Financial Terms Glossary: 96 Small Business Words and Phrases You Should Know

Written by Eddy Hood

Warren Buffet rightly said that “accounting is the language of business.” Sadly, for most business owners, it’s a foreign language. It feels like you and your advisers need an interpreter just to converse.

Stop using grunts and hand gestures to communicate financial terms and concepts. Learn the lingo now for more meaningful, business-building conversations with your accountants.

And because none of us has perfect recall, feel free to print this page and keep it as a desk reference for future conversations.

A

Account

An account refers to the category or “account code” to which you assign financial transactions, like credits or debits.

Accounting Period

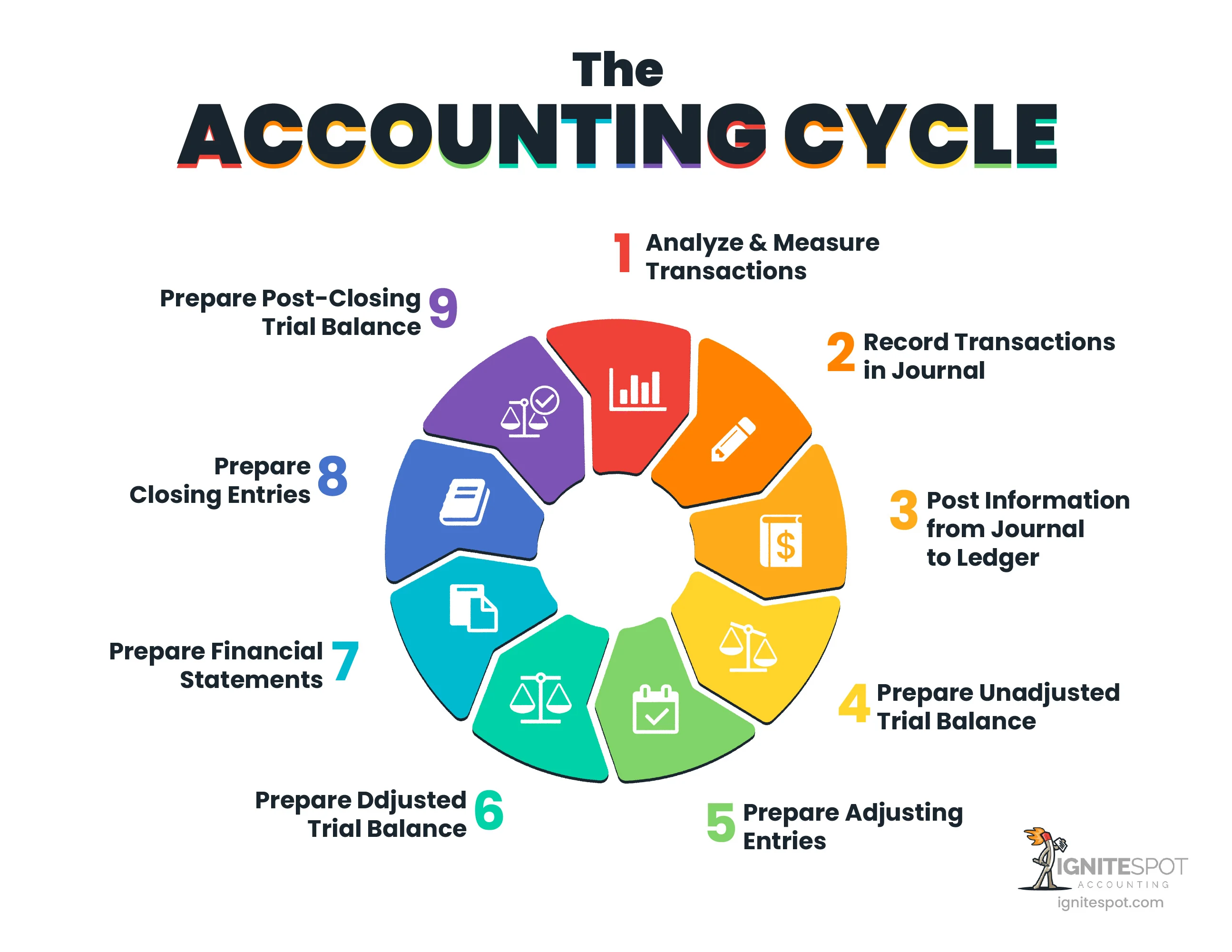

An accounting period is the time span required to complete all the steps of an accounting cycle.

Source: IgniteSpot Accounting

A typical accounting period is one year.

Accounts Payable

Your business’s accounts payable is the total amount you owe others. These unpaid bills are usually due to merchants and service providers.

Accounts Receivable

Your business’s accounts receivable is the opposite — it’s funds owed to you. Usually, this amount is comprised of unpaid invoices.

Accrual-basis Accounting

Accrual-basis accounting is the method of bookkeeping whereby revenue transactions are recorded at the time of the agreement — not at the time of service, product, or money exchange. This method contrasts with cash-basis accounting (covered below), where bookkeepers account for transactions at the time of each deal’s completion or fulfillment.

Amortization

Amortization is using a specific schedule to pay back a debt’s principal and interest in equal payments by the end of the loan term.

Annual Percentage Rate

APR indicates the interest and fees charged for a loan over a one-year period. It’s typically expressed as a percentage of the total balance.

Annuity

Annuities are equal payments made to an investor, occurring at regular intervals. Annuities also include compounded interest.

Appreciate

An asset or investment appreciates in value when its worth increases. See this financial term’s counterpart, depreciate, below.

Asset

An asset is something you own, such as property, physical structures, money, investments like stocks or bonds, or first-party email list and intellectual property.

Audit

An audit is an in-depth examination of an individual’s or company’s finances performed by an auditor.

B

Bad Debt

Bad debt refers to funds owed to your business that — for one reason or another — will never be paid to you.

Balance

Balance is one of those financial terms that have multiple meanings. A balance may be ...

- the amount of money present in a checking or savings account.

- the amount of money remaining to be repaid on a loan.

- the act of finding discrepancies in the goal of making totals match.

Balance Sheet

A balance sheet is the financial report that compares your assets and equity to your debts and liabilities.

Bank Reconciliation

Bank reconciliation is the bookkeeping exercise of ensuring the cash balance of your bank account matches your bank account statement. If they don’t, you must track down and account for any differences.

Bankruptcy

Bankruptcy is an option when an individual or a company has insurmountable debt and cannot repay it. Declaring bankruptcy gives an entity legal protection from debts. Bankruptcy involves a legal process, possibly including the sale of assets to reduce the debt amount.

Bond

Bonds are agreements to investors indicating a specific debt between the business entity and the investor. The government or corporation agrees to pay the investor the face value of the bond and interest for the term of the bond.

Book Value

An asset’s book value is its financial worth based on its depreciation and original documented value.

Budget

A budget is a written or electronic accounting plan to help you manage your finances and save money.

C

Cash-basis Accounting

Cash-basis accounting is a method of accounting whereby transactions are recorded at the time money actually changes hands. Accrual-basis accounting (covered above) records business transactions when the deal is made, not finalized.

Cash Flow

Cash flow is a measure of the timing of transactions and how business leaders manage that financial stream. People often think cash flow is a description of how much money comes in versus how much flows out, but the true concept focuses on when money moves.

Certificate of Deposit

A certificate of deposit (or CD) is an investment that involves the deposit of a specific amount of money into an account. You must keep your money in the account for a specified term to earn interest. Early withdrawal results in a penalty.

Certified Public Accountant (CPA)

A CPA is a designation one earns by fulfilling accredited educational training, the CPA examination, and a required number of real-life business experiences. CPA refers to both the status and the person behind it. In other words, a person can “study for their CPA” while another person “looks for a reliable small-business CPA.”

Charge

A charge is an interest amount paid on a revolving credit account. The consumer borrows the money, which will result in interest charges unless the borrower pays the amount in full before the grace period ends.

Chart of Accounts (COA)

Your business’s Chart of Accounts (COA) is the visual representation of how you classify and categorize all your financial transactions. It shows the name of each account, a short description, and an identification code to refer to for quick recall and data analysis.

Collateral

Collateral is property required by lenders to assure repayment of the loan.

Commodities

Commodities refer to tangible assets such as gold or wheat.

Cosigner

A cosigner is an additional party added to a lending contract to guarantee payment if the borrower defaults. Some lenders require cosigners in particular scenarios.

Cost of Goods Sold (COGS)

A business’s Cost of Goods Sold (COGS) is the amount it spent to create and deliver its products or services. To calculate COGS, simply subtract your ending inventory’s value from the sum of your total purchases and the value of your starting inventory, like so:

(starting inventory + inventory bought or produced during the period) – ending inventory = COGS

Credit

Credit refers to borrowed money that will need to be repaid. In bookkeeping, credit also refers to any financial transaction where money flows into the business. The opposite of a credit is a debit, covered below.

Credit History

A credit history details the way consumers manage finances like borrowing and repaying money. Future loans depend on a solid credit history, because when lenders consider funding startup businesses, they check this information.

D

Debit

A debit refers to any financial bookkeeping transaction where money flows out of the business. A debit’s counterpart is a credit, covered above.

Debt

A debt refers to any money, goods, or services owed to another individual or to another entity.

Default

A default is when a payment is not made according to the terms of a written agreement.

Deposit

Deposit means an amount of money placed into an account. Deposit is also a verb; one could say they deposit checks regularly.

Depreciation

Depreciation is an asset’s downward change in value over a period of time due to wear and tear.

Diversify

To diversify is to spread out investment capital among various types of investments. This practice helps reduce investment risks.

Dividend

Dividends are company disbursements of the business profits to shareholders.

Double-entry bookkeeping

Double-entry bookkeeping is the financial organization method where you record all transactions twice — once as a debit and again as a credit.

E

Earned Income

For business owners, earned income is your net take-home pay. People who work for their wages receive earned income.

Equities

A business owner’s equities are the amounts they own (or value of the business) after all liabilities are accounted for. Equities can be found on your balance sheet near your assets and liabilities.

Expense

Expenses are monies spent on business activities and merchandise.

Expense Categories

An expense category is the classification you assign to transactions for compilation, reporting, and analysis. By bucketing your credits and debits into expense categories like “COGS” or “office supplies,” you make them trackable for stowage and recall.

F

Finance Charge

Finance charges are fees lenders charge borrowers for the loaned money. Borrowers who pay off a balance within a grace period can avoid finance charges.

Fiscal Year

Fiscal years, also called tax years, are 12-month long non-calendar accounting periods. They begin and end in any month except January and December, respectively.

Fixed Expenses

Fixed expenses are those payments that do not change from month to month. An example of a fixed expense might be a car payment. This term is interchangeable with the phrase “fixed costs.”

Forecast

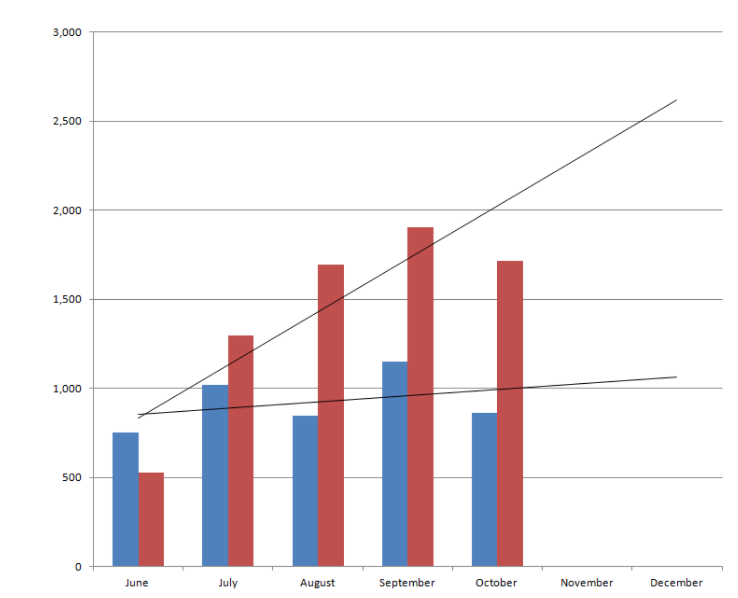

A financial forecast is a model (or group of models) that displays the outcomes of different scenarios. It relies on past data to project future hypotheticals, which inform business decisions. For example, the graph below shows the answer to the question, “Where will our blue and red numbers be in two months if we continue on the current trajectory?”

Foreclosure

Foreclosure is when a lender initiates legal proceedings to seize the property associated with the debt. This occurs when a borrower does not make payments on a secured debt. Default on a mortgage could result in foreclosure and auction of the property.

G

Grace Period

Grace periods are when revolving credit card borrowers need not pay finance charges or interest if they pay balances in full.

General Ledger

A business’s general ledger is the primary accounting system and file. It’s a running list of every transaction in the life of your company. The general ledger is organized into journals, also called accounts, so that all the data is ready to be used to create your regular financial reports.

Generally Accepted Accounting Principles (GAAP)

Generally Accepted Accounting Principles (GAAP) is a set of tenets that all nongovernmental organizations’ accounting practices and standards must honor. These principles ensure (among other things) financial regularity, consistency, sincerity, prudence, periodicity, and good faith.

Gross

Gross means before adjustments. It implies there’s more to the story. When you see financial terms that start with gross (like gross income), know that there’s often a “net” version of the same value, which includes deductions.

I

Income

Income is any business revenue that “comes in.” The most common (and usually largest) form of income is sales receipts, but income can also come from private investing and financing activities.

Income Statement

Your business’s income statement (also referred to as a profit-and-loss report) is a snapshot showing what money your business made and spent in a period of time. It depicts your company’s profits and losses (covered below) for a specific time span.

Insufficient Funds

Insufficient funds is a term used to describe when an account holder makes a bookkeeping error and writes a check without having at least this much money in a checking account. The bank may return the check and charge penalty fees for insufficient funds.

Interest

Interest is the percentage of a loan amount that lenders charge as a fee for the loan.

Interest Rate

The interest rate is the percentage of the loan balance charged in interest.

Inventory

The financial term inventory refers to the assets that are made up of any wares and merchandise your business owns and plans to sell. You’ll find your inventory’s value on your balance sheet listed as a current asset (defined above).

Invest

To invest is to earn a profit from your money by making purchases or placing the money into specific types of accounts that are expected to grow.

J

Journals

In business bookkeeping, journals are often referred to as accounts. Financial transactions are recorded into journals which then are categorized into the general ledger. Complex businesses have up to seven different journals.

L

Liabilities

In financial terms, liabilities are simply debts owed. In business, however, liabilities are also considered the legal risks your company manages.

Lien

A lien is a contingency that gives a lender legal right to the property if the borrower defaults on the loan.

Liquid

Liquid means easily accessible cash or legal tender, while liquidity refers to the value of all your liquid assets. It’s an indication to investors and lenders of how quickly you’d be able to pay off all your debts, should ever the need arise.

Loan

A loan is simply when a lender and a borrower make a legal contract for the borrower to use money given by the lender. The borrower usually pays interest for the use of the money and must agree to pay back the money within a specified time.

Loss

A loss is when your business’s expenses exceed income. This term can describe a lone transaction, a deal, an initiative, or a span of time that involves all operating activities.

M

Margin

Your margins are the variance between your income and what you spend to generate that income. You can apply this term to your operations and your profits alike to assess your money-making traction; the higher your margins, the faster you’ll gain ground toward your business goals.

Market Value

Market value is an asset’s current worth in cash. The term can also be applied to a whole company. An asset’s open market valuation (or OMV) is often shortened to simply market value.

Minimum Payment

A minimum payment is the smallest payment amount currently due by the borrower. Borrowers can pay more than the minimum payment.

Money Market Account

Money market accounts are an investment vehicle that earns interest on the balance. Investors must maintain a minimum balance.

Mortgage

A mortgage is the loan used for the purchase of your business’s real estate.

Mutual Fund

Mutual funds are when a group of investors hold a collection of different types of assets together. This type of investment provides investors with diversification, which can reduce investors’ risks.

N

Net

A net number is a figure that accounts for both positive and negative amounts for a final total.

Gross and net are financial terms that always go together. Labeling an amount gross implies there’s a net version of that number and vice-versa.

O

Overdraw

An overdraw is an attempt to withdraw an amount of money from an account that exceeds the account balance. If you have a problem managing employee spending (which often results in overdraws), today’s financial tools like Divvy can solve for this.

Overhead

Overhead refers to any expenses of running a business that does not trace straight back to the development and deployment of your product or service. Insurance, equipment upkeep, office space, and other non-production-related costs all contribute to your total overhead.

P

Points

Points are a percentage of the loan amount, due as a lump sum payment. Lenders may add points to the principal amount of a loan.

Principal

Principal is the amount borrowed for a loan without interest. The amount of money invested by an investor is also the principal.

Profit

In business, profit refers to your company’s excess earnings after subtracting expenses and taxes.

Additionally, an investor may make a profit after subtracting the principal invested and any additional amount of money spent in connection with the investment.

Profit-and-Loss (P&L) Statement

A profit-and-loss statement, often called an income statement (described above), is a regularly generated report that reveals your business’s income, expenses, and profits or losses during a time span.

R

Return

Return is any money returned to an account holder. In business financial terms, a return can also mean how much money a business activity generates — after costs.

Revenue

Revenue, often mistaken for income, is the money that comes into your business from the sale of your products and services. It does not include income from financing or investing activities.

Risk

The risk of an investment is the likelihood that the investor will lose money from the transaction.

S

Secured Credit Card

A secured credit card is one where the consumer deposits money to create a balance. A young consumer trying to develop a positive credit history may use a secured credit card. With this type of account, the consumer can then make charges up to this balance to demonstrate responsible use of the account.

Securities

Securities are paper or electronic instruments verifying ownership of stocks or bonds.

Service Charges

Service charges are fees levied by a financial institution onto account holders for the upkeep and maintenance of bank accounts.

Share

A share is a unit of business ownership measurement. Investors who own a portion of a corporation own a share of the company.

Single-entry Bookkeeping

Single-entry bookkeeping is the lesser-used of the two accounting methods (the other being double-entry, covered earlier). These financial terms describe how many times bookkeepers enter each transaction into the accounting books.

Sole Proprietor

A sole proprietor is an individual who sells a product or service.

Source Documents

Source documents are the hard copies of financial business transactions — like bills, purchase orders, receipts, contracts, and time cards.

Stock

Stocks are ownership certificates companies issue to investors as proof of ownership in a part of the company.

T

Taxes

Taxes are compulsory fees that government typically charges its citizens to help maintain the government.

Trial Balance

The trial balance statement is a visual representation of your ledger’s closing account totals. The trial balance allows you to compare your debits and credits before generating your financial reports. If the amounts don’t add up, you can investigate discrepancies before creating the formal reports.

U

Unearned Income

Unearned income is income businesses make from interest and financing activities.

V

Variable Expenses

Variable expenses, also known as variable costs, are expenses that change from month to month. Examples of variable expenses include groceries or utility bills.

W

Withdrawal

A withdrawal is anytime you remove money from an account.

Working Capital

Working capital refers to monies or assets that are available for use. It’s calculated by simply finding the difference between your current assets and short-term current liabilities.

Worksheet

In accounting, worksheets are spreadsheets that show a business’s accounts, account balances, adjustments, and adjusted balances. A worksheet helps accountants find disparities between the business’s trial balance and bank record.

Bookmark, print, and use this financial terms glossary

While managing your finances, you will come across terms you don’t understand. Increase your knowledge of the financial world by keeping this resource accessible. Bookmark it, print it, and schedule a part of each day to learn one new term.

Remember, finance is the language of business. And if you want to achieve your business goals, you’ll need to understand how to speak its language. That’s what we do at Ignite Spot — our accountants use financial concepts to help business owners achieve their goals.

When you’re ready to discuss how these concepts can work together to grow your business, call an Ignite Spot accountant. Your first 30-minute session is free!

.png)