Fintech apps save you time and money by simplifying complex accounting processes like managing your team's expenses. Here are 3 apps that seamlessly integrate with QuickBooks to make your accounting systems more consistent and organized to maximize visibility in your company's spending and track your data in real-time.

Today’s business leaders must embrace the rapid advances in technology if they want to remain relevant in their industry. That said, it can be overwhelming to know where to start. And when it comes to taking care of your small business accounting needs, there are literally thousands of options available for making your life easier to manage.

Learn more about expense management apps in the video below.

The good news is that, as virtual accountants, we spend a lot of time focused on the tools of the trade that make accounting more efficient and organized. We use many of these in our own business and know that they can work well for yours as well.

These solutions also happen to integrate with QuickBooks, the industry standard for accounting software. Although QuickBooks offers robust accounting capabilities, the platform does have its limitations when it comes to providing options for streamlining expense management, tracking time, and managing your payables.

In this post, we’ll review the benefits of four popular small business accounting applications and provide examples of how you can connect them with QuickBooks.

TSHEETS

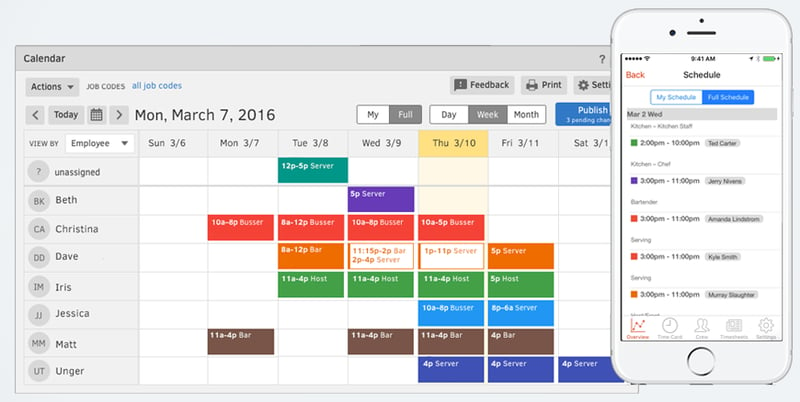

Manual processes slow down your business every day. It’s time to put an end to handwritten timesheets and manually tracking each employee’s location with TSheets, one of the most popular mobile time tracking apps around. This web-based, flexible, mobile software can be used for payroll, job costing, scheduling, employee time tracking, and much more. This app provides so many benefits that you will find useful for your day-to-day operations. Here are three of the major advantages that TSheets can offer your small business:

Streamlined tracking of employees from any remote work location

As the mobile workplace takes off, TSheets offers an ideal solution for businesses whose employees work outside of the office occasionally or even full time.

For example, if your team travels for work, think about how time-consuming it can be to track reimbursable expenses, project costs and employee time. While QuickBooks offers limited options to streamline these categories, third-party application designers have bridged the gap by creating time-saving tools that easily integrate with this software.

TSheets provides a variety of ways to manage time reports and attendance records. More specifically, the app allows employees to choose from several options when the need to clock in remotely. They can record their hours directly in the mobile app, by text messages or even via Twitter. The mobile app also tracks the employee’s specific location every 10 minutes. And all entries will be GPS-stamped providing you with the highest level of accountability.

Tracking job cost and billable hours

Not only does TSheets monitor employees’ time and location, but it also provides job costing tools within the app to save you even more time. Job costing is essential for project-based companies (e.g. consulting firms) that rely on accurate estimates and invoicing in real-time. With the app, when employees clock in they can select the job code for each project they are working on. There’s a job code for all project-based tasks, tracking overhead, travel mileage and even including expenses such as the cost of materials.

Producing data in real-time

All tracking is done in real-time completely eliminating the need for calculating mileage reimbursement.

How to Export Timesheet Data to QuickBooks

TSheets is compatible with all versions of QuickBooks and the best part is that there’s no hardware or software to install. Everything is set up online so that it can be synced to your company files within QuickBooks quickly.

As mentioned above, TSheets allows to you track billable hours by employee, then import the data into QuickBooks. Here are the easy steps to easily export timesheet data to QuickBooks Online:

• In TSheets, select QuickBooks in the top right-hand corner of the application

• Export All Approved Time [Note that at this stage all job codes, costing and billable information are already input into TSheets]

• Click Export All Hours

• Navigate to QuickBooks to view the exported data by clicking on Employees>Enter Time>Use Weekly Timesheet

It’s as simple as that!

By utilizing the reporting tool available within the application, project managers can close out projects seamlessly making it easy to stay on top of project costs.

EXPENSIFY

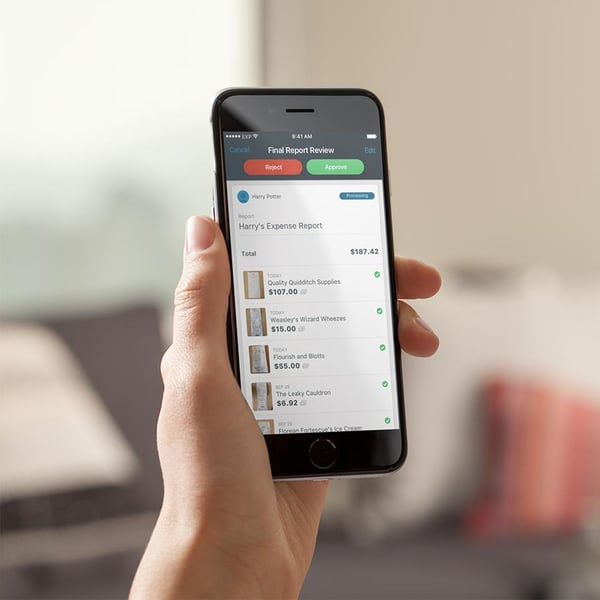

Tracking expenses typically ranks high on the list of things you wish you didn’t have to do to run your business...right up there with filing taxes. We completely agree that keeping up with paper receipts, coding, tracking and issuing payments to employees is not an easy task. So that’s why we recommend switching to an online solution such as Expensify.

Expensify is a cloud-based platform that allows you to streamline all your expense reporting needs. Everything will be completely digital, including reimbursements. If you’re looking to take your business 100% paperless, then this is an excellent expense reporting option to consider.

So what makes Expensify so great? There are many applications out there that allow you to take pictures of your receipts and upload them to your credit card. However, Expensify’s technology takes things a step further by automatically filling out and submitting the expense report for you once you snap a photo of your receipt. In addition to uploading receipts, users can also capture additional data such as mileage, parking fees, meals and other reimbursable expenses.

Your team can also access Expensify offline when necessary, and upload the captured information later on.

Other Benefits of Expensify

- Integrates with multiple applications including Dropbox, Evernote and Quickbooks

- Provides a full audit trail for all transactions

- Offers affordable, multi-tier price levels

- Compatible with over 160 currencies and converts to USD automatically.

How to Integrate Expensify with QuickBooks

Currently, Expensify is only compatible with QuickBooks Online. However, the two platforms work well together. Expensify not only simplifies the way that employees manage and submit expense receipts, but it also streamlines the processing of these expenses by offering easy import/export of data such as expense account details, projects, clients and funds from QuickBooks. As a result, users can simply enter receipt details using the correct account information and export directly to QuickBooks.

Compliance controls also allow managers to set guidelines such as an automated approval workflow, as well as specific rules for each expense type. This works well if employees have a set spending limit for expense categories because the system will reject anything that exceeds the threshold. Items that are rejected will not be available for export to QuickBooks.

Once you create an Expensify account, all Quickbook Online expense accounts will be automatically imported into Expensify as categories. These accounts can be enabled/disabled for each individual employee. Specific rules can also be established for expense categories. You can consider changing the names of the imported categories in Expensify to make it easier for employees to determine which account best fits their expense. Too many unfamiliar category names could be confusing and result in coding errors which you will want to avoid.

Quick Example

In Expensify, non-reimbursable expenses (e.g. company card transactions) export to QuickBooks Online as either a Credit Card or Debit Card Transaction.

If you want the payee field for Credit Card expenses in QuickBooks Online to display the merchant name, you must ensure that that Vendor is already set up in QuickBooks Online. Expensify will search for an exact match when the data is being exported. If the system can’t find it, it will create a Credit Card Misc. Vendor.

BILL.COM

An important part of the payables process involves keeping track of outstanding invoices from vendors. However, this can be overwhelming if you’ve got multiple vendors and if you do your own bookkeeping. It’s easy to fall behind, even if you don’t intend to.

And as you know, late payments can result in extra fees and strained relationships with your vendors.

Fortunately, there’s an excellent solution called Bill.com that streamlines the entire accounts payable process. This cloud-based application is designed to reduce the time it takes to process payments and approve invoices by 50%. It’s as simple as scanning, faxing or emailing your documents to Bill.com to get the process started.

Once set up, everything will be paperless, so you no longer have to worry about keeping track of physical invoices.

The bill approval process is also pain-free:

- The system sends you an email alert every time you have a new bill to approve.

- Next, you can review all details of the bill.

- You can either approve the invoice for payment or route it for further approval. If you route the invoice an email is generated for the approver as well.

Another excellent benefit of this platform is that bills can be paid directly through Bill.com so you can say goodbye to processing check payments manually.

Online Invoicing for Customers

In addition to managing accounts payable, Bill.com can assist you with keeping a better handle on items in accounts receivable.

Bill.com will save you time and money by doing everything electronically. Think of all the time you will save by not using snail mail to send invoices to customers.

When invoices are sent to customers the system lets you track every step of the process:

- Get notified when the customer has viewed the invoice.

- Track customer interactions with the invoice to see when they approve or pay (this includes the ability to track scheduled payments).

- Payment options include credit card, PayPal, check or autopay.

- Customers are even able to ask questions about the invoice.

As you can see, Bill.com simplifies the accounts receivable process, saving you time and making it easier for your customers to settle their invoices.

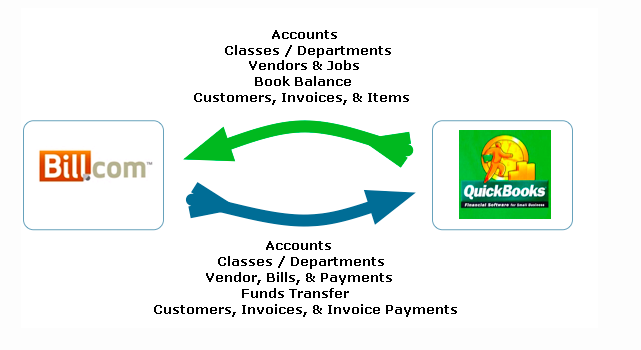

Bill.com Integration with QuickBooks

Bill.com integrates with QuickBooks 2006 or later as well as QuickBooks Online Essential or Plus. It takes less than an hour to connect Bill.com with Quickbooks and there is no additional software to purchase.

Each time you sync, Bill.com identifies any changes to QuickBooks and QuickBooks is updated to reflect any changed in Bill.com

QuickBooks Updates to Bill.com:

- Accounts

- Departments (called Classes in QuickBooks)

- Vendors Jobs (called "Customer : Jobs " in QuickBooks)

- Book Balance (so Bill.com can project your cash flow)

- Customers

- Invoices (new and edited invoices)

- Items

- Accounts

- Classes (called Departments in Bill.com)

- Vendors

- Bills

- Bill Payments

- Vendor Credits

- Funds Transfers

- Customers

- Invoices (new invoices only)

- Invoice payments

Bill.com Updates to QuickBooks:

- Accounts

- Classes (called Departments in Bill.com)

- Vendors

- Bills

- Bill Payments

- Vendor Credits

- Funds Transfers

- Customers

- Invoices (new invoices only)

- Invoice payments

While the two platforms communicate with each other seamlessly, you must sync very frequently otherwise changes will be missed. Unfortunately, automatic syncing is not yet available.

NEXT STEPS: SCALING YOUR BUSINESS

Automating your small business accounting needs using these three apps offers an excellent stepping stone to getting a better handle on your business finances. However, you may still need more help with the books to ensure that all your financial records are kept up-to-date each week. Remember, having accurate real-time data will allow you to make the most informed decisions for business growth.

Instead of managing the books on your own or hiring an expensive in-house bookkeeper, consider the services of an outsourced accounting firm like Ignite Spot. Get a complete bookkeeping solution including: bank reconciliations, customer invoicing and collections, bill payment, credit card management and more at a fraction of the cost.

We can provide guidance for your business allowing you to focus on growing your business instead of worrying about recording journal entries, ledgers and invoices.

As mentioned above, bank reconciliation is one of our core services offered to customers who use online bookkeeping to manage their company accounts. Some of our bank reconciliation services include daily, weekly, or monthly data entry from your bank account to your accounting software. In addition, we can also assist you with cash reporting on an as-needed basis.

We are here to get you started on the journey to fully automate your finances in the cloud. If you’re a business owner or executive looking for affordable and convenient ways to streamline your operations, improve cash flow management, and scale your business, then consult with our accounting experts today.

Download our pricing guide by clicking the button below:

.png)