees: not too much jerkiness, but not too much niceness either:

Think about it – if you’re all tough, you’ve been deemed a jerky boss. The byproduct of this is that you end up with poorly performing employees who are over-stressed and constantly live in fear of whatever you’ll do next. On the other hand, if you’re all love, you have no accountability, which means no results – good campfire songs don’t pay the bills… revenue does.

02. Inc.com: 75 Inspiring Quotes on Leadership

Yes. 75. And, yes, we read every single one. Definitely inspiring. Here's a few of our favorites:

"Don't waste your energy trying to educate or change opinions; go over, under, through, and opinions will change organically when you're the boss. Or they won't. Who cares? Do your thing, and don't care if they like it." - Tina Fey

"I have three precious things which I hold fast and prize. The first is gentleness; the second is frugality; the third is humility, which keeps me from putting myself before others. Be gentle and you can be bold; be frugal and you can be liber; avoid putting yourself before others and you can become a leader among men." -Lao Tzu

"If you want to build a ship, don't drum up the men to gather wood, divide the work, and give orders. Instead, teach them to yearn for the vast and endless sea." -Antoine de Saint-Exupery

For the Budget-Conscious

01. "4 Ways to Be a Frugal CEO"

Entrepreneur.com's Jerry Jao has this advice for CEOs:

- How to setup an office on a shoestring.

- How to control legal fees.

- DIY marketing & PR.

- Thrifty travel.

02. "How Much Cash To Have On Hand"

Joe Worth instructs business owners how to calcuate how much cash to keep on hand, and advises CEOs where, when and how to spend it. Here's the gist:

- Analyze the last 12 months of costs, broken down into production costs (otherwise known as cost of goods sold in manufacturing or distribution businesses or cost of sales in service businesses), and overhead costs that are spent every month, regardless of sales volume.

- Take your current assets (bank balances, outstanding accounts receivable, inventory value) and subtract your annual liabilities (taxes due, accounts payable, loans payable in the short term), then divide by 365 to come up with your daily operating capital. Multiply this by the number of days to arrive at a contingency amount you're comfortable with.

.png)