Most business owners don’t lack confidence or decisiveness. No, to make better business decisions, most leaders lack data. Specifically, they lack relevant, up-to-date, accurate financial data — and the ability to apply that knowledge to their strategy.

The ugly result is that a mere 20% of businesses say their organizations nail good decision-making.

Source: McKinsey & Company

To make the best business decisions — consistently — you must know how to use the financial numbers available.

Know your past performance

Your financial statements reveal your business's historical data informing your future decisions.

Study your income statement

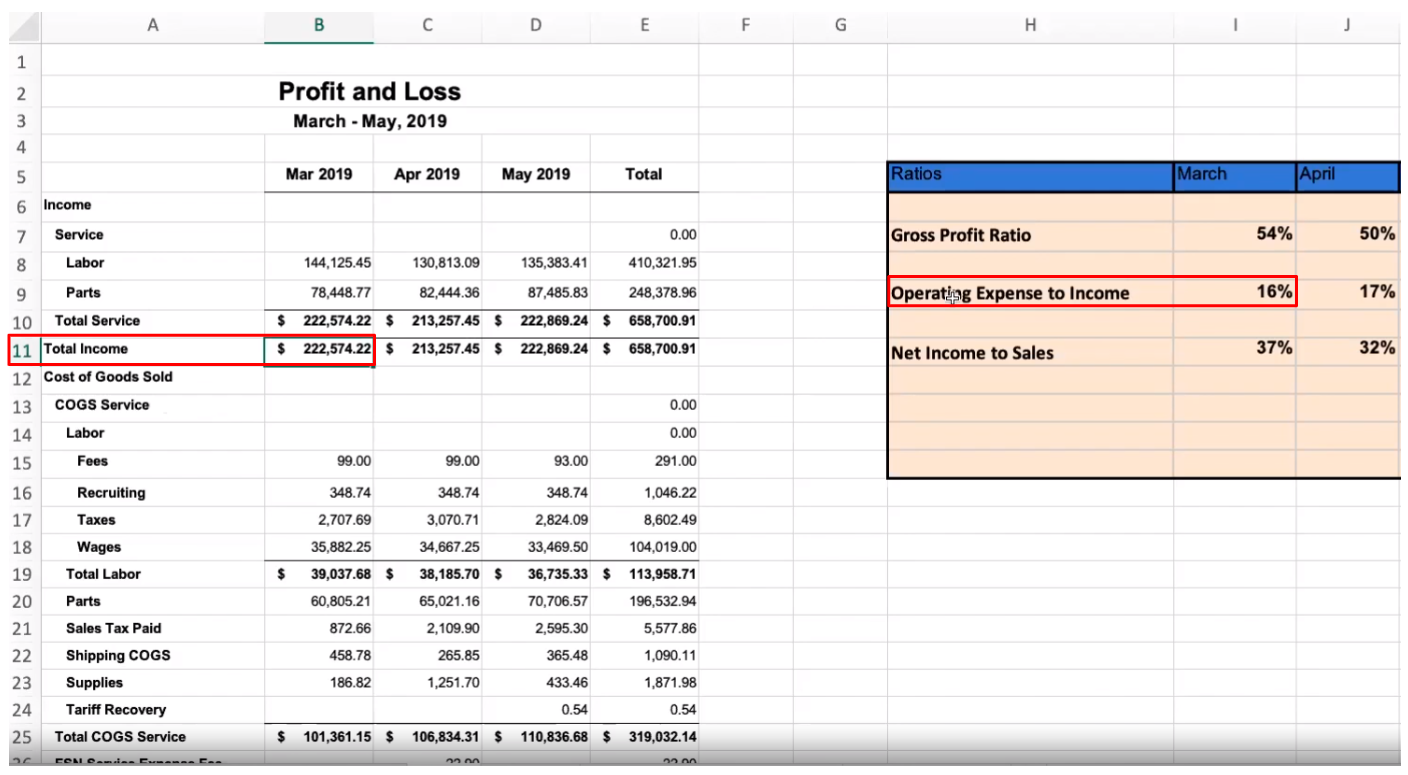

Source: How to Read Financial Statements Webinar

The income statement is a list of monthly or quarterly revenue and outlays. It’s sometimes called the income report or the profit and loss (P&L) report. You can prepare a simple one-step income statement yourself, but it won’t give you as much insight as a more comprehensive report.

QuickBooks has published a great guide for preparing your first-ever income statement. The tutorial also shows you how to create a robust, two-step income statement that will provide even more insights.

Insights like what, you ask? Good question.

We’ve seen that small-business owners lean on income statements because they provide critical details, including:

- • Revenue in (sales, accruals, and receivables);

- • Expenses out (like cost of goods sold and operating expenses);

- • Non-operating income (for instance, returns on business investments and capital gains); and

- • Non-operating costs (think taxes, interest paid, and capital losses).

The total picture shows your net income (or loss). But, if you look closely, it also reveals the relationship between all the income and outflow: an overall picture of “what happened.” Now, all you need to do is apply this knowledge to your business decisions.

First, acknowledge any epiphanies. Admit the on-paper revelations that you didn’t see before. List any and all “surprises.” Then, determine what needs to change operationally so you’re not surprised again (even if the data revealed a happy surprise).

Compare the gross profit and net profit from your last income statement against the same figures from this month’s report. Decide what you want to see less of or what things you’d like to increase. Some leaders take this opportunity to tackle wastage and achieve better efficiencies.

Another decision you can intelligently make now is what you need. An income statement gives the data you need in order to know whether to borrow — and it gives lenders some of the info they need to extend credit. So make a call: Do you need (or want) funding? And considering this new data, could you attract venture capital?

You may also now decide whether and where to invest in new initiatives like fresh talent, equipment, or geographic markets. Or you could decide to scale back spending in areas that are not supporting your long-term strategy or generating revenue.

Having just seen your new income statement, one of the most important business decisions you can make right now is to determine whether your goal-setting and budgeting were spot on or whether it needs work. Use your income statement to compare budget versus actuals.

We’ve put together a quick how-to for this analysis, but we also want you to know that our virtual accountants are standing by to help. But before you move on, decide whether and how to improve your budgeting based on what went right ... and what went awry.

Also, look at your current income and expense totals through the lens of your exit strategy. Make the decision to change the data you see based on your succession plan, even if that event is far into the future.

Scrutinize your profit, too. Decide if you’re too profitable for your current business structure, and make a change to set yourself up for lower taxes in the future.

If you want to take your analysis to the next level, find a public income statement for a company in your space. Probe it for weak spots, competitive advantages, opportunities.

Know your financial position

Your overall valuation — combined with the gritty details that make up that valuation — shows you even more of your options.

Understand your balance sheet

In short, a balance sheet is a compilation of your debts and assets. The snapshot gives you a great picture of both the company’s overall valuation and the smaller pieces that make up that bottom line. The balance sheet is typically prepared every quarter or annually.

Like the income statement, the balance sheet also has a few nicknames. It’s been called the “statement of financial position,” or sometimes the “statement of financial condition.” We like those names because they’re descriptive when thinking about strategic leadership and decision-making. Knowing your position and condition is the foundation of all good decisions.

Your balance sheet shows your assets and liabilities, owners’ equity, and important ratios about the business.

You can use this data to decide how to improve your position. For example, you can do the following:

- • Decide to reduce your risk, or take measured risks via “leverage.” Compare your debt ratio against sector benchmarks to see the general threshold. How do your current ratios compare?

- • Decide to withdraw or distribute profits or dividends. Based on your balance sheet, you can remove some profits and cash reserves from the business and put that harvest into the hands of the business owners.

- • Decide to reinvest that surplus into more tangible and intangible assets. This could be done as a tax strategy or growth lever — or both.

- • Decide to sell or exchange assets on a small or large scale. Increase your liquidity by selling an asset, or avoid a taxable event by exchanging assets.

- • Decide to buy a competitor or a complementary business to improve your position. There’s that term again: position. Indeed, smart business owners often position themselves by acquiring target companies.

As you can see, knowing what you have and what you owe is key to making better, more successful business decisions.

Read your cash-flow statement

Your cash-flow report is an eye-opening look at where and when all transactions happen. From it, you can decipher why these transactions routinely tend to occur when they do. This report has also been called the “statement of cash flows.”

Knowing how your operating cash moves is imperative. If you’ve ever heard yourself say, “I know we’re making money, but there never seems to be enough,” then cash flow may be the culprit. The cash-flow statement illuminates the timing between all the income and the outflows. It gives you an overall rhythm of what’s happening financially.

Applying the data from your cash-flow statement is easier once you have this new visibility. Decisions become less stressful and more straightforward.

Determine first how comfortable you are with the current pace of cash flowing in and out of your business. Depending on your goals, decide to target your operating, investing, or financing activities to improve cash flow in one or all of these areas.

From now on, when you encounter upsets and surprise windfalls, you can also decide to consider this flow and respond more intelligently.

Another decision you can make is to use your cash-flow data to improve your profitability. Simply watch the relationship between the speed of liquid cash through your business and your profitability. Then, decide whether you’re happy with the current cause-and-effect and what changes you’ll make to improve it.

And finally, know that your rate of cash flow either contributes to your business’s health or undermines it. Decide now if your current cash flow is an asset to you — something to show to investors — or a bottleneck to be addressed.

Foresee what’s possible

If you had a financial crystal ball, then making business decisions would become exponentially easier. We can’t say you’d never misstep again, but at least you’d do it knowing all your options.

Get your cash-flow forecast

Now that you know what a cash-flow statement is, you can appreciate the cash-flow forecast. This report is exactly what it sounds like: It’s a look at what your cash flow will be in three, six, or twelve months based on the choices you make today.

We highly recommend you conduct this exercise multiple times throughout each year.

Of small businesses that perform cash-flow forecasts annually, only 36% succeed. That figure jumps to 80% for the companies who forecast their cash flow each month.

Where do you get such a helpful projection? Grab a free cash-flow forecasting tool from Ignite Spot. It’s a mechanism that other accountants charge $500-$5,000 for, because it combines the expertise of a finance professional with the real numbers from your business.

Once you see your financial future, here are some business decisions you can (intelligently) make:

- • Pull out of a painful vendor relationship to which you’ve devoted all you can before absorbing losses.

- • Shore up reserves for anticipated cash shortages.

- • Put a stop to habitually late payers.

- • Extend your payment terms to an agreed-on duration to keep money accessible longer.

- • Decide to (or not to) expand to a new market or invest in new equipment.

- • Hire without the worry of ever coming up short on payroll.

Mapping your numbers and potential choices into the future is the perfect way to make the best business decisions.

From now on, base all business decisions on the whole picture

By now, you can see the importance of using a financial compass to plot your course. The effective use of financial statements has been shown to increase business viability. Futurist Stowe Boyd even calls uninformed decision-makers decision-fakers.

We’ll leave you with one word of warning: Now that you have seen how much financial data is available, resist the temptation to fixate on one metric or another. Watch them all in tandem.

In his co-authored book The Balanced Scorecard, Harvard Business School professor emeritus of accounting Robert S. Kaplan tells a funny story to illustrate this point. He tells readers to imagine a plane cockpit with only one instrument. Would you board the plane after exchanging these words with the pilot?

Q: I’m surprised to see you operating the plane with only a single instrument. What does it measure?

A: Airspeed, I’m really working on airspeed this flight.

Q: That’s good. Airspeed certainly seems important. But what about altitude? Wouldn’t an altimeter be helpful?

A: I worked on altitude for the last few flights and I’ve gotten pretty good on altitude. Now I have to concentrate on proper airspeed.

Q: But I notice you don’t even have a fuel gauge. Wouldn’t that be useful?

A: Fuel is important, but I can’t concentrate on doing too many things well at the same time. So, this flight I want all my attention focused on airspeed. Once I get to be excellent at airspeed, as well as altitude, I intend to concentrate on fuel consumption on the next set of flights.

(Probably no one would choose to be a passenger on this plane.)

Be sure you keep a watchful eye on all your data, now that you know your way around your whole financial dashboard. Changing your visibility like this doesn’t just help you make a few good course corrections — it changes you as a leader. For the first time, you’ll be a truly successful decision-maker. Start making better decisions today by contacting the business finance experts at Ignite Spot. We’d love to chat with you for 30 minutes to improve your financial visibility.

.png)