As a business owner, you must know how to send an invoice that won’t get lost, ignored, or put off. A survey conducted by Fundbox shows that 79% of business owners cannot pay themselves when faced with just one unpaid invoice. And aging receivables are more common than you’d expect: 40% of businesses report experiencing direct negative effects of delinquent payments.

If you improve your invoicing, then you’ll get paid faster — a move that streamlines your cash flow. Get started by taking one or all of these actions.

Qualify your clients

Do a little research ahead of signing on with “just any” business customer. Digging around to learn a potential customer’s credibility may not be the most fun exercise, but it can pay off — literally.

Before entering into a working relationship with new customers, sniff around online to learn a bit about their reputation. Small Business Trends recently published a helpful list of 26 Business Review Sites where customers grade businesses on their overall conduct. See if there are any surprising stories that may help you get to know your future partner. Next, check the Better Business Bureau (BBB) for any prior nonpayment complaints. Finally, search their name in trade association discussion boards and online industry groups. Look for any stories of “I should never have worked with that client” or “beware!”

Again, you’ll likely find nothing negative. But diligence upfront can save you a lot of future heartaches.

Finally, ask them about their budget. Clarify and reiterate how much you charge and why. Even after your new client signs on, listen for any indication that your services stretch their budget or capacity.

You’ll be glad you paid attention to these details. That dedication creates a client roster that’s both reputable and capable of paying their bills.

Talk about money early to avoid discussing it often

When you discuss payment expectations in advance, you set the partnership up for success. Protecting the client relationship is the No. 1 reason business owners don’t chase late payments. Avoid this dodgy position by setting the expectations early.

Talking money early does a few things for you:

-

• It shows you’re not afraid to discuss awkward topics. As a business owner, you are both brave and honest. There’s no better way to convey these characteristics than to discuss finances early and candidly.

-

• It also sets the tone. Discussing money upfront shows that you assume your client is also brave and honest. It’s your way of saying, “In this relationship, we are transparent and upfront with one another.” Other touchy topics won’t be so weird if you’ve set the tone, and it’s one of openness and trust.

-

• It prevents confusion later. Vocalize what you expect and why. For extra security, convey those expectations in writing, too. That way, you’ll avoid the mix-ups that ambiguity always creates. Provide an open channel for questions and challenges. This thwarts the dreaded dilemma of withholding deliverables until payment arrives.

Source: Steve Wasterval via Business Quick Magazine

-

• And finally, it gives your accounts receivable (A/R) team the resources they need. You probably don’t have any hostage negotiators on your accounting team (and if you do, that’s a whole other conversation). The typical accounts receivable admin needs your clients’ payment methods and agreements in place to draft payment or run credit cards regularly — and avoid pressuring customers for delinquent payments.

When it comes to your cash flow, an ounce of prevention here really is worth a pound of cure. Learn to discuss finances openly and early on in your customer relationships

Set it and forget it (automate without reinventing how to send an invoice)

To get paid on time consistently, enhance your A/R processes with automation. But beware; some automation tools add complexity to your business by bringing the wrong tech to an otherwise working process. If you already have an accounting or bookkeeping tool that creates invoices, then there’s no need to reinvent the wheel.

Only bring on new technology that integrates into your current processes and adds value by saving time and motivating customers to pay on time. As you shop around for automation technology, beware of:

-

• Tools that boast features you don’t need. Your accounting software already has most of what you need to know on how to send an invoice — so don’t grab a solution that’ll create a bunch of feature overlap. Instead, get one that integrates seamlessly with your current accounting software without stepping on its toes.

-

• Tools that make you change your processes just to adopt them. Great news: Engineering has evolved. These days, A/R automation tools exist that enhance your payment collection operations instead of tripping them up.

-

• Tools that don’t offer much customer support. Read review sites like G2 to learn how prospective automation tools back up their service with self-help knowledge centers and in-person support.

-

• Tools that don’t let your customers pay the way they want. Accepting alternative payment forms like Apple Pay was — until recently — a perk. These days, though, it’s table stakes. Ensure your A/R tools give you the ability to accept all payment forms.

-

• Tools that put you in a templatized box. Want to know how to send an invoice that’ll stand out? By branding it, of course! Your marketing department agonizes over your branding, so be sure your invoices match that snazz. Don’t get an invoice creation or A/R automation tool that generates generic documents. Find one that lets you customize the experience to both your brand and the customer’s unique situations. Ensure your invoices have everything displayed that your customer needs to pay on time, in full:

-

-

⸰ your address

⸰ ways to pay

⸰ payment terms

⸰ a reminder of the customer’s auto-pay option

⸰ an encouragement to use their customer web portal (read on)

-

-

Give your customers control

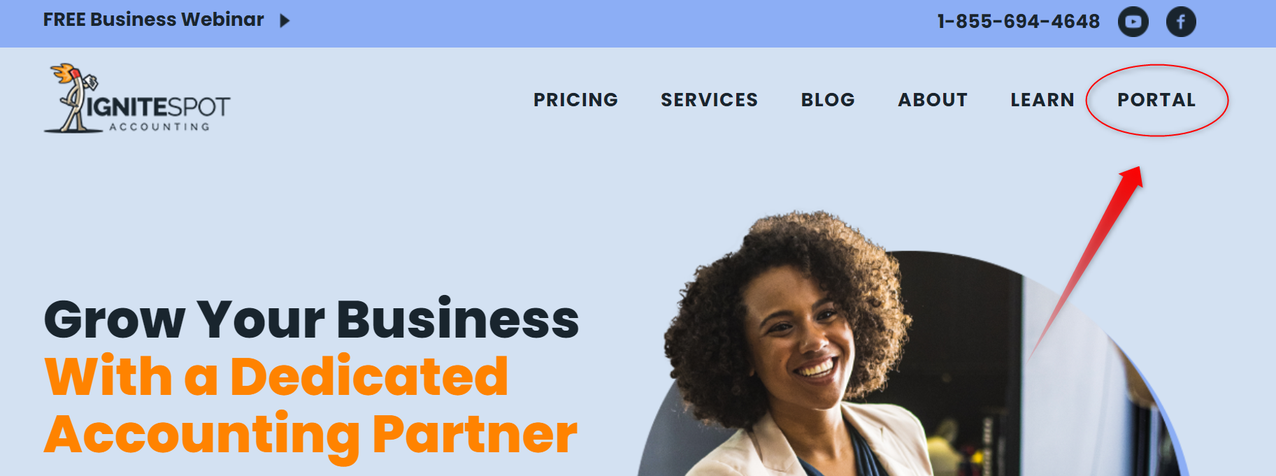

A customer web portal? Yes, one of the best ways to ensure payment collection is to help customers get more invested in the relationship. And a web portal does exactly that.

A customer web portal is simply a page on your site where clients can log in and view and/or change their payment plans, payment terms, and payment methods. They can also see their transaction history and make important decisions based on that information. Source: igniteSpot.com

Source: igniteSpot.com

People prefer to solve their own problems for many simple issues. A surprising 69% of customers want to find answers to their own queries, but only a third of businesses provide a self-serve knowledge base or help hub. Among people who are unable to resolve their own issues, over half said it’s because there wasn’t enough information online for them.

To give customers control, give them a web portal. Include:

-

• an easy-to-find FAQ list with the most commonly asked questions (among them all) more prominently displayed

-

• visibility into their previous transactions with drill-down detail to answer both obvious and not-so-obvious questions

-

• the ability to change their forms of payment and personal information

-

• a way to contact a representative

Automate reminders

There’s nothing more stressful than hounding your customers for payment because you know that you risk the future of the relationship by badgering them. Instead, automate these reminders so that payment notices go to the right place at the right time and through the right channel for every situation — all without taxing you mentally.

AND CHOOSE A REMINDER TOOL THAT HUMANIZES YOUR FOLLOW-UPS

Earlier, we mentioned how to send an invoice that’s well-branded. But as you continue automating, reminders are another opportunity to customize your A/R processes. Because when you send bespoke reminders, your invoices are more likely to get paid. The key? Don’t settle for personalized reminders — shoot for humanized reminders. Here’s how.

-

• Tailor your reminders for certain financial situations. This may mean you include a sentence or two about your late fees to preserve a customer relationship or mention how you offer a payment plan to extend grace to a struggling client.

-

• Change your messaging to reflect your values as they evolve. Current events, lessons learned, industry trends, and your own growth as a business person should influence your payment conditions. Express those evolutions in your automated invoice reminders.

-

• Tweak the medium to your own liking for efficiency. A surprising 73% of consumers say they prefer receiving paper messages from businesses because hard copies let them read when it’s most convenient for them. Business owners don’t realize that you can apply such a future-forward tool like automation to a primitive (yet effective) channel like paper mail. But you can. And in many cases, you should.

-

• Adjusting terms to improve your business’s cash flow. Your reminders can also remind customers of new payment terms. Use your automated follow-ups to reinforce novel requirements like net-30 or maximum outstanding balances.

When you need to know how to send an invoice that won’t be ignored ...

Sending invoices is easy. But learning how to send an invoice that you know will get paid requires more than you’d expect. Thankfully, the upfront work you do on your systems and processes will pay off, diminishing your accounts receivables and improving your cash flow.

Qualify your new customers better. Learn to talk to them openly, candidly, and early. Automate your invoice creation and dispatch. Offer a self-service customer portal so clients can own their relationship with you. And finally, completely rethink your follow-ups so that they’re automatic — yet still human.

Sound impractical? Until recently, it was. We’ve discovered a tool called Biller Genie that lets business owners do all this and more. In fact, we’ve been using Biller Genie ourselves as a business and couldn’t be happier. According to Ignite Spot COO Dan Luthi, we save 15 to 20 hours per week on automatable tasks. Plus, we get paid more reliably, and cash comes in much quicker than before. And when you partner with us as your outsourced accountants, you get access to Biller Genie, too. Call us today for a free 30-minute conversation to learn exactly how.

.png)