![[Ebook]: A Tax Director’s Top 7 Tax Strategies for Small Businesses in 2021](https://www.ignitespot.com/hs-fs/hubfs/IS_TaxStrategies2021_SM.jpg?width=960&length=960&name=IS_TaxStrategies2021_SM.jpg)

Six billion.

That’s how many hours Americans spend each year collecting their financial information to file their taxes. No wonder the majority of business owners dread handling their taxes. Former President Ronald Reagan famously said that our tax system is “...complicated, unfair, cluttered with gobbledygook and loopholes designed for those with the power and influence to hire high-priced legal and tax advisers.”

The good news is you don’t have to be a victim of tax troubles. With the right tax strategies in place, you can navigate this necessary part of running a business—and eventually, even make the tax code work in your favor. To learn exactly what those strategies are, we caught up with John Riggs, Tax Director at Ignite Spot.

For 15 years, John has worked in tax and accounting in the public, private, and nonprofit sectors. He holds a master’s of accountancy degree with special emphasis in taxation—and puts all that knowledge to use to save his clients as much tax money as possible.

Americans spend about six billion hours a year collecting data for their tax forms.

1. Prioritize your bookkeeping

Wait, I thought we were talking about tax strategies! We are. Tidy, accurate, up-to-date bookkeeping supports and informs all other tax strategies. What most people consider a menial task—bookkeeping—is, in reality, the most important thing you can do for your taxes.

The irony is that entrepreneurs often overlook this because it’s thought to be an easy task that “anyone can do.” But if it were so easy, then why do so many businesses suffer from messy books? The answer is because it takes routine discipline to stay organized.

An equally tempting, equally dangerous trap is to treat bookkeeping as a low-importance task by hiring the least expensive bookkeeper—or worse, a buddy—to do it.

“I see this all the time,” says John. “If you're paying somebody who's super cheap and they're just there to kind of throw your transactions in and make sure you balance, then, for example, you may have $10,000 worth of business deductions ending up in like an owner's draw or unclassified spot.” Many business owners settle for this type of subpar service since the totals balance out. And if they're balanced, who cares? The job's done, right?

Wrong. “If it's misclassified and you give it to your tax preparer, then you might have just shot yourself in the foot,” says John. All because you partnered with the cheaper accounting firm that sees your bookkeeping as a mere “to-do item.” Instead, find someone who actively looks for ways to organize your books properly, so you can effortlessly deduct more come tax time.

If you want to use the tax code to your advantage, a good ledger is the place to start.

2. Understand your current tax rate (and how it will change)

Every time a new political party is elected to federal office, strategic small business owners start planning for how taxation will change.

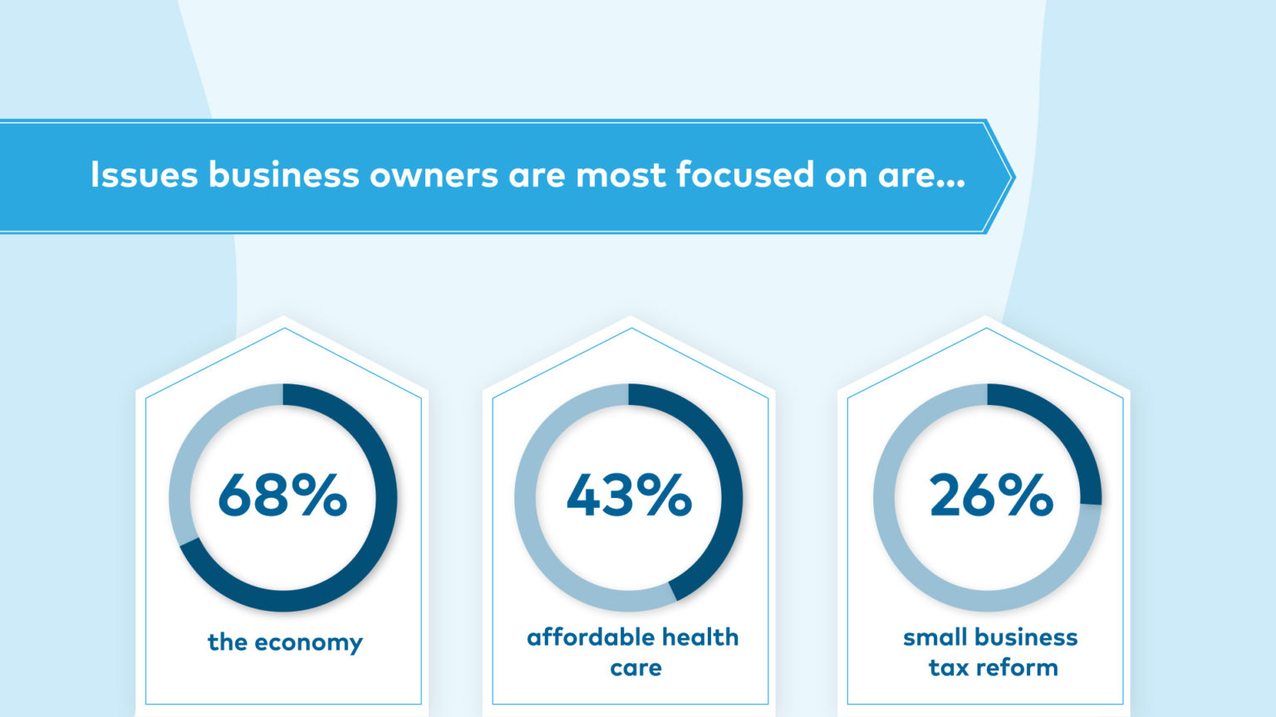

A recent survey conducted by Vistaprint found that small business owners really want the new administration to focus on the economy, health care, and of course, small business tax reform.

Image Source: Vistaprint

“It doesn’t matter whether you're a Democrat or Republican, the thing that businesses hate the most is uncertainty,” says John. “We can't plan for the future if we don't know what the future is going to be. Right now policies keep changing, often three or four times, even in a year. That's hard to plan for.”

If you don’t know exactly where you fall in the new administration’s plan, read the Tax Foundation’s guide, or call a tax expert at Ignite Spot to get your bearings. Because once you learn how your tax rates will change, you and your accountant can plan your income, spending, and investing for the year to coincide with the most favorable policies.

And remember: Both major political parties always agree the tax code must favor small businesses, but they’ve never agreed on how. So, even as you strategize in 2021, keep an eye on young politicians whose plans may influence future administrations and their policies in three, five, or ten years from now.

3. Choose (or change to) the best business structure

Once you know whether (and how) your tax rate is about to change, you may want to reassess your choice of entity type. Each entity type gives business owners a unique combination of legal protection and taxation options.

“There are an awful lot of small businesses that are not organized ideally—especially as entrepreneurs starting a new business—they often don't know what entity they should pick or how that works,” says John.

“There are an awful lot of small businesses that are not organized ideally—especially as entrepreneurs starting a new business—they often don't know what entity they should pick or how that works.”

So, how does a business owner know the best structure for them? John says start with your goals. “Whether you’re starting a new business or scaling an existing small business, the business type you choose must fit the goals you want [to achieve].”

For example, you may want to ensure you always have ready access to capital. Or you may want to invite a few hundred buddies to become micro-investors in your business. Meanwhile, someone else’s main goal is to avoid an audit at all costs.

“I’ve got one client who I beg to change entity types for the tax benefits but he refuses because of the legal benefits he’s getting,” John says, smiling. “And at the end of the day, I can’t blame him, because at least he’s doing it eyes-wide-open, knowing all his options.”

To learn all the benefits and drawbacks of each entity type, read “What is an Entity Type?” and “How to Choose the Right Entity.” Then, compare your own business goals against the entity types and their allowances. Understand there will be some compromise, and decide which variables you’re willing to trade-off to serve your ultimate strategy.

4. Engage a great tax preparer who goes to bat for you

Remember the lessons above about good bookkeeping? The same wisdom applies to your tax preparation. This task is an important opportunity to save tax dollars. Treat it as such by hiring someone who will work hard—and smart—on your behalf.

Recall the last time your taxes were done by a professional. If, having just met you, that person prepared and filed your taxes in an hour for $150, you might feel confident...at first.

But the feeling that you “scored” a cheap and easy exchange will give way to curiosity:

- • “Did my tax preparer score all the deductions I deserve?”

- • “Why doesn’t my tax preparer ask me any clarifying questions?”

- • “Shouldn’t there be more collaboration involved?”

- • “If my tax preparer didn’t ask any questions, does that mean they made some assumptions?”

- • “Aren’t there any flags they noticed that I should know about?”

Curiosity gives way to the desire to improve. Because sooner or later, all business owners realize that a tax professional should assure you they’ve done the job correctly and in a way that most benefits you.

The short-term benefits of a more proactive, quality tax prep service

Upgrade from the most basic tax preparation service, and you’ll see immediate short-term benefits. First, you’ll get someone who knows what they’re doing and why. You’ll have an ally who saves you short-term money in the form of averted fees and deserved deductions.

“Last year, I helped a guy that has a few different entities,” recalls John. “He was looking to switch to us. His last tax preparer had done everything correct on his tax return, but they had his business entities separate. He was paying quite a bit in tax. So, we looked at it—in our proposal process—and I told him, ‘You could make this aggregation election and treat them all the same and you save $13,000.’” To say John’s new client was happy would be an understatement.

“He was paying quite a bit in tax.

So, we looked at it—in our proposal process—and I told him, ‘You could make this aggregation election and treat them all the same and you save $13,000.’”

The long-term benefits of a true tax prep pro

While the immediate benefits of upgrading your tax services are exciting, the same move saves you money in the long term, too. How? Most notably, by caring about and tracking basis.

Basis is—in the simplest terms—what something is worth at any given time. It’s your “skin in the game.” A cumulative measure of basis can help you save substantial tax dollars in many common scenarios (like buying or selling property or claiming damage for insurance).

Consider the story of the Oklahoma couple whose property sustained tornado damage. The loss should have been tax-deductible, but the IRS claimed that the taxpayers hadn’t accurately valued the property’s new (now diminished) value. Thankfully, the tax court disagreed with the IRS—a huge relief to the couple. However, sadly, the couple couldn’t prove their basis in the property, which meant they could not deduct the damages after all.

A good tax accountant will help you track basis, so you’re always poised to prove your skin in the game.

5. Protect yourself from audits and penalties

The best financial offense really is a good tax defense. So, strategize to keep the money you earned by avoiding investigations and fees.

Implementing the first four tax strategies above is a good start:

- • A clean, accurate ledger ensures your tax prep helper is equipped with the reliable data they need.

- • Knowing tax rates lets you plan for future tax policy changes, large or small.

- • Using the best business structure helps you use the tax code to your advantage, ultimately serving your own business goals.

- • Having an expert tax preparer saves you tax money by catching deductions and tracking long-term vitals like basis.

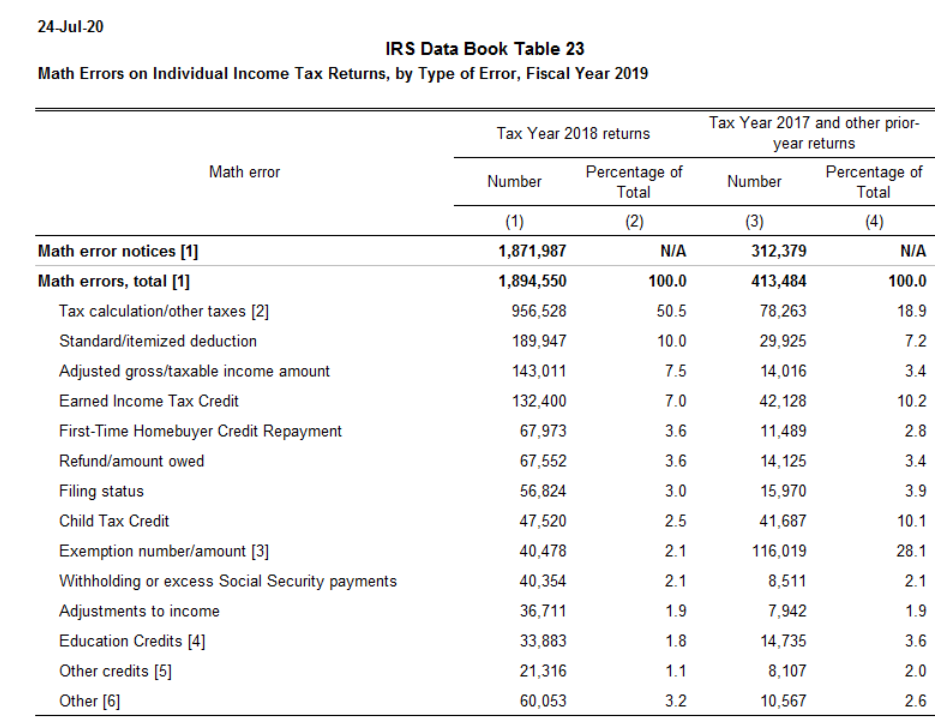

The next best way to sidestep audits and fees is to know and avoid the most common small business tax filing errors:

Source: Tax Policy Center

The tax experts at Bloomberg say math errors are only the beginning, and add to the list of cringe-worthy mistakes to avoid.

5 Most Common Small Business Tax Filing Errors

- • Filing on the wrong date (if the tax deadline is on a weekend or federal holiday, this is an easy one to make)

- • Allowing typos or outdated info to slip in

- • Accidentally omitting interest and dividends

- • Putting the right data...in the wrong place

- • Attaching forms in the wrong order

Many business owners read these tips and rest assured knowing that their accountant will handle these tasks. But remember, they’re human, too. So, don’t give your figures and books to your tax accountant at the last minute. Give them time to devote to the high-quality work you expect.

Finally, to reduce your risk of investigation and penalties, use technology—but do so carefully. Either spend time getting to know a bookkeeping software before implementing it, or ideally, hire an expert who’s proficient in both accounting and accounting’s new tools.

To reduce the chances of being audited and incurring fees even further, read our blog titled “13 Red Flags That Will Get Your Small Business Audited.”

6. Create quarterly tax strategies with an advisor

You can save thousands of dollars by spending your business’s capital strategically throughout the year. That’s right, spending and investing at the right time may cost—or save—you thousands. A financial advisor can help you know when to save the most.

With a financial advisor’s help, you can choose when to be taxed on some business expenses or income. Your decision will be based on how your tax rates will change throughout the year (sound familiar?). This collaborative strategy is especially powerful at the end of the year.

“If you're sitting on a huge net income at the end of the year, and you don't want to be, one way to bring down taxable income is by buying assets, or having expenses at the end of the year,” John explains. “So, if you're sitting on $100,000 of income, for example, you can choose—do you want to pay $30,000 in taxes? Or were you already planning on buying a new car? Were you already planning on upgrading your computer system?”

Spending that money now would lower your taxable income.

On the other hand, if tax rates are about to increase (as discussed earlier), then you’d likely want to wait to invest in capital expenditures. An advisor should help you decide. “A lot of posts people are putting out there as 'tax strategy' is really standard stuff that any good reputable accountants should just be doing for you anyway.”

7. Get all your tax breaks and subsidies

Deductions are just the beginning. Truly strategizing means knowing about and nabbing government incentives and assistance.

One example is the Research and Development (R&D) or Research and Experimentation (R&E) tax credit. In 2015, the federal government eternalized this incentive, which was originally temporary. The concept is simple: Innovation is risky, which demotivates businesses to try new things. Governments, however, benefit greatly from innovative breakthroughs that come with the risk-taking research and experimentation of the private world. This credit is the government’s way of helping mitigate some of the risks. You may not be eligible for this incentive now, but one of the most brilliant tax strategies is to evaluate your processes regularly—because you can enter eligibility at any time.

Another example of a tax break you can score is in the form of accelerated depreciation allowances. For instance, if you hire a firm to conduct a cost segregation analysis on your behalf, they could find multiple building or property elements (or improvements) that can be depreciated over just five or seven years instead of the typical 27.5 or 39 years—an undeniable win.

One final example of this strategy is to take advantage of the employee retention credit. The government’s tone almost pleads with you to grab this money: “The IRS urges employers to take advantage...,” so why don’t you do it? Breaks like that are meant for you as a business owner. Strategizing means proactively doing what it takes to leverage them.

The best tax strategies are unique to your business

A simple blog post can’t cover all the ways to strategize for the optimal tax plan. It will take a deep analysis of your business and the local, state, and U.S. tax codes.

The good news? That’s what we at Ignite Spot do best. John Riggs and his team love strategizing on behalf of their clients. We begin with a 30-minute consultation. So, call today to start the process, and we’ll begin strategizing with a free, low-pressure conversation.

.png)