Whether you are a new entrepreneur or a seasoned business owner, having an accounting system that you can trust is a must. Your bookkeeping software should be one that’s user-friendly, able to handle all your business transactions and provide the most up-to-date technology all without breaking the bank.

QuickBooks is one of the most recognized accounting solutions for a variety of business structures. Whether you’re looking for a system to track inventory, provide unlimited reporting or a solution for self-employed individuals, QuickBooks has you covered.

At the same time, with so many versions offered within the QuickBooks family, it can be a challenge to choose the one that best fits your needs.

QUICKBOOKS DESKTOP VS QUICKBOOKS ONLINE

While the QuickBooks Desktop version has been on the market since the early 1990’s, Intuit’s newest release is QuickBooks Online or QBO. And it’s already gaining popularity. This platform is essentially a stripped-down version of the Desktop edition that can still handle lots of transactions and reporting needs.

With that said, let’s explore the differences between QuickBooks Desktop and QuickBooks Online so you can determine which software best fits your small business accounting needs.

QUICKBOOKS ONLINE OVERVIEW

QuickBooks Online or QBO is a cloud-based system that provides you with the flexibility of being able to access your company files via a web browser. You no longer need to wait for your in-house bookkeeper or accountant to send files to you because you can now pull them up online from any device regardless of your location.

One of the best selling points of QBO is that it requires no installation. That’s right, there is absolutely nothing to download as everything is web hosted. All you need is an internet connection to access your data which will be backed up to a secure cloud. Furthermore, if an update is required at any point in time, you can download it directly from your web browser.

Another excellent feature of QBO is its ability to handle multiple users at one time via any device, at no extra cost (though there is a user limit).

In fact, within the platform, authorized users can access company files simultaneously. However, we don’t recommend making changes at the same time as other users just to be safe.

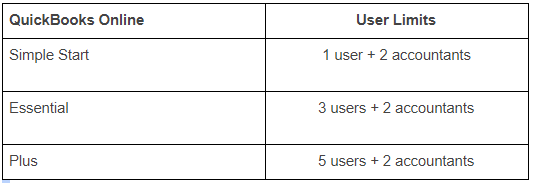

User Limits

User limits will vary based on the QBO plan you subscribe to either: Simple Start, Essential and Plus. Simple Start is the most basic and cheapest version within the QBO suite whereas Plus is the most expensive. Each level up allows you to add more users as shown in the table below:

There is no contract required to run QBO and the plans described above can be downgraded or upgraded at any time by contacting Intuit.

TIP: If you choose to cancel your QuickBooks Online subscription, the software will save your data as read-only for one year. During this time, no changes can be made to your company files. However, the system will allow you to export the information to the Desktop version or Excel. After one year, the data will disappear into the cloud and you won’t be able to access it.

ADVANTAGES OF QUICKBOOKS ONLINE VS QUICKBOOKS DESKTOP

The online version of QuickBooks is ideal for small service-based businesses, freelancers and consultants due to its flexibility and ability to simplify accounting features.

As mentioned above, multiple users can access the cloud-based software with real-time reporting. Data will also be synced automatically and backed up to the cloud.

The following features are supported by QuickBooks Online but are not available to Desktop users.

- Upload backup documents, images or files from a mobile device

- Schedule and send automatic transactions

- Automatic nightly download of bank transactions

- Auto-add bank register feature rule (see image below)

- Custom splitting by amount or percentage, along with assigning class/location rule

- Audit log to review actions and track changes over time

- 7 different customized names for “customer”

- Multi-line journal entries for Accounts Payable and Accounts Receivable

- The ability to delay charges and credits for non-posting transactions that will be billed later

- Seamless integration with numerous third-party apps such as TSheets, Bill.com or Expensify

- Multi-fiscal year budgeting capabilities

- Free 30-day trial period

QUICKBOOKS DESKTOP OVERVIEW

One downside of QuickBooks Desktop compared to QBO is that a user license must be purchased for each user’s computer. Therefore, if you want to allow multiple users, you’ll have to invest in more licenses. This doesn’t mean that multiple employees can’t use the software simultaneously, the point is that each computer and person will need their own license.

All that said, QuickBooks Desktop still offers many solutions that can meet your small business accounting needs.

Quick note: While we refer to “QuickBooks Desktop” in this post, there are actually three separate products within the Desktop grouping that you can choose from: QuickBooks Pro, QuickBooks Premier and QuickBooks Enterprise.

Some of the features below are only supported by Premier and Enterprise and not QuickBooks Pro. Refer to the chart below for the most up to date breakdown of each product.

ADVANTAGES OF QUICKBOOKS DESKTOP VS QUICKBOOKS ONLINE

With its robust bookkeeping and numerous built-in accounting features, many product-based companies see the benefit of using QuickBooks Desktop for their small business accounting. This system provides inventory tracking, financial reporting to track profitability along with sales and expense forecasting all from one bookkeeping software without purchasing third-party add ons.

The following features are available via QuickBooks Desktop but are not supported via QBO.

Reporting Capabilities:

- Industry Specific Reporting

- Business Planning, Forecasting and Balance Sheet by Class Options

- Enhanced Header and Footer Customization

- Scheduled Reporting*

*Scheduled reporting is a new feature recently added in 2017 to QuickBooks Desktop that allows users to set a schedule to run reports. Timely reports can be generated and scheduled to be sent via email. This is great for reviewing company financials with key stakeholders in your small business.

Accounting Benefits:

- Ability to Print Form 1099-MISC

- Produce Period Copy

- Backup and Restore Feature for Accountants

- Client Data Review Tools

- Clean-Up Files

- Visual Reminder to Deposit any Undeposited Funds

- Correcting Unapplied Credits and Payments

- Fixing Sales Tax Errors

Data Entry:

- Customized Billing Rate Levels

- Ability to create Invoice Batches

- Payroll Can Accept Batched Timesheets

- Batch Transactions

Inventory Features:

- Unit of Measurement Inventory

- Sales Order Tracking

- Purchase Order Process Receiving Capabilities

- Valuation Method for Average Cost of Inventory

- Custom Inventory Reorder Scheduling

Many of these custom features have been added that mimic QuickBooks Online in some ways. The idea is to make the Desktop version more use- friendly and turn it into an excellent option for those users who want the capabilities of apps, without foregoing the robustness of the original desktop software.

FIVE POINTS TO CONSIDER WHEN MAKING YOUR DECISION

All that said, let’s quickly review the key differences between QuickBooks Desktop and QuickBooks Online by highlighting five key areas to consider when thinking of your small business accounting needs:

Customization

QuickBooks Desktop offers a lot more freedom to customize forms, expense categories, prepare Form 1099’s and track employee mileage. Unfortunately, you can’t customize these in QBO.

Cost

QBO offers a free 30-day trial period after which you are charged a monthly fee. On the other hand, with any Desktop version you have to invest in the software upfront and the cost varies depending on which product you select i.e. Pro, Premier or Enterprise.

Automated Functions

QuickBooks Online was designed to automate accounting tasks such as customer billing, downloading bank transactions and payment processing. Most of these have to be done manually via QuickBooks Desktop, with the exception of automatic reporting which is a new feature offered in the recent software update.

Accessibility

QuickBooks Desktop can only be accessed on the device for which the software or license has been purchased. On the other hand, because it’s cloud-based, QuickBooks Online can be remotely from anywhere that has internet connection as well as from multiple devices.

MOVING FROM QUICKBOOKS DESKTOP TO QUICKBOOKS ONLINE

Intuit is pushing more and more users to adopt QuickBooks Online as technology continues to rapidly transform the business world to the cloud. For users who are currently using QuickBooks Desktop who want to make the switch to Online, that is also an option.

Here are the steps if you want to convert data from QuickBooks Pro or Premier into QuickBooks Online:

- Open QuickBooks Desktop

- Select Company > Export Company File to QuickBooks Online

- Click Help > Update QuickBooks

- Choose All Updates in the Update Now window.

- Select Get Updates. (Important: If all updates are not downloaded, the export company link may not appear).

- Click Close

- Choose File > Exit.

- Restart QuickBooks and complete installing the updates. This process may take at least 15 minutes to run, depending on how much time has passed since your last update.

- Enter your QuickBooks Online login info, agree to the Terms of Service and hit Submit.

- Select the online company you want to import your data into, or create a new company.

- Click OK, Got it and look out for an email from QuickBooks confirming the data conversion.

SO, WHICH VERSION IS RIGHT FOR YOU?

As you can see, there are many differences between QuickBooks Desktop and Online and the version you select will be dependent on your small business accounting needs.

To recap, Quickbooks Desktop is designed for those who want to explore more customized reporting and budgeting options (as some users do not wish to pay for a monthly subscription). These users are also typically not concerned about being able to gain online remote access to their books.

It is important to know that not every business will actually have a need for all the features that Desktop offers. And that’s just fine. You can easily start with QBO and find an easy-to-use app that can help bridge the gap if there are any features missing on the software. However, keep in mind that most third-party apps will charge a monthly or annual fee that can add up over time.

We also think it’s worth mentioning that QuickBooks isn’t the only accounting software out there. And depending on your specific business model and industry, QuickBooks may not always be the answer. The important thing is to choose an accounting system that supports your needs so that you can focus on your core business.

NEXT STEPS

At Ignite Spot, we know it can be difficult to make a final decision. But we are here to offer guidance. Once we determine the best software for your needs, then our consultants will provide exceptional start to finish company set up along with individualized training.

At that point, you may still need more help with the books to ensure that all your financial records are kept up-to-date each week. Remember, having accurate real-time data will allow you to make the most informed decisions for business growth.

Instead of managing the books on your own or hiring an expensive in-house bookkeeper, consider the services of an outsourced accounting firm like Ignite Spot. Get a complete bookkeeping solution including: bank reconciliations, customer invoicing and collections, bill payment, credit card management and more at a fraction of the cost.

We can provide guidance for your business allowing you to focus on growing your business instead of worrying about recording journal entries, ledgers and invoices.

As mentioned above, bank reconciliation is one of our core services offered to customers who use online bookkeeping to manage their company accounts. Some of our bank reconciliation services include daily, weekly, or monthly data entry from your bank account to your accounting software. In addition, we can also assist you with cash reporting on an as needed basis.

We are here to get you started on the journey to fully automating your finances in the cloud. If you’re a small business owner looking for fast, affordable and convenient ways to streamline your operations, improve cash flow management and scale your business, then reach out to our team today.

.png)