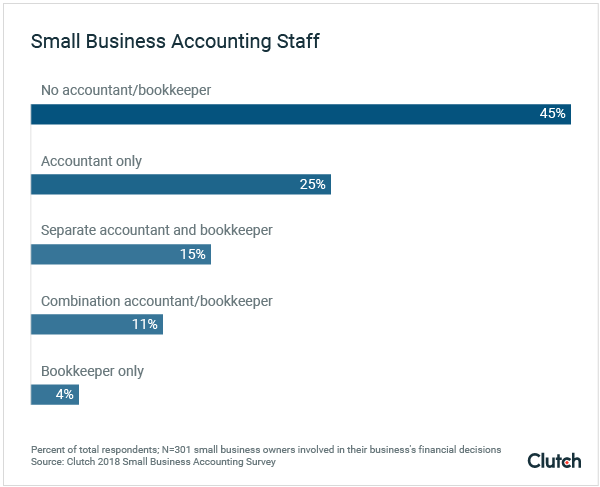

Almost half of all small business owners say they don’t have a bookkeeper or an accountant. Source: Clutch 2018 Small Business Accounting Survey

Source: Clutch 2018 Small Business Accounting Survey

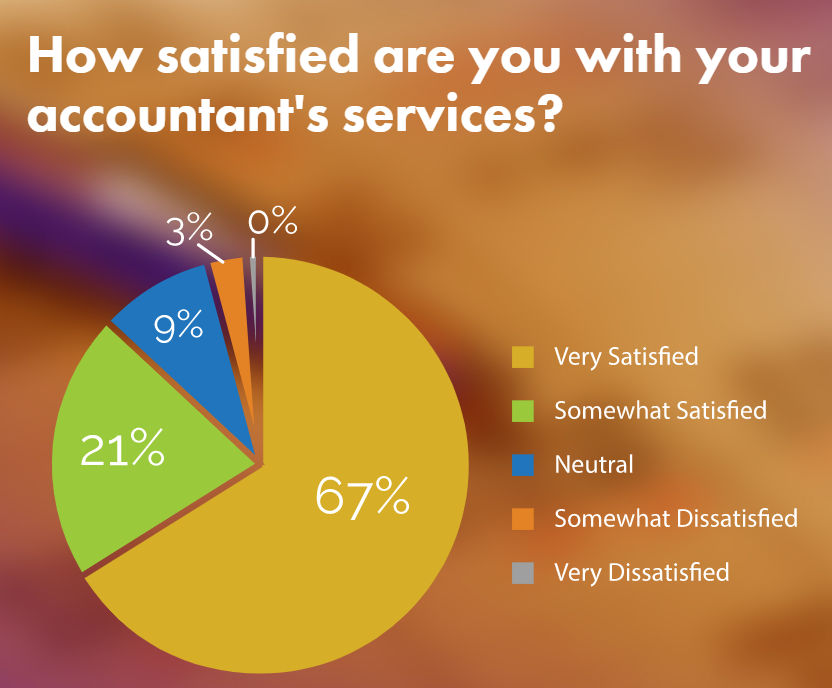

But among business owners who do employ accounting professionals, a whopping 88% say they’re either satisfied or very satisfied with their services. Source: Wasp Barcode Technologies

Source: Wasp Barcode Technologies

Why the disconnect? If so many business owners are happy with their accountants and bookkeepers, why don’t more businesses engage them? We believe it’s because most decision makers are unclear on what exactly a bookkeeper does.

A good bookkeeper changes the trajectory of a business. We’ve seen hundreds of companies turn around, all because of the important, often unsung work of a good bookkeeper.

What does a bookkeeper do? They organize your transactions

Bookkeepers capture all the transactional information floating through and around your business, and they wrangle it into your accounting system, so it’s now safe, retrievable, measurable, and—best of all—usable. Think about the many data points on each invoice, bill, expense receipt, and bank deposit. Seizing those nuggets of information enables you to run your business more intelligently and confidently.

Why organized transactions matter

As bookkeepers enter data, they also categorize it. Correctly categorized ins and outs give you better visibility. For example, when a marketing activity starts to produce impressive results, you can look back over the life of that campaign to calculate the effort’s return on investment (ROI).

Organized transactions also enable and support your ability to make decisions, both strategic and on the fly. Let’s say you like that ROI you just calculated. You can use that intelligence to reroute spend from another marketing activity that—financially—appears to be sputtering.

Decisiveness like that gives a business leader confidence. A bookkeeper’s balanced totals assure you that you can make those calls, that you’re not missing something big or important. And that confidence lets you relish your role again. Knowing what you have (and even knowing what you don’t have) helps you enjoy daily operations. It feels good knowing you can answer basic questions as they pop up instead of always telling others, “I’ll get back to you on that.”

When you’re really feeling confident in your finances, you can even time your decisions based on what money you have—and will have. This is called “managing cash flow.”

Finally, organized books allow you to mitigate risk by catching mistakes and fraud early. This way, little problems don’t have the chance to become big ones.

Beyond data entry: data expertise

Most companies first engage a bookkeeper to organize all transactions. This means:

-

- • collecting all “source documents,” which are the paper receipts, emails, and other electronic records that provide proof of a transaction

-

• entering transaction data into an internal database

- • keeping the records and ensuring their storage is secure

- • tracking inventory

- • reconciling bank records with the internal ledger

- •alerting superiors of anomalies, trends, overages, or shortages

Many organizations soon outgrow one bookkeeper and engage a separate bookkeeper for each account. For example, one bookkeeper will handle all the accounts payable (AP), while another manages accounts receivable (AR), and still one more juggles payroll or travel expenses. In that case, the assigned bookkeeper tracks and manages data in their account only.

What does a bookkeeper do? They investigate imbalances

Have you ever noticed something wonky about your finances and thought to yourself, “I wish I had time to analyze that...”? If so, consider hiring a bookkeeper to do these inspections on your behalf.

The web is full of true stories that tell how a bookkeeper has saved their employer money by examining irregularities.

Jerry Bellune, the owner and CEO of the Bellune Co., recalls the story of a “tale of two bookkeepers.” One investigated an anomaly and her discovery helped catch another bookkeeper embezzling.

On the Better Business Bureau (BBB) site, a complainant mentions fraudulent bank account activity that would have gone unnoticed if not for a bookkeeper’s investigation and proactive alert. Never again will this particular person ask, “Exactly what does a bookkeeper do?”

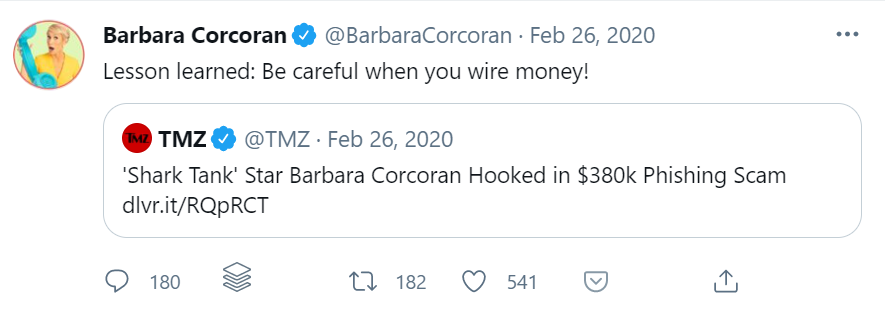

Last year, famous investor Barbara Corcoran fell for a phishing scam that cost her nearly $400,000. The amount could have been much higher if it wasn’t for her bookkeeper, whose keen eye spotted a clue and stopped the perps from taking more.

Source: Barbara Corcoran via Twitter

Without someone to investigate, losses just add up... indefinitely. In 2018, the city of Philadelphia lost $33 million, seemingly into thin air.

“The city doesn't know where it is,” said City Controller Rebecca Rhynhart. If that wasn’t discouraging enough, the following year, Philadelphia reported $924 million in bookkeeping errors.

“At Ignite Spot, we don't even call our bookkeeping staff bookkeepers,” says Eddy Hood, CEO of Ignite Spot. “Instead, we call them data experts, because a good bookkeeper does more than put data into a system. They're experts in knowing how that data flows through the system.”

To illustrate, Hood describes a likely scenario. “If asked, ‘Why is our rent expense higher this quarter?’ A mediocre bookkeeper shrugs their shoulders and says, ‘because that's how much the bill was.' Contrast that with a Data Expert, who answers 'because our CAM fees increased by 2% this year.'”

Who would you rather have handling your data?

What does a bookkeeper do? They ensure your business hits deadlines

A crucial—and often overlooked—aspect of bookkeeping is fulfilling all these tasks efficiently and promptly.

Your accountant needs up-to-date, reliable books to report to you each month. These financial statements rely on the general ledger, which is updated by the bookkeeper.

The government also expects your information on their time. Each year, your tax preparer needs a concise and clear record of all accounts and categories to report the period’s inflows and outflows. As you may have experienced, trying to collect this data at the last moment is a nightmare for everyone involved. In this case, what does a bookkeeper do? Well, a good bookkeeper has your books ready for tax time. If that wasn’t enough, tidy books also decrease your chance of an audit: the IRS is less likely to investigate your business if your books are on time and neat and line items align.

Your accountant and the government aren’t the only people who need your data on their time. Investors, bankers, and potential buyers also need updated, accurate data to assess your business. And all those parties would also be interested in historical figures as well as projections—pictures that can only be painted with reliable financial numbers.

What a bookkeeper does NOT do

While it sounds like a good bookkeeper does it all, keep in mind what’s not typically covered in the bookkeeper job description. Bookkeepers do not:

-

- • research industry and market trends

- • prepare in-depth financial reports

- • interpret your financial data and decipher business trends

- • advise on operational changes

- • assess market opportunities or merger/acquisition deals

- • forecast or predict cash flows

- • create helpful models or scenarios based on your possible decisions and their outcomes

- • help you create or manage your talent strategy

The good news is that a qualified accountant does do these things. And at Ignite Spot, you can find a superior bookkeeper and an excellent accountant under the same proverbial roof. Our team collaborates on your behalf: the data experts on our bookkeeping team inform the business advisors on our accounting team. The result is a holistic approach to ensuring your business’s finances fuel your growth.

Remember, if your small business finance and accounting baffles you, you’re not alone: 60% of small business owners say they’re not confident in their financial knowledge. A proactive bookkeeper can help with that by getting you organized. To get to know Ignite Spot’s bookkeeping and accounting team today, call us at 1-855-694-4648.

.png)