We get a lot of questions concerning home office deductions, and we're more than happy to keep answering all those specific queries. It's not always obvious what you can and can't deduct when trying to do your small business tax preparation. In the following video, our CPA, Ryan Steck, brings much-needed clarification to pain-in-the-neck tax definitions of the home office and the deductions that go along with that. Easy as pie.

Click here to get a free 30-minute tax prep session with Ryan.

We have another in-depth article here that lists most of the rules, and gives you example scenarios to explain IRS terms and rules: Home Office: Personal vs. Business Expenses

More Tax Prep Videos:

How to Choose the Right Business Entity

Video Transcript

Ryan: Hi I’m Ryan Steck, and I’m the lead CPA here at Ignite Spot.

Ann: And I’m Ann Whittaker, and I’m in the marketing department, and know nothing about accounting or taxes.

Ryan: Well we’re excited to talk to you today, and go into home office deductions. So, for starters, let’s go into what is the home office deduction? The home office deduction is basically your ability to work from home. If you’re working from home, do you have a computer? Do you have an office space? Do you have a space in your home that is strictly dedicated to running your business?

Ann: So what you’re saying when you say “strictly dedicated”, but what if I have my laptop and like to work on my sofa?

Ryan: That doesn’t qualify generally as home office deductions. Because the rules technically state that any home office you have must specifically be dedicated for the purpose of doing work.

Ann: Got it.

Ryan: And so that’s the rub when it comes to home offices. That space has to be really has to be strictly for your work.

Ann: Ok.

Ryan: So, that’s rule number one.

Ann: So, I have another question for you.

Ryan: Please.

Ann: What if you work, let’s say, three days at a business office? But then at home you work maybe two days from an office, a set aside room, at home. How do you work that into your deductions?

Ryan: And so, really there’s no problem there. An office is an office whether you have multiple locations or not. You still get the deduction of having a home office because you have that multiple location.

Ann: Awesome.

Ryan: So there’s no problem with having more than one location when it comes to the home office.

Ann: Great.

Ryan: The only thing is we do have to make sure we remember the number one rule: it has to be dedicated strictly for business use.

Ann: Got it.

Ryan: So let’s start with the basics. When you’re looking at a home office, the first thing you have to understand is how big is that office? So, let’s say for example your home office is 100 square feet. You take that 100 square feet and divide it by the total square footage of your home.

Ann: Ok.

Ryan: For simplicity’s sake, let’s say your home is 1,000 square feet. So now we take 100 divided by 1,000, so 10% of your home is dedicated to your home office space.

Ann: Ok, I have a quick question.

Ryan: Yeah.

Ann: Can that space be detached from the house? Can it be in the garage? Can it be out in the shed? How does that work?

Ryan: Yes, absolutely. And when you’re looking at total square footage, you’re looking at the total square footage of the entire home. Which can include a garage or detached space.

Ann: Ok.

Ryan: Absolutely. But it does need to be home office like we’ve talked about. It does have to be specifically dedicated and we do have to be able to tie it to the house somehow.

Ann: Ok.

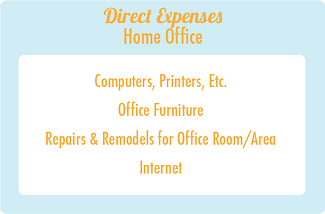

Ryan: So now that we know our percentage—we’ll call it our multiplier—now all of the sudden we have to look at what are the expenses and the deductions we get to take from our home office. We just know that we have a 10 percent number. What does that 10 percent mean? Well it means that 10 percent of our home expenses get to be offset in the home office deduction.

Ann: Ok. So what are some of those expenses?

Ryan: Let’s talk about those. The first one that always come to mind is the utilities. So your gas, electric, heat, power, internet, television, all those things get wrapped into your home office.

Ann: Ok, that’s easy.

Ryan: And so, well it sounds easy, but how fun is it to sit there at the end of the year and take twelve months’ worth of receipts from all of your utility bills, add them all up, then multiply them by 10 percent.

Ann: Not fun.

Ryan: Yeah it’s a little bit of a pain. So that’s one of the hard things with the home office deduction is you have to know all the receipts, you have to have all the receipts, you have to know where they are, and you have to add them all up. A bit of a pain.

Ann: So what about things like mortgage interest?

Ryan: That’s a great question. Let’s just take a moment and look at the house overall. So we’ve talked about the utilities, the square footage, but the household overall is worth something in the home office deduction. So your mortgage interest that you’ve talked about, a portion of that gets allocated, in our exampled 10 percent of that mortgage gets allocated to the home office deduction. Your real estate taxes, that’s another one. Another one that people look at is actually depreciating their home at 10 percent. That one is an interesting one and a lot of times I actually advise clients not to do it.

Ann: It sounds complicated.

Ryan: Well, it’s not that complicated, but it has some repercussions. And so let’s talk about that for a minute because that’s a big deal. So with a home, if you have a home office, you can actually depreciate part of the value of your home over 39 and a half years.

Ann: That’s a long time.

Ryan: It’s a long time, but if you look at the purchase price of your home and know that you’re going to get a little benefit every year, it sounds attractive. Here’s the problem when you start depreciating your home: you run into laws that deal with your ability to sell your personal residence.

Ann: Oh.

Ryan: So the laws right now currently allow your to sell your personal residence, as long as you have lived there for two years, and take any profits you have up to $250,000 if you’re single, or up to $500,0000 if you’re married and not pay any taxes on that money.

Ann: Awesome.

Ryan: That is fantastic. But if you start depreciating part of your home, you start impairing your ability to do that.

Ann: Ok.

Ryan: And so this is a scenario where I often look at how long do you want to live in that home? How long is it going to be your residence? You need to consider that when you’re deciding whether or not you’re going to have the home office deduction include depreciation of your home.

Ann: Ok, so really personal and you’ve got to be strategic about it.

Ryan: Absolutely.

Ann: Ok.

Ryan: So that’s a general overview of the home office deduction and how it works. One thing I will point out before we go into our last topic is a lot of people are scared of the home office deduction because it is a flag with the IRS and may get your triggered for an audit. I’m not fearful of the home office deduction but I do agree that it can increase your risk of being audited. But as long as your report things correctly, I’m never afraid of the IRS. If you’re allowed the deduction I think you should take the deduction. But just be aware that there are rumors, and a lot of them are substantiated, that the home office deduction can increase your risk of getting audited.

Ann: Got it.

Ryan: So now that we’ve gone through this complicated method of doing the home office deduction the IRS last year came out, thank goodness, with a simplified method to do all this.

Ann: Yay.

Ryan: If you hate receipts, you hate going through everything, you know the square footage of your home office, there’s an easier way you get to do it now, if you’d like.

Ann: Great. Tell us about that, please.

Ryan: So we talked about our multiplier, in our example we talked about a 100 square foot home office, and 1,000 square foot home. Well we still have our 10 percent multiplier, or in this case, we still have our 100 square feet that is dedicated to the home office. Instead of going through calculations, adding in utilities, doing all these other calculations, the IRS has come out and said “Ok, if you know the square footage of your home office, we’re going to allow you to take a deduction of 500 dollars per square foot." So in our example, a 100 square foot home office will be allowed a 500 dollar annual deduction on that home office and we don’t have to do anything else with the calculation, other than show the square footage of the home and the square footage of the home office.

Ann: Awesome. That’s math I can do.

Ryan: So if you hate all the receipts, all the paperwork and everything else, $5 is not a bad reimbursement for your home office.

Ann: Awesome.

.png)